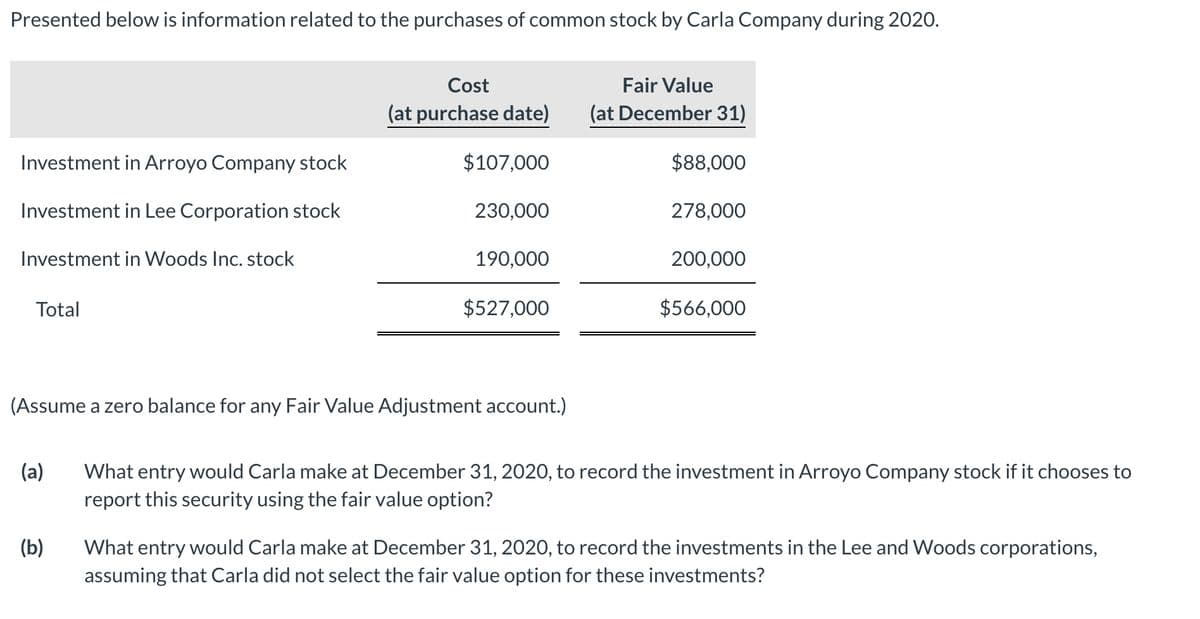

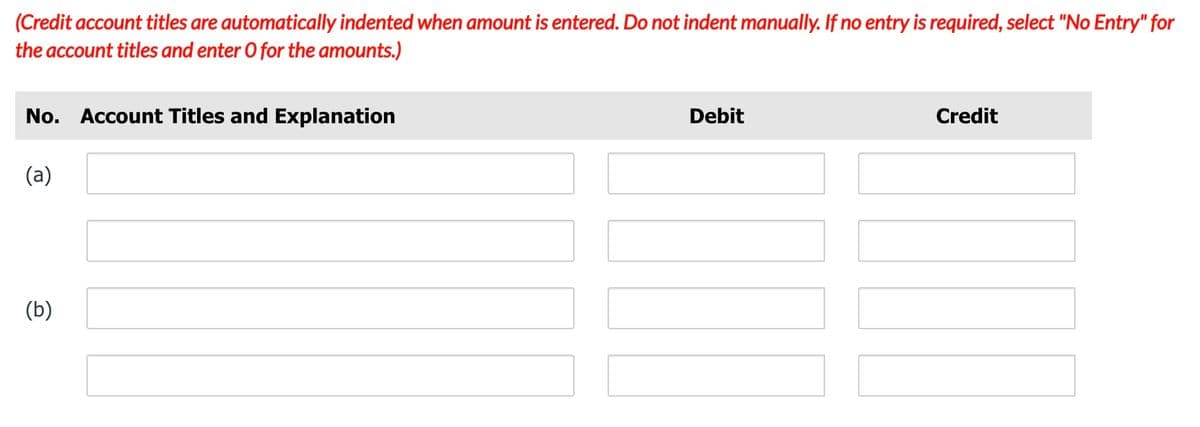

Presented below is information related to the purchases of common stock by Carla Company during 2020. Cost Fair Value (at purchase date) (at December 31) Investment in Arroyo Company stock $107,000 $88,000 Investment in Lee Corporation stock 230,000 278,000 Investment in Woods Inc. stock 190,000 200,000 Total $527,000 $566,000

Q: On December 31, 2020, the balance sheet of Legend Corporation shows a total equity of P1,260,000.…

A: Retained earnings is the amount of earnings accumulated during the period of time. This is an…

Q: On April 10, 2019, Amelia Inc. purchased 450 shares of its own common stock in the market for $22…

A: Accounting equation is based on the concept of double entry system where it assumes that each…

Q: Stellar Co. acquired 25% of the 500,000 shares of outstanding common stock of Overload Inc. on…

A: Securities available for sale are those debt or equity securities investments made by the company…

Q: Presented below is a condensed balance sheet for Tiger Company as of December 31, 2020: Book Value…

A: An acquisition refers to that one company purchases another company's shares to gain control of that…

Q: An investor company purchased 42,000 of the 100,000 outstanding shares of the investee company's…

A: Equity method is a method of accounting for investments. This method is used when investor has…

Q: James Company issued shares as consideration for the purchase of inventory on January 1, 2020. The…

A: Inventory means the stock of goods in hand . Goods means the thing in which the business deals and…

Q: Jaybu Company acquired the following portfolio of equity instruments held for trading during 2022…

A: If equity instruments are held for trading then on each reporting date, investments are reported at…

Q: On December 31, 2020, Loving Company showed shareholder’s equity of P5,000,000. The share capital of…

A: Retained Earnings is the left out earnings of the company that is not distributed among…

Q: Paul Company presented the following information pertaining to its investments in equity securities.…

A: Investment in equity securities can be designated in either way: 1. FVPL 2. FVOCI

Q: On January 1, 2021, MNO Company acquired 12,500 of the outstanding common shares of Esther…

A: The portion of the dividend is based on the portion of holdings. The holding can be calculated by…

Q: Presented below is information related to the purchases of common stock by Indigo Company during…

A: Answer Journal entries Date Particulars Debit($) Credit($) 31-Dec-20…

Q: Below are Lebnas Corp.’s 2019 income statement and comparative balance sheet at 12/31/2019 and…

A: Calculate dividend declared during the period as follows: The Dividend of $87,000 is paid during…

Q: On January 1, 2019, in its first year of operation, Olson Company acquired some of the outstanding…

A: As the Oslon company acquired 25% Bryant company, which means Oslon can exercise significant…

Q: Parnevik Company has the following securities in its investment portfolio on December 31, 2020 (all…

A: a) Date Accounts title and Explanation Debit ($) Credit ($) Jan.15 2021 Cash ($66,000 - 2,150)…

Q: Apple Corp. had the following portfolio of financial instruments of the December 31, 2020. All…

A: Realized gain on the sale of the bond When a bond is sold before its maturity, the realized gain…

Q: DEF, Inc. had the following portfolio of financial assets as of December 31, 2021 before any…

A: Correct balance of the investment in equity securities = number of shares held x Trading price at…

Q: Metlock Corporation made the following cash purchases of securities during 2020, which is the first…

A: The question is based on the concept of Financial Accounting.

Q: Following are the consolidated Statement of Financial Position accounts of Bracker Inc. and its…

A: Cash flow statement: It is a statement which reports the cash inflows and outflows of a business…

Q: Ace Holding Co. shows the following investments in its accounting records at January 1, 2020:…

A: Solution Royalty income is income received from allowing someone to use your property. Royalties are…

Q: Unit IV question 9

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: During 2020, Strawberry Corporation purchased several equity securities, all of which are designated…

A: Here discuss about the purchase and sale of share investment which are made through the fair value…

Q: Asda Ltd purchased shares of Simon plc. As of 30 June 2019, E50,000 was the Equity-Pald op Capital.…

A: Below is the Statement of Comprehensive Income and the Statement of Changes in Equity and the the…

Q: On November 1, 2020, Drucker Co. acquired the following investments in equity securities measured at…

A: d. Journal entries are as follows:

Q: Prepare the journal entries to record the above three security purchases.

A: In these case the equity securities purchase do not indicate exercise of significant influence and…

Q: An investor company purchased 121,000 of the 250,000 outstanding shares of the investee company's…

A: Owners’ equity: It is a owner's value and amount invested by an individual in the firm. It is…

Q: Presented below is information related to the purchases of common stock by Cheyenne Company during…

A: An entity has two options to measure its investment. Cost Method. Equity method.

Q: On November 1, 2020, Drucker Co. acquired the following investments in equity securities measured at…

A: Investment: It is an asset or item which is purchased and held to generate income or for…

Q: On January 1, 2020, Concord Corporation purchased 1,100 shares of treasury stock. Other information…

A: Formula for Return on common stockholder's equity: Return on common stockholder's equity = (Net…

Q: During 2021 Carla Vista Company purchased 10700 shares of Kingbird Inc. for $37 per share. During…

A: Purchased 10700 shares @$37 per share Sold 2850 shares @$42 per share Market price at 31 December…

Q: he entity sold 10,000 shares of B on January 5, 2022 for P150 per share. The market price per share…

A: In this case stock valued at the end of each year at the fair value and the difference is transfer…

Q: On January 1, 2020, Alpha Aviation issues 105,000 shares of stock. Shortly thereafter, Delta Tech…

A: Dividend refers to the profit distribution to its shareholders and when the business earns the…

Q: Prepare journal entries to record the transactions assuming: a.) The securities are classified as…

A: Journal entry: Journal entry is the book of original entry where first transactions are recorded in…

Q: During 2020, Maria Company purchased trading securities with the following cost and market value on…

A: Given information Security B = 10,000 shares Sold at p150 per share Trading investments are…

Q: a. Compute the amount of net income or net loss that Lilly should report for 2021, taking into…

A: Investment may be defined as the allocation of amount into such avenues, financial instruments or…

Q: SLC Corp. has the following portfolio of securities acquired for trading purposes and accounted for…

A:

Q: During 2019 Lovely Company purchased trading securities with the following cost and market value on…

A: A firm may purchase financial assets to invest its surplus cash in order to earn some extra income.…

Q: On December 31, 2020, Loving Company showed shareholder’s equity of P5,000,000. The share capital of…

A: Retained Earnings is the part of profit which is not distributed to shareholders as dividend but…

Q: On January 1, 2020, Swifty Corporation purchased 37% of the common stock outstanding of Cullumber…

A: A stock (sometimes called equity) is a financial instrument that represents ownership of a share of…

Q: 3. What is the investment in Two Company common stock at year-end? 4. What is the recovery of…

A: On December 31, 2020, Dreamer Company reported as Available-for-sale securities: Particulars Qty…

Q: Presented below is information related to the purchases of common stock by Lilly Company during…

A: Journal entry: A ) Date Particulars Debit ( $ ) Credit ( $ ) December 31 , 2020 Unrealized…

Q: At December 31, 2020, Taehyung Company properly reported the following trading securities: Cost…

A: The following calculations are done for Taehyung Company to compute the cost of investment.

Q: Swifty Corp. has the following portfolio of securities acquired for trading purposes and accounted…

A: Journal Entry - It is a record of every business transaction in day-to-day life over a particular…

Q: How much is the gross profit from the sale of the inventory on May 1, 2021?

A: Gross profit = Sales - cost of goods sold Here cost of goods sold means the cost of inventory…

Q: On January 2, 2020, the Statement of Financial Position of Arden Company and Wonder Company…

A: Calculate Identifiable Net Assets of Wonder Co.: Amount (P) Fair value of assets:…

Q: Fish Galore Corp. bought 25% of Fin Chaser Corporation's stock for $70,000 on January 1, 2020.…

A: Journal entries are passed following the golden rules of accounting Debit all assets and expenses…

Q: L Company owns 30% of S Company’s common stock which gives it the ability to apply significant…

A: Since the intra sales include transfer of goods costing $120,000 to parent corporation for $200,000…

Q: based on the following data: Page 136 Chapman Company obtains 100 percent of Abernethy Company's…

A: Consolidated worksheet Consolidated financial statements of a parent and its subsidiaries are…

Q: Lexington Co. has the following securities outstanding on December 31, 2020 (its first year of…

A:

Q: On January 1, 2020 Rosen Company purchased 35,000 which is 15% of the total common stock owned by…

A: Answer:- Common stock meaning:- A common stock is a form of stock generally issued to the majority…

Q: Presented below is information related to the purchases of common stock by Thomlin Company during…

A: Unrealized Investment Gain or Loss: Unrealized gain refers to a rise in the price of an item or…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Refer to the information in RE13-11. Assume that on December 31, 2019, the investment in Cornett Company stock has a market value of 10,500. Prepare the year-end journal entry to record the unrealized gain or loss.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.

- Hamilton Companys balance sheet on January 1, 2019, was as follows: Korbel Company is considering purchasing Hamilton (a privately held company) and discovers the following about Hamilton: a. No allowance for doubtful accounts has been established. A 10,000 allowance is considered appropriate. b. Marketable securities are valued at cost. The current market value is 60,000. c. The LIFO inventory method is used. The FIFO inventory of 140,000 would be used if the company is acquired. d. Land, included in property, plant, and equipment, which is recorded at its cost of 50,000, is worth 120,000. The remaining property, plant, and equipment is worth 10% more than its depreciated cost. e. The company has an unrecorded trademark that is worth 70,000. f. The companys bonds are currently trading for 130,000. g. The pension liability is understated by 40,000. Required: 1. Compute the amount of goodwill if Korbel agrees to pay 500,000 cash for Hamilton. 2. Next Level What are the reasons that the book value of Hamiltons net identifiable assets differ from their market value? 3. Prepare the journal entry to record the acquisition on the books of Korbel assuming Hamilton is liquidated. 4. If Korbel agrees to pay only 400,000 cash, how much goodwill exists? 5. If Korbel pays only 400,000 cash, prepare the journal entry to record the acquisition on its books, assuming Hamilton is liquidated.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Income Statement, Lower Portion Cunningham Company reports a retained earnings balance of 365,200 at the beginning of 2019. For the year ended December 31, 2019, the company reports pretax income from continuing operations of 150,500. The following information is also available pertaining to 2019: 1. The company declared and paid a 0.72 cash dividend per share on the 30,000 shares of common stock that were outstanding the entire year. 2. The company incurred a pretax 21,000 loss as a result of an earthquake, which is not unusual for the area. This is included in the 150,500 income from continuing operations. 3. The company sold Division P (a component of the company) in May. From January through May, Division P had incurred a pretax loss from operations of 33,000. A pretax gain of 15,000 was recognized on the sale of Division P. Required: Assuming that all the pretax items are subject to a 30% income tax rate: 1. Complete the lower portion of Cunningham's 2019 income statement beginning with Pretax Income from Continuing Operations. Include any related note to the financial statements. 2. Prepare an accompanying retained earnings statement.

- Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Income Statement and Retained Earnings Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance: The following information is also available for 2019 and is not reflected in the preceding accounts: 1. The common stock has been outstanding all year. A cash dividend of 1.28 per share was declared and paid. 2. Land was sold at a pretax gain of 6,300. 3. Division X (a major component of the company) was sold at a pretax gain of 4,700. It had incurred a 9,500 pretax operating loss during 2019. 4. A tornado, which is an unusual event in the area, caused a 5,400 pretax loss. 5. The income tax rate on all items of income is 30%. 6. The average shareholders equity is 90,000. Required: 1. Prepare a 2019 multiple-step income statement for Huff. 2. Prepare a 2019 retained earnings statement. 3. Compute the 2019 return on common equity (Net Income 4 Average Shareholders Equity).