Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

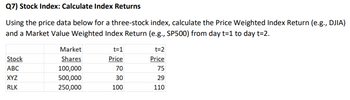

Transcribed Image Text:Q7) Stock Index: Calculate Index Returns

Using the price data below for a three-stock index, calculate the Price Weighted Index Return (e.g., DJIA)

and a Market Value Weighted Index Return (e.g., SP500) from day t=1 to day t=2.

Stock

ABC

XYZ

RLK

Market

Shares

100,000

500,000

250,000

t=1

Price

70

30

100

t=2

Price

75

29

110

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Vinayarrow_forwardBholaarrow_forwardProblem 2-12 (Algo) Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two for one in the last period. Stock Po A B P1 01 P2 02 00 140 145 145 145 145 145 135 290 130 290 130 290 270 290 280 290 145 580 C Required: Calculate the first-period rates of return on the following indexes of the three stocks (t = 0 to t = 1): Note: Do not round intermediate calculations. Round your answers to 2 decimal places. a. A market-value-weighted index. b. An equally weighted index. a. Rate of return b. Rate of return % %arrow_forward

- An index consists of the following securities and has an index divisor of 3.0. What is the price-weighted index return? Index Stock Shares Outstanding 1,000 Beginning Share Price $26 Ending Share Price 4,000 $32 $28 $30 3,000 $19 $ 22 DEF 9.33% 10.35% 11.54% 12.33% 13.00%arrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period (t=2). Po A 100 B 60 C 120 Qo 100 200 200 P₁ 105 55 130 Rate of return b. An equally weighted index. Rate of return Q₁ 100 200 200 % P2 % 105 55 65 Calculate the first-period rates of return on the following indexes of the three stocks (t = O to t = 1): (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A market value-weighted index. Q2 100 200 400arrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forward

- What is the reward-to-risk ratio for Stock X, in decimal form? Round your answer to 4 decimal places (example: if your answer is .03579, you should enter .0358). Margin of error for correct responses: +/- .0005. expected return (implied by market price) Beta Stock X 9.6% 1.46 S&P500 12% ? T-bills 4% ?arrow_forwardPlease answer fast I give you upvote.arrow_forwardConsider the following annual closing prices of stock A, values of market index (S&P 500) and Treasury bills rate. A B C с D Date Stock A Prices (in $) Market Index Value Risk Free Rate (in %) 2 Period 1 119 3 Period 2 100 11829 11843 9639 88 131 12854 9580 11640 8469 11412 9115 10682 NOSAWNH 1 4 Period 3 Period 4 6 Period 5 7 Period 6 8 Period 7 9 Period 8 10 Period 9 11 Period 10 12 O 1.1 13 What is the value of CAPM beta for stock A? O 1.4666 O 1.8333 O2.0533 82 113 O 0.3666 65 109 95 113 1.48 1.76 1.64 1.2 1.43 1.36 1.3 1.72 1.71 1.77arrow_forward

- Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. A B C Ро 90 50 100 Rate of return 90 100 200 200 P1 95 45 110 Rate of return b. An equally weighted index Required: Calculate the first-period rates of return on the following indexes of the three stocks: (Do not round intermediate calculations. Round answers to 2 decimal places.) a. A market value-weighted index % 01 100 200 200 % P2 95 45 55 92 100 200 400arrow_forward2. The following table shows the constituent stocks of a hypothetical index. Stock B splits two-for-one during the period. Stock A B C Beginning of Period Price ($) Shares 30 75 36 2,000 500 1,200 End of Period Price ($) 26 40 32 Shares 2,000 1,000 1,200 a. Calculate the returns on both the price-weighted index and the market value- weighted index of three stocks over the period. b. If you just buy 5,000 shares of stock C for $36, hold for 1 year, collect $8 dividend and sell it at $32. Calculate your total return.arrow_forwardWhat is the standard deviation of Stock B returns given the information below about its returns across future states of nature? Enter return in decimal form, rounded to 4th digit, as in "0.1234"arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education