Please solve 2(b

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1jM

Related questions

Question

Please solve 2(b)

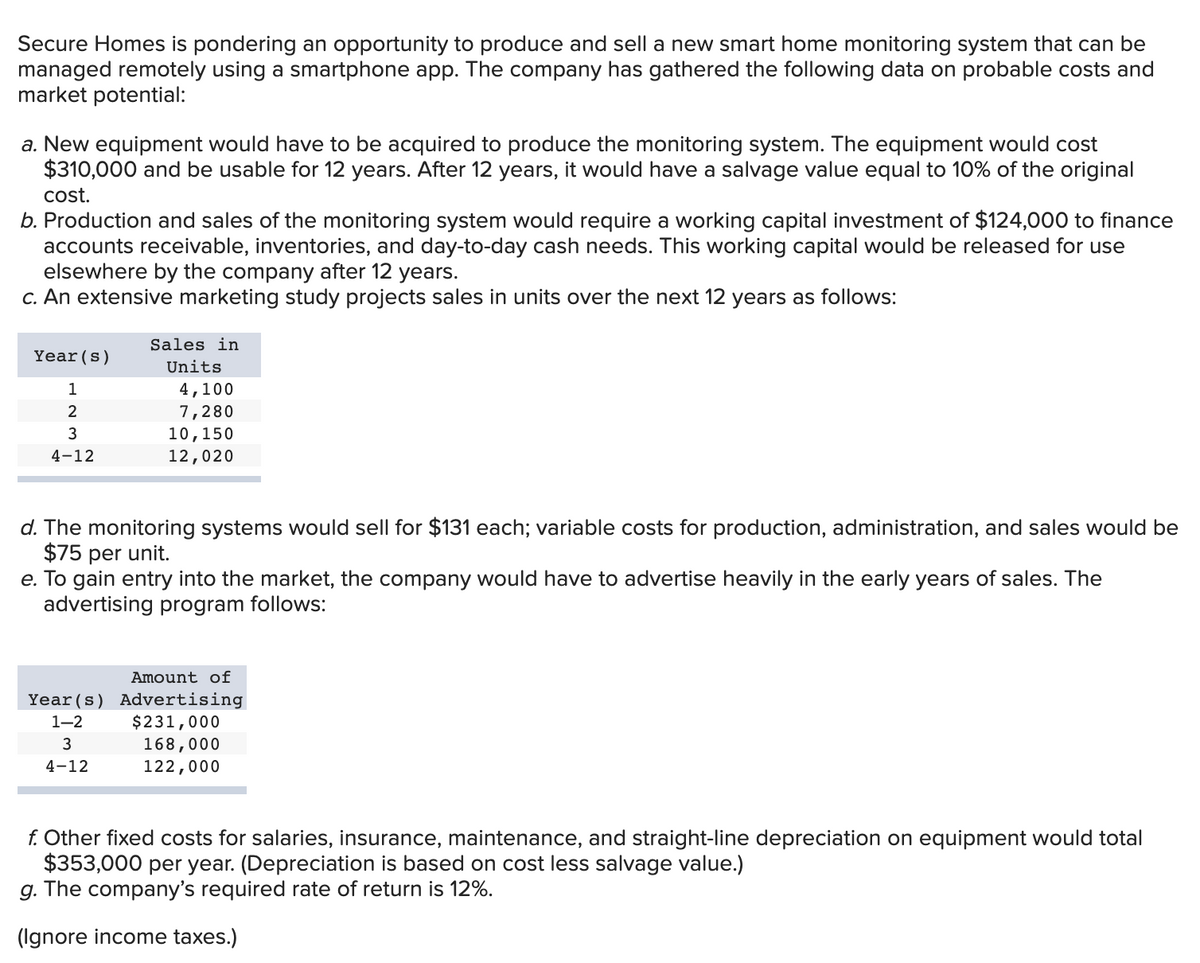

Transcribed Image Text:Secure Homes is pondering an opportunity to produce and sell a new smart home monitoring system that can be

managed remotely using a smartphone app. The company has gathered the following data on probable costs and

market potential:

a. New equipment would have to be acquired to produce the monitoring system. The equipment would cost

$310,000 and be usable for 12 years. After 12 years, it would have a salvage value equal to 10% of the original

cost.

b. Production and sales of the monitoring system would require a working capital investment of $124,000 to finance

accounts receivable, inventories, and day-to-day cash needs. This working capital would be released for use

elsewhere by the company after 12 years.

C. An extensive marketing study projects sales in units over the next 12 years as follows:

Sales in

Year(s)

Units

1

4,100

7,280

2

10,150

12,020

3

4-12

d. The monitoring systems would sell for $131 each; variable costs for production, administration, and sales would be

$75 per unit.

e. To gain entry into the market, the company would have to advertise heavily in the early years of sales. The

advertising program follows:

Amount of

Year (s) Advertising

$231,000

168,000

122,000

1-2

4-12

f. Other fixed costs for salaries, insurance, maintenance, and straight-line depreciation on equipment would total

$353,000 per year. (Depreciation is based on cost less salvage value.)

g. The company's required rate of return is 12%.

(Ignore income taxes.)

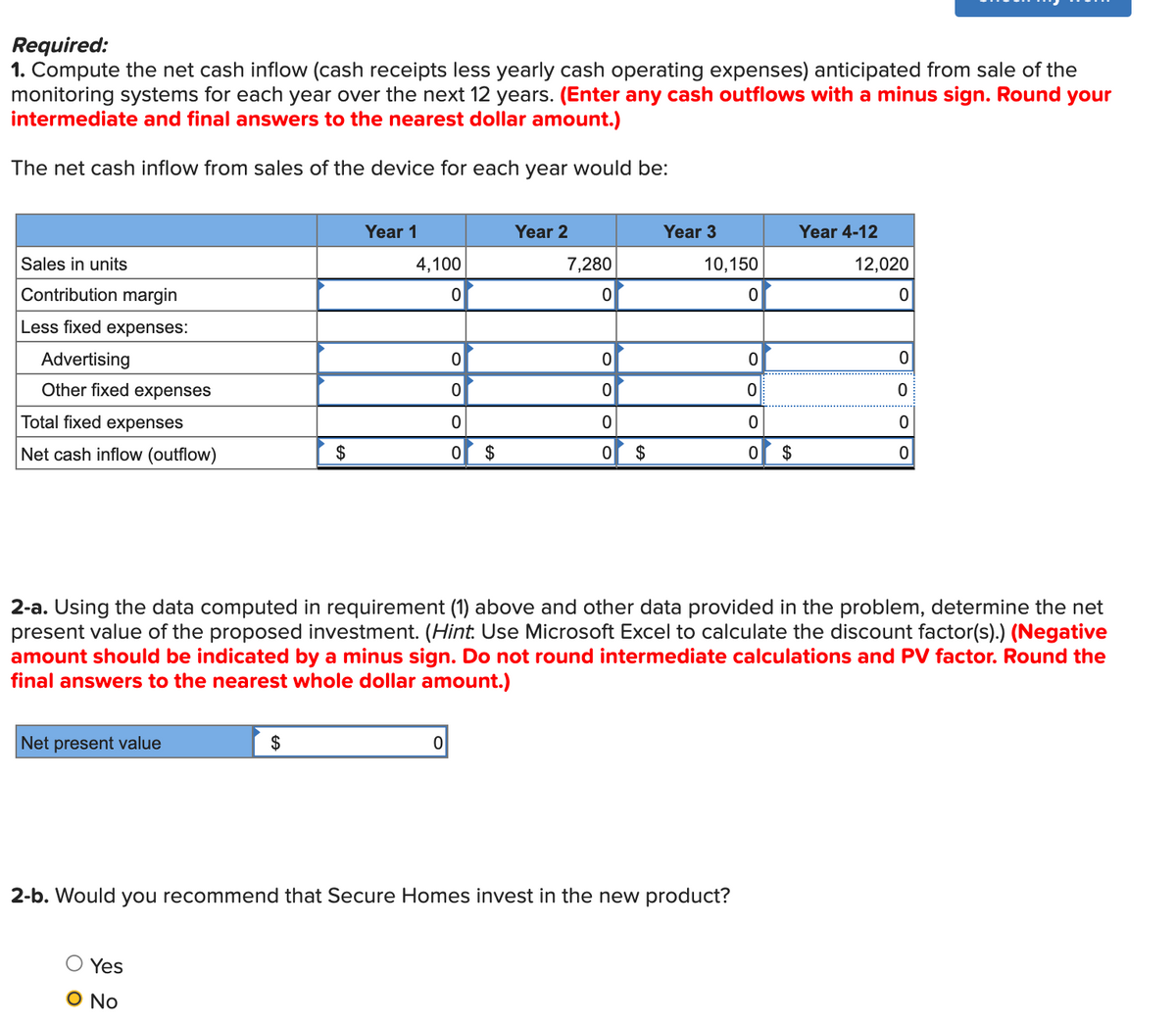

Transcribed Image Text:Required:

1. Compute the net cash inflow (cash receipts less yearly cash operating expenses) anticipated from sale of the

monitoring systems for each year over the next 12 years. (Enter any cash outflows with a minus sign. Round your

intermediate and final answers to the nearest dollar amount.)

The net cash inflow from sales of the device for each year would be:

Year 1

Year 2

Year 3

Year 4-12

Sales in units

4,100

7,280

10,150

12,020

Contribution margin

Less fixed expenses:

Advertising

Other fixed expenses

Total fixed expenses

Net cash inflow (outflow)

$

$

$

2$

2-a. Using the data computed in requirement (1) above and other data provided in the problem, determine the net

present value of the proposed investment. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Negative

amount should be indicated by a minus sign. Do not round intermediate calculations and PV factor. Round the

final answers to the nearest whole dollar amount.)

Net present value

$

2-b. Would you recommend that Secure Homes invest in the new product?

Yes

O No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT