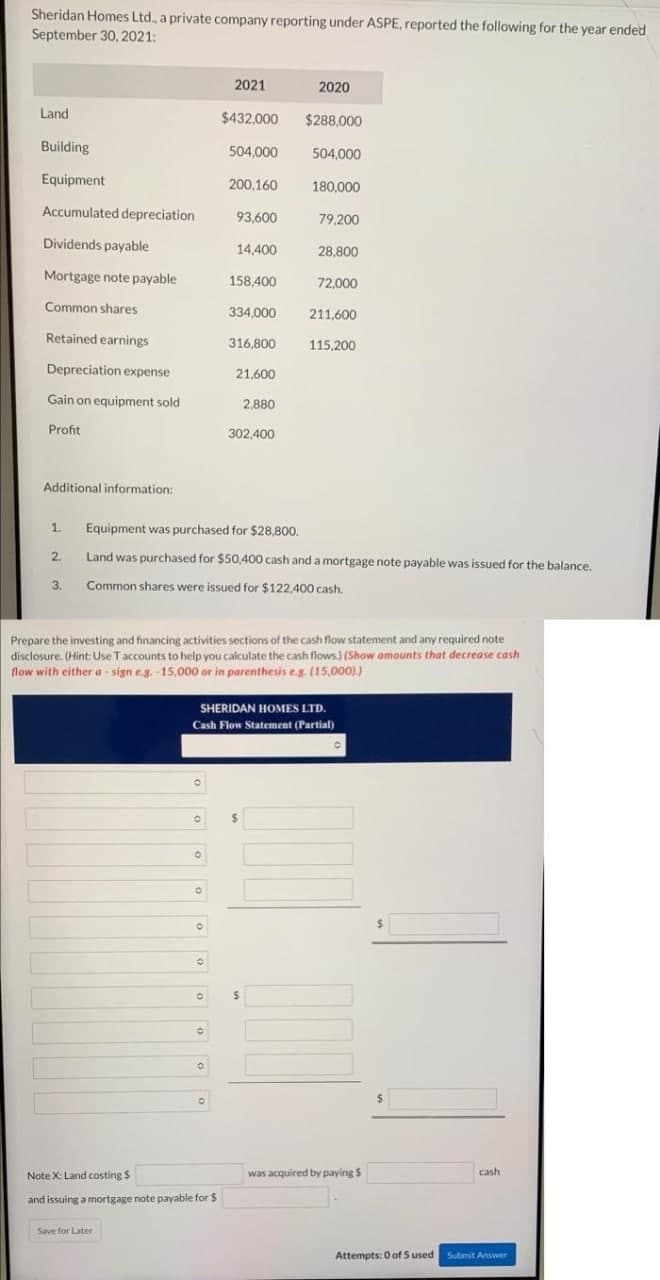

Sheridan Homes Ltd., a private company reporting under ASPE, reported the following for the year ender September 30, 2021: 2021 2020 Land $432,000 $288,000 Building 504,000 504,000 Equipment 200,160 180,000 Accumulated depreciation 93,600 79,200 Dividends payable 14,400 28,800 Mortgage note payable 158,400 72,000 Common shares 334,000 211,600 Retained earnings 316,800 115.200 Depreciation expense 21.600 Gain on equipment sold 2,880 Profit 302,400 Additional information: 1. Equipment was purchased for $28,800. 2. Land was purchased for $50,400 cash and a mortgage note payable was issued for the balance. 3. Common shares were issued for $122,400 cash. Prepare the investing and financing activities sections of the cash flow statement and any required note disclosure. (Hint: Use Taccounts to help you calculate the cash flows) (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis es. (15,000)) SHERIDAN HOMES LTD. Cash Flow Statement (Partial)

Sheridan Homes Ltd., a private company reporting under ASPE, reported the following for the year ender September 30, 2021: 2021 2020 Land $432,000 $288,000 Building 504,000 504,000 Equipment 200,160 180,000 Accumulated depreciation 93,600 79,200 Dividends payable 14,400 28,800 Mortgage note payable 158,400 72,000 Common shares 334,000 211,600 Retained earnings 316,800 115.200 Depreciation expense 21.600 Gain on equipment sold 2,880 Profit 302,400 Additional information: 1. Equipment was purchased for $28,800. 2. Land was purchased for $50,400 cash and a mortgage note payable was issued for the balance. 3. Common shares were issued for $122,400 cash. Prepare the investing and financing activities sections of the cash flow statement and any required note disclosure. (Hint: Use Taccounts to help you calculate the cash flows) (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis es. (15,000)) SHERIDAN HOMES LTD. Cash Flow Statement (Partial)

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 15DQ

Related questions

Question

Transcribed Image Text:Sheridan Homes Ltd., a private company reporting under ASPE, reported the following for the year ended

September 30, 2021:

2021

2020

Land

$432,000

$288,000

Building

504,000

504,000

Equipment

200,160

180,000

Accumulated depreciation

93,600

79,200

Dividends payable

14,400

28,800

Mortgage note payable

158.400

72.000

Common shares

334,000

211.600

Retained earnings

316,800

115,200

Depreciation expense

21.600

Gain on equipment sold

2,880

Profit

302,400

Additional information:

1.

Equipment was purchased for $28,800,

2.

Land was purchased for $50,400 cash and a mortgage note payable was issued for the balance.

3.

Common shares were issued for $122,400 cash.

Prepare the investing and financing activities sections of the cash flow statement and any required note

disclosure. (Hint: Use Taccounts to help you calculate the cash flows.) (Show amounts that decrease cash

flow with either a - sign eg. -15,000 or in parenthesis eg. (15,000).)

SHERIDAN HOMES LTD.

Cash Flow Statement (Partial)

24

%24

Note X: Land costing $

was acquired by paying S

cash

and issuing a mortgage note payable for $

Save for Later

Attempts: 0 of 5 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning