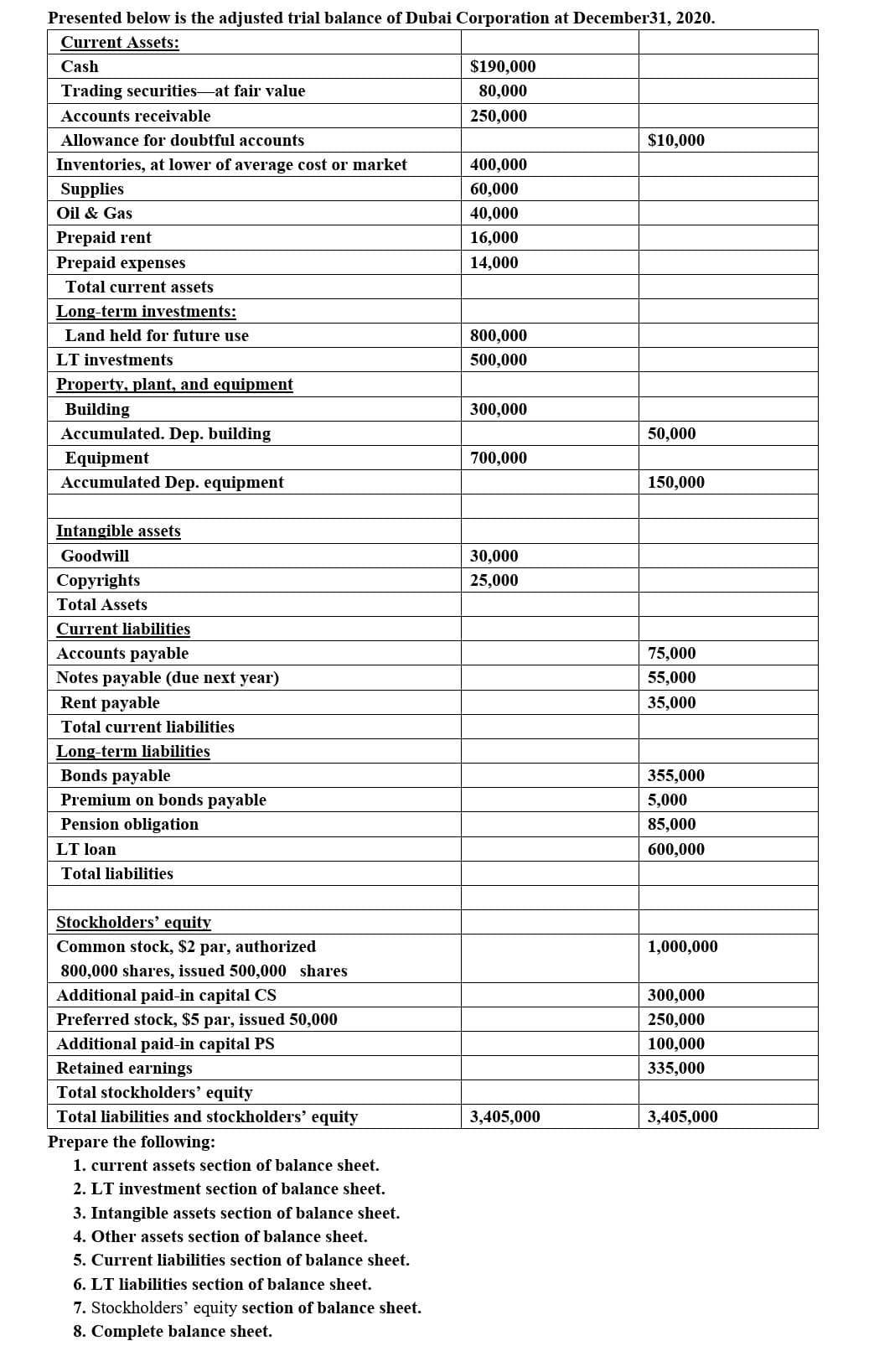

Presented below is the adjusted trial balance of Dubai Corporation at December31, 2020. Current Assets: Cash $190,000 Trading securities-at fair value 80,000 Accounts receivable 250,000 Allowance for doubtful accounts $10,000 Inventories, at lower of average cost or market 400,000 Supplies 60,000 Oil & Gas 40,000 Prepaid rent 16,000 Prepaid expenses 14,000 Total current assets Long-term investments: Land held for future use 800,000 LT investments 500,000 Property, plant, and equipment Building 300,000 Accumulated. Dep. building 50,000 Equipment 700,000 Accumulated Dep. equipment 150,000 Intangible assets Goodwill 30,000 Сорyrights 25,000 Total Assets Current liabilities Accounts payable 75,000 Notes payable (due next year) 55,000 Rent payable 35,000 Total current liabilities Long-term liabilities Bonds payable 355,000 Premium on bonds payable 5,000 Pension obligation 85,000 LT loan 600,000 Total liabilities Stockholders' equity Common stock, $2 par, authorized 1,000,000 800,000 shares, issued 500,000 shares Additional paid-in capital CS 300,000 Preferred stock, $5 par, issued 50,000 250,000 Additional paid-in capital PS Retained earnings 100,000 335,000 Total stockholders' equity Total liabilities and stockholders' equity 3,405,000 3,405,000 Prepare the following: 1. current assets section of balance sheet. 2. LT investment section of balance sheet. 3. Intangible assets section of balance sheet.

Presented below is the adjusted trial balance of Dubai Corporation at December31, 2020. Current Assets: Cash $190,000 Trading securities-at fair value 80,000 Accounts receivable 250,000 Allowance for doubtful accounts $10,000 Inventories, at lower of average cost or market 400,000 Supplies 60,000 Oil & Gas 40,000 Prepaid rent 16,000 Prepaid expenses 14,000 Total current assets Long-term investments: Land held for future use 800,000 LT investments 500,000 Property, plant, and equipment Building 300,000 Accumulated. Dep. building 50,000 Equipment 700,000 Accumulated Dep. equipment 150,000 Intangible assets Goodwill 30,000 Сорyrights 25,000 Total Assets Current liabilities Accounts payable 75,000 Notes payable (due next year) 55,000 Rent payable 35,000 Total current liabilities Long-term liabilities Bonds payable 355,000 Premium on bonds payable 5,000 Pension obligation 85,000 LT loan 600,000 Total liabilities Stockholders' equity Common stock, $2 par, authorized 1,000,000 800,000 shares, issued 500,000 shares Additional paid-in capital CS 300,000 Preferred stock, $5 par, issued 50,000 250,000 Additional paid-in capital PS Retained earnings 100,000 335,000 Total stockholders' equity Total liabilities and stockholders' equity 3,405,000 3,405,000 Prepare the following: 1. current assets section of balance sheet. 2. LT investment section of balance sheet. 3. Intangible assets section of balance sheet.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 2MC: During 2021, Anthony Company purchased debt securities as a long-term investment and classified them...

Related questions

Question

Transcribed Image Text:Presented below is the adjusted trial balance of Dubai Corporation at December31, 2020.

Current Assets:

Cash

$190,000

Trading securities-at fair value

80,000

Accounts receivable

250,000

Allowance for doubtful accounts

$10,000

Inventories, at lower of average cost or market

400,000

Supplies

60,000

Oil & Gas

40,000

Prepaid rent

16,000

Prepaid expenses

14,000

Total current assets

Long-term investments:

Land held for future use

800,000

LT investments

500,000

Property, plant, and equipment

Building

300,000

Accumulated. Dep. building

50,000

Equipment

Accumulated Dep. equipment

700,000

150,000

Intangible assets

Goodwill

30,000

Сорyrights

25,000

Total Assets

Current liabilities

Accounts payable

75,000

Notes payable (due next year)

55,000

Rent payable

35,000

Total current liabilities

Long-term liabilities

Bonds payable

355,000

Premium on bonds payable

5,000

Pension obligation

85,000

LT loan

600,000

Total liabilities

Stockholders' equity

Common stock, $2 par, authorized

1,000,000

800,000 shares, issued 500,000 shares

Additional paid-in capital CS

300,000

Preferred stock, $5 par, issued 50,000

250,000

Additional paid-in capital PS

100,000

Retained earnings

335,000

Total stockholders' equity

Total liabilities and stockholders' equity

3,405,000

3,405,000

Prepare the following:

1. current assets section of balance sheet.

2. LT investment section of balance sheet.

3. Intangible assets section of balance sheet.

4. Other assets section of balance sheet.

5. Current liabilities section of balance sheet.

6. LT liabilities section of balance sheet.

7. Stockholders' equity section of balance sheet.

8. Complete balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning