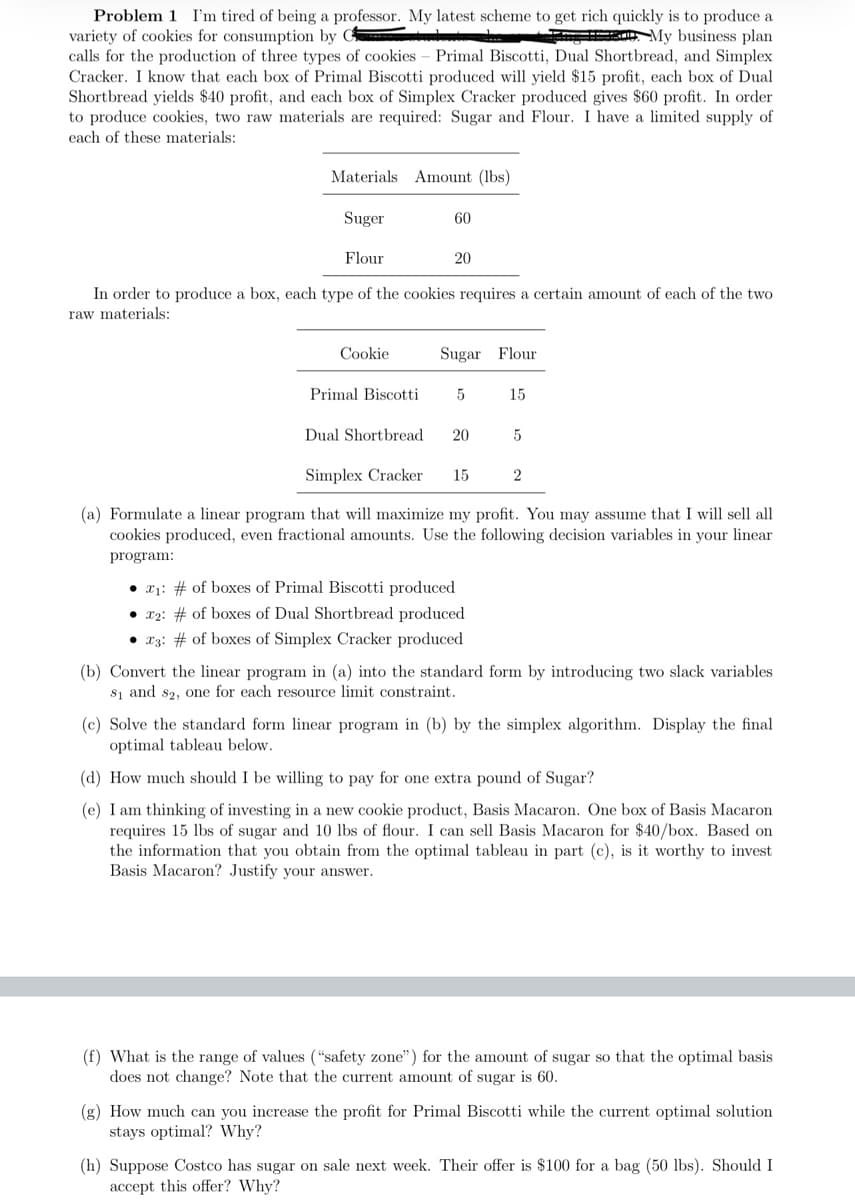

Problem 1 I'm tired of being a professor. My latest scheme to get rich quickly is to produce a variety of cookies for consumption by G calls for the production of three types of cookies - Primal Biscotti, Dual Shortbread, and Simplex Cracker. I know that each box of Primal Biscotti produced will yield $15 profit, each box of Dual Shortbread yields $40 profit, and each box of Simplex Cracker produced gives $60 profit. In order to produce cookies, two raw materials are required: Sugar and Flour. I have a limited supply of My business plan each of these materials: Materials Amount (lbs) Suger 60 Flour 20 In order to produce a box, each type of the cookies requires a certain amount of each of the two raw materials: Cookie Sugar Flour Primal Biscotti 5 15 Dual Shortbread 20 Simplex Cracker 15 2 (a) Formulate a linear program that will maximize my profit. You may assume that I will sell all cookies produced, even fractional amounts. Use the following decision variables in your linear program: • x1: # of boxes of Primal Biscotti produced • x2: # of boxes of Dual Shortbread produced • T3: # of boxes of Simplex Cracker produced (b) Convert the linear program in (a) into the standard form by introducing two slack variables s1 and s2, one for each resource limit constraint. (c) Solve the standard form linear program in (b) by the simplex algorithm. Display the final optimal tableau below. (d) How much should I be willing to pay for one extra pound of Sugar? (e) I am thinking of investing in a new cookie product, Basis Macaron. One box of Basis Macaron requires 15 lbs of sugar and 10 lbs of flour. I can sell Basis Macaron for $40/box. Based on the information that you obtain from the optimal tableau in part (c), is it worthy to invest Basis Macaron? Justify your answer. (f) What is the range of values ("safety zone") for the amount of sugar so that the optimal basis does not change? Note that the current amount of sugar is 60. (g) How much can you increase the profit for Primal Biscotti while the current optimal solution stays optimal? Why? (h) Suppose Costco has sugar on sale next week. Their offer is $100 for a bag (50 lbs). Should I accept this offer? Why?

Problem 1 I'm tired of being a professor. My latest scheme to get rich quickly is to produce a variety of cookies for consumption by G calls for the production of three types of cookies - Primal Biscotti, Dual Shortbread, and Simplex Cracker. I know that each box of Primal Biscotti produced will yield $15 profit, each box of Dual Shortbread yields $40 profit, and each box of Simplex Cracker produced gives $60 profit. In order to produce cookies, two raw materials are required: Sugar and Flour. I have a limited supply of My business plan each of these materials: Materials Amount (lbs) Suger 60 Flour 20 In order to produce a box, each type of the cookies requires a certain amount of each of the two raw materials: Cookie Sugar Flour Primal Biscotti 5 15 Dual Shortbread 20 Simplex Cracker 15 2 (a) Formulate a linear program that will maximize my profit. You may assume that I will sell all cookies produced, even fractional amounts. Use the following decision variables in your linear program: • x1: # of boxes of Primal Biscotti produced • x2: # of boxes of Dual Shortbread produced • T3: # of boxes of Simplex Cracker produced (b) Convert the linear program in (a) into the standard form by introducing two slack variables s1 and s2, one for each resource limit constraint. (c) Solve the standard form linear program in (b) by the simplex algorithm. Display the final optimal tableau below. (d) How much should I be willing to pay for one extra pound of Sugar? (e) I am thinking of investing in a new cookie product, Basis Macaron. One box of Basis Macaron requires 15 lbs of sugar and 10 lbs of flour. I can sell Basis Macaron for $40/box. Based on the information that you obtain from the optimal tableau in part (c), is it worthy to invest Basis Macaron? Justify your answer. (f) What is the range of values ("safety zone") for the amount of sugar so that the optimal basis does not change? Note that the current amount of sugar is 60. (g) How much can you increase the profit for Primal Biscotti while the current optimal solution stays optimal? Why? (h) Suppose Costco has sugar on sale next week. Their offer is $100 for a bag (50 lbs). Should I accept this offer? Why?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter11: Simulation Models

Section: Chapter Questions

Problem 68P

Related questions

Question

Please answer ONLY the parts from D to H please only that parts please.

Transcribed Image Text:Problem 1 I'm tired of being a professor. My latest scheme to get rich quickly is to produce a

variety of cookies for consumption by G

calls for the production of three types of cookies – Primal Biscotti, Dual Shortbread, and Simplex

Cracker. I know that each box of Primal Biscotti produced will yield $15 profit, each box of Dual

Shortbread yields $40 profit, and each box of Simplex Cracker produced gives $60 profit. In order

to produce cookies, two raw materials are required: Sugar and Flour. I have a limited supply of

My business plan

each of these materials:

Materials Amount (lbs)

Suger

60

Flour

20

In order to produce a box, each type of the cookies requires a certain amount of each of the two

raw materials:

Cookie

Sugar Flour

Primal Biscotti

15

Dual Shortbread

20

5

Simplex Cracker

15

(a) Formulate a linear program that will maximize my profit. You may assume that I will sell all

cookies produced, even fractional amounts. Use the following decision variables in your linear

program:

x1: # of boxes of Primal Biscotti produced

• x2: # of boxes of Dual Shortbread produced

• x3: # of boxes of Simplex Cracker produced

(b) Convert the linear program in (a) into the standard form by introducing two slack variables

s1 and s2, one for each resource limit constraint.

(c) Solve the standard form linear program in (b) by the simplex algorithm. Display the final

optimal tableau below.

(d) How much should I be willing to pay for one extra pound of Sugar?

(e) I am thinking of investing in a new cookie product, Basis Macaron. One box of Basis Macaron

requires 15 lbs of sugar and 10 lbs of flour. I can sell Basis Macaron for $40/box. Based on

the information that you obtain from the optimal tableau in part (c), is it worthy to invest

Basis Macaron? Justify your answer.

(f) What is the range of values (“safety zone") for the amount of sugar so that the optimal basis

does not change? Note that the current amount of sugar is 60.

(g) How much can you increase the profit for Primal Biscotti while the current optimal solution

stays optimal? Why?

(h) Suppose Costco has sugar on sale next week. Their offer is $100 for a bag (50 lbs). Should I

accept this offer? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 7 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,