Problem 2: ABC Company was formed on January 1, ollowing financial statements pertaining to the first yea ncome Statement Sales Cost of goods sold Inventory - January 1 Purchases Goods available for sale Inventory-December 31 Gross profit Operating expenses Expenses excluding depreciation Depreciation ncome before income tax Less: Income tax expense Net Income Statement of Financial Position Assets Cash Accounts receivable nventory Land Equipment (Life- 10 years) Accumulated depreciation Total assets Liabilities and Shareholders' Equity Accounts payable Notes payable ncome tax payable Share capital Retained Earnings Net Income Dividends P 650 ( 200 Total liabilities and shareholders' equity Current cost information on December 31, 2020: Cost of goods sold at average current cost nventory Land Equipment

Problem 2: ABC Company was formed on January 1, ollowing financial statements pertaining to the first yea ncome Statement Sales Cost of goods sold Inventory - January 1 Purchases Goods available for sale Inventory-December 31 Gross profit Operating expenses Expenses excluding depreciation Depreciation ncome before income tax Less: Income tax expense Net Income Statement of Financial Position Assets Cash Accounts receivable nventory Land Equipment (Life- 10 years) Accumulated depreciation Total assets Liabilities and Shareholders' Equity Accounts payable Notes payable ncome tax payable Share capital Retained Earnings Net Income Dividends P 650 ( 200 Total liabilities and shareholders' equity Current cost information on December 31, 2020: Cost of goods sold at average current cost nventory Land Equipment

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 74E

Related questions

Question

Realized holding gain ?

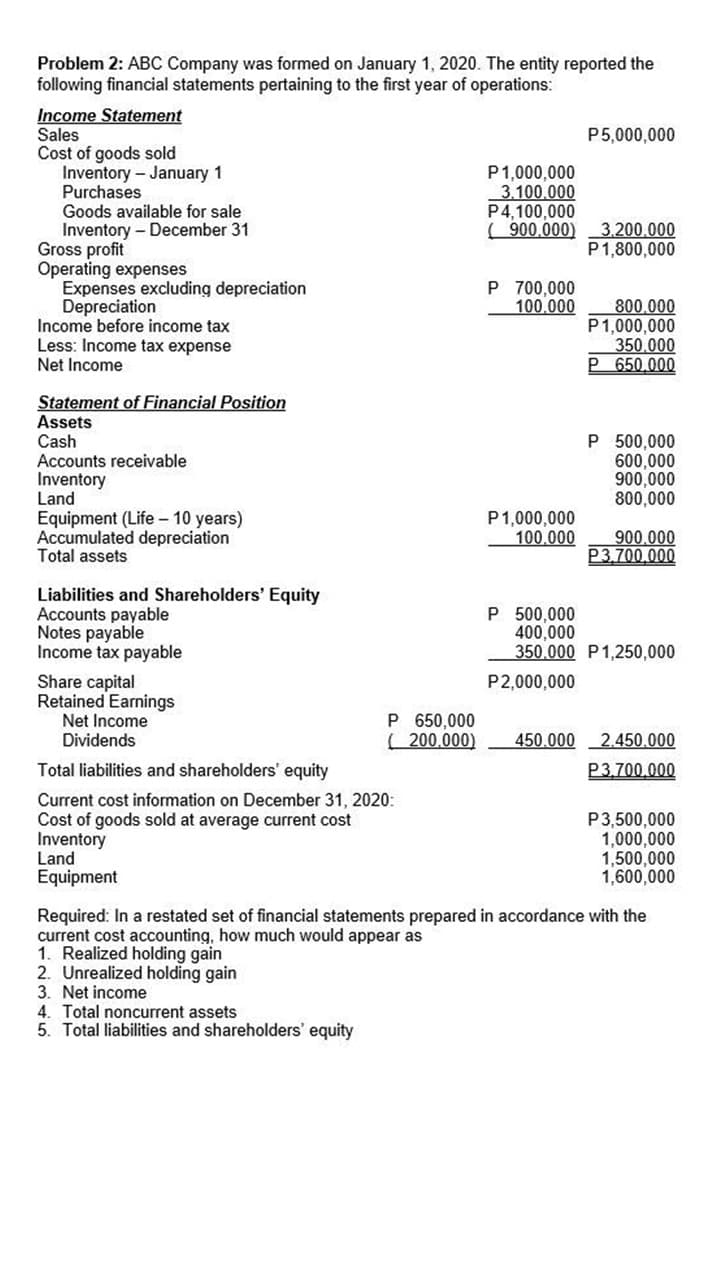

Transcribed Image Text:Problem 2: ABC Company was formed on January 1, 2020. The entity reported the

following financial statements pertaining to the first year of operations:

Income Statement

Sales

Cost of goods sold

Inventory - January 1

Purchases

Goods available for sale

Inventory - December 31

Gross profit

Operating expenses

Expenses excluding depreciation

Depreciation

Income before income tax

Less: Income tax expense

Net Income

P5,000,000

P1,000,000

3.100.000

P4.100.000

( 900.000)

3,200.000

P1,800,000

P 700,000

100.000

800.000

P1,000,000

350.000

P 650.000

Statement of Financial Position

Assets

Cash

Accounts receivable

Inventory

Land

Equipment (Life - 10 years)

Accumulated depreciation

Total assets

P 500,000

600,000

900,000

800,000

P1,000,000

100.000

900.000

P3.700.000

Liabilities and Shareholders' Equity

Accounts payable

Notes payable

Income tax payable

P 500,000

400,000

350,000 P1,250,000

Share capital

Retained Earnings

Net Income

Dividends

P2,000,000

P 650,000

( 200.000)

450.000 2.450.000

Total liabilities and shareholders' equity

P3,700,000

Current cost information on December 31, 2020:

Cost of goods sold at average current cost

Inventory

Land

Equipment

P3,500,000

1,000,000

1,500,000

1,600,000

Required: In a restated set of financial statements prepared in accordance with the

current cost accounting, how much would appear as

1. Realized holding gain

2. Unrealized holding gain

3. Net income

4. Total noncurrent assets

5. Total liabilities and shareholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage