Question 1 a. What is the significance of a demand curve and a supply curve? b. Suppose $2,000 is borrowed at a simple interest rate of 8%. Calculate (i) the principal plus interest at the end of the 6th year? (ii) what will be the future value if the interest was compounded within the stated period? C What is meant by the terms discounting and compounding? Why are these important

Question 1 a. What is the significance of a demand curve and a supply curve? b. Suppose $2,000 is borrowed at a simple interest rate of 8%. Calculate (i) the principal plus interest at the end of the 6th year? (ii) what will be the future value if the interest was compounded within the stated period? C What is meant by the terms discounting and compounding? Why are these important

Microeconomics A Contemporary Intro

10th Edition

ISBN:9781285635101

Author:MCEACHERN

Publisher:MCEACHERN

Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 13PAE

Related questions

Question

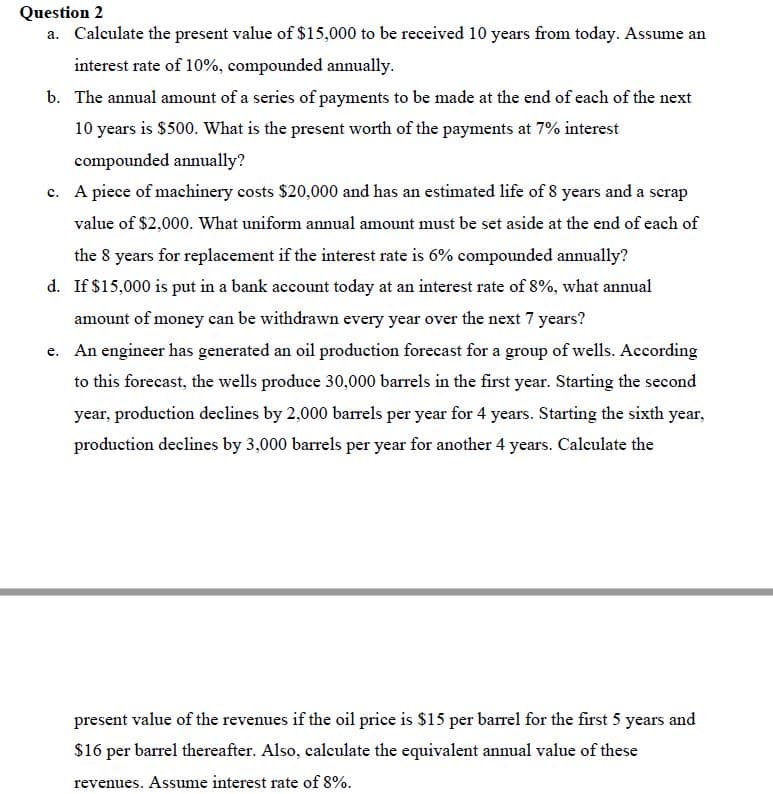

Transcribed Image Text:Question 2

a. Calculate the present value of $15,000 to be received 10 years from today. Assume an

interest rate of 10%, compounded annually.

b. The annual amount of a series of payments to be made at the end of each of the next

10 years is $500. What is the present worth of the payments at 7% interest

compounded annually?

c. A piece of machinery costs $20,000 and has an estimated life of 8 years and a scrap

value of $2,000. What uniform annual amount must be set aside at the end of each of

the 8 years for replacement if the interest rate is 6% compounded annually?

d. If $15,000 is put in a bank account today at an interest rate of 8%, what annual

amount of money can be withdrawn every year over the next 7 years?

e. An engineer has generated an oil production forecast for a group of wells. According

to this forecast, the wells produce 30,000 barrels in the first year. Starting the second

year, production declines by 2,000 barrels per year for 4 years. Starting the sixth year,

production declines by 3,000 barrels per year for another 4 years. Calculate the

present value of the revenues if the oil price is $15 per barrel for the first 5 years and

$16 per barrel thereafter. Also, calculate the equivalent annual value of these

revenues. Assume interest rate of 8%.

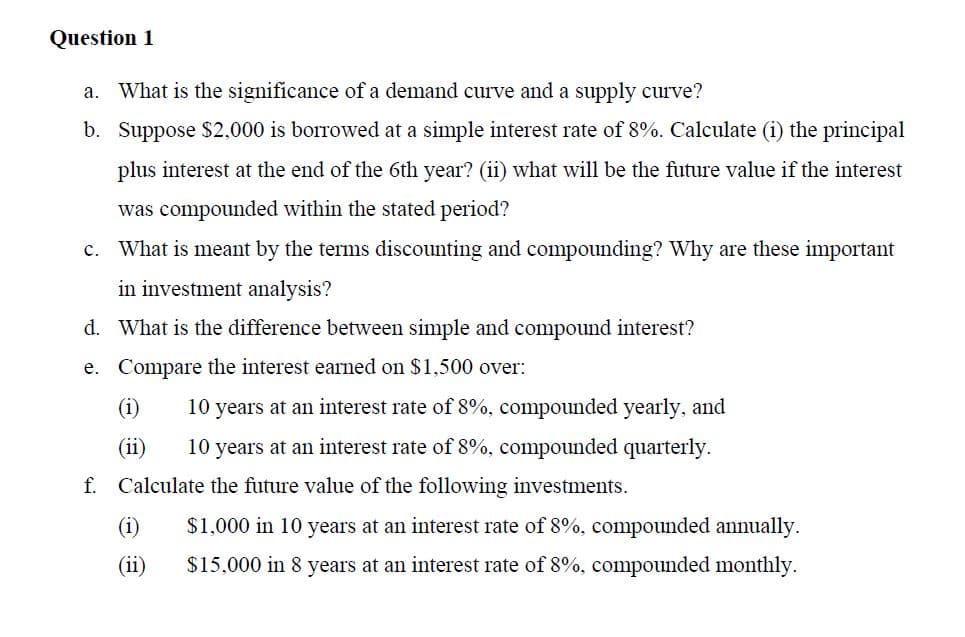

Transcribed Image Text:Question 1

a. What is the significance of a demand curve and a supply curve?

b.

Suppose $2,000 is borrowed at a simple interest rate of 8%. Calculate (i) the principal

plus interest at the end of the 6th year? (ii) what will be the future value if the interest

was compounded within the stated period?

c. What is meant by the terms discounting and compounding? Why are these important

in investment analysis?

d. What is the difference between simple and compound interest?

e. Compare the interest earned on $1,500 over:

(i)

10 years at an interest rate of 8%, compounded yearly, and

(ii)

10 years at an interest rate of 8%, compounded quarterly.

f. Calculate the future value of the following investments.

(1)

$1,000 in 10 years at an interest rate of 8%, compounded annually.

$15,000 in 8 years at an interest rate of 8%, compounded monthly.

(ii)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning