Question 1 McCracken Aerial, Inc., produces and sells a unique type of TV antenna. The company has just opened a new plant to manufacture the antenna, and the following cost and revenue data have been provided for the first month of the plant’s operation in the form of a worksheet. Beginning inventory Units produced Units sold . 80,000 70,000 Selling price per unit $30 Selling and administrative expenses: Variable per unit $1 Fixed (total) .. $160,000 Manufacturing costs Direct materials cost per unit $10 Direct labor cost per unit $4 Variable manufacturing overhead cost per unit. $2 Fixed manufacturing overhead cost (total) . $640,000 Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for the month. 2. Assume that the company uses variable costing. a. Determine the unit product cost. b. Prepare a contribution format income statement for the month. 3. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income. Question 2 Landers Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard cost per unit Actual costs used in production of 12,000 units 1.80 feet at $3.00 per 24,000 feet purchased at a total cost of $69,900, used only 21,000 feet in production Direct materials foot Direct 0.90 hours at $18.00 11,400 hours at $17.40 per hour labor per hour Variable 0.90 hours at $5.00 11,400 hours at a total cost of $62,600 overhead per hour Required: 1. Compute the total standard cost per unit and total actual cost per unit. How much is the difference between the actual unit costs and standard cost? 2. Compute the following variances for May: a. Materials quantity and price variances. b. Labor efficiency and rate variances. с. Variable overhead efficiency and rate variances. 3. Discuss the main reasons for the difference between the actual unit costs and standard cost you computed in (1).

Question 1 McCracken Aerial, Inc., produces and sells a unique type of TV antenna. The company has just opened a new plant to manufacture the antenna, and the following cost and revenue data have been provided for the first month of the plant’s operation in the form of a worksheet. Beginning inventory Units produced Units sold . 80,000 70,000 Selling price per unit $30 Selling and administrative expenses: Variable per unit $1 Fixed (total) .. $160,000 Manufacturing costs Direct materials cost per unit $10 Direct labor cost per unit $4 Variable manufacturing overhead cost per unit. $2 Fixed manufacturing overhead cost (total) . $640,000 Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for the month. 2. Assume that the company uses variable costing. a. Determine the unit product cost. b. Prepare a contribution format income statement for the month. 3. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income. Question 2 Landers Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard cost per unit Actual costs used in production of 12,000 units 1.80 feet at $3.00 per 24,000 feet purchased at a total cost of $69,900, used only 21,000 feet in production Direct materials foot Direct 0.90 hours at $18.00 11,400 hours at $17.40 per hour labor per hour Variable 0.90 hours at $5.00 11,400 hours at a total cost of $62,600 overhead per hour Required: 1. Compute the total standard cost per unit and total actual cost per unit. How much is the difference between the actual unit costs and standard cost? 2. Compute the following variances for May: a. Materials quantity and price variances. b. Labor efficiency and rate variances. с. Variable overhead efficiency and rate variances. 3. Discuss the main reasons for the difference between the actual unit costs and standard cost you computed in (1).

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter2: Basic Managerial Accounting Concepts

Section: Chapter Questions

Problem 26BEA

Related questions

Question

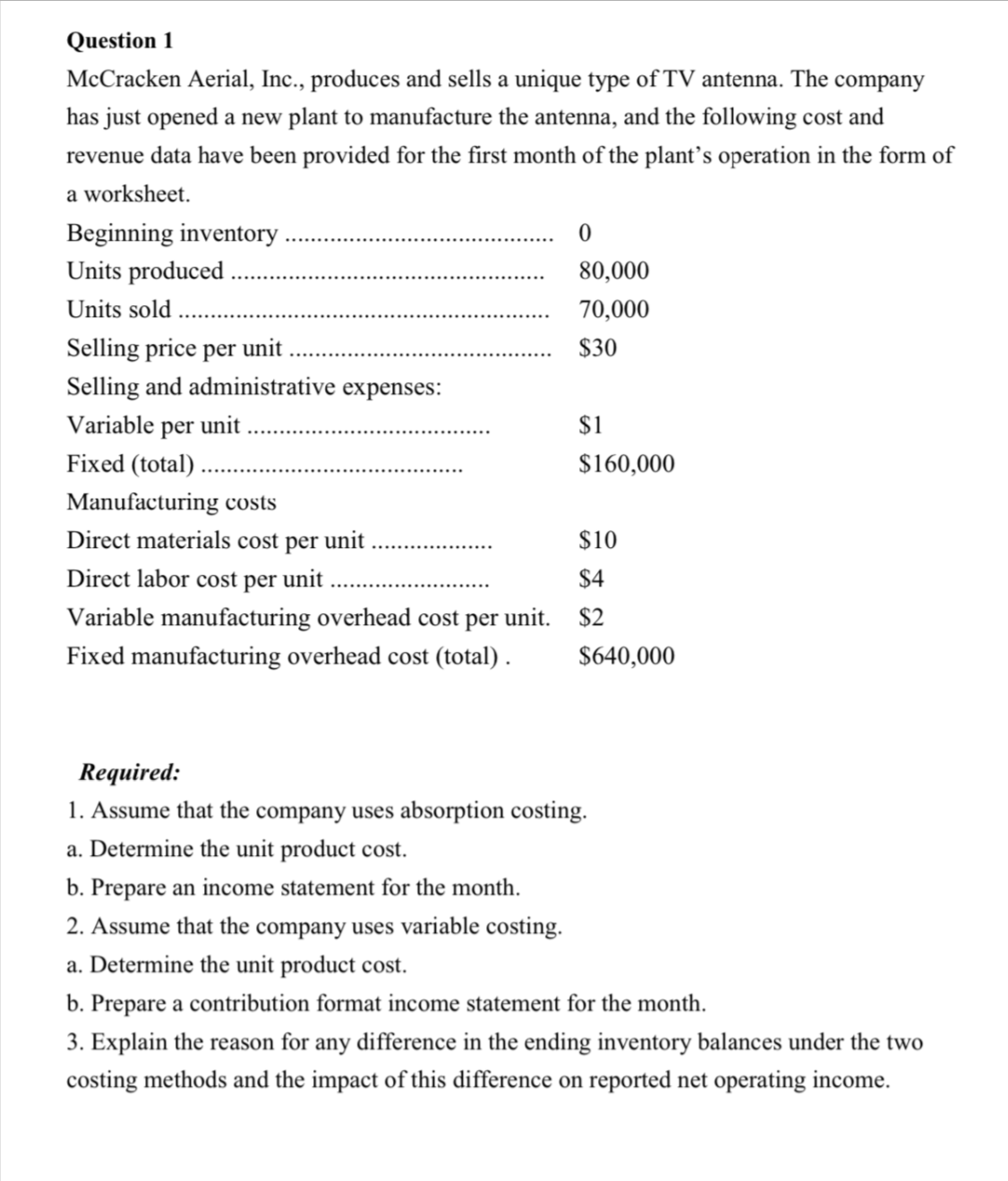

Transcribed Image Text:Question 1

McCracken Aerial, Inc., produces and sells a unique type of TV antenna. The company

has just opened a new plant to manufacture the antenna, and the following cost and

revenue data have been provided for the first month of the plant’s operation in the form of

a worksheet.

Beginning inventory

Units produced

Units sold .

80,000

70,000

Selling price per unit

$30

Selling and administrative expenses:

Variable per

unit

$1

Fixed (total) ..

$160,000

Manufacturing costs

Direct materials cost per unit

$10

Direct labor cost per unit

$4

Variable manufacturing overhead cost per unit. $2

Fixed manufacturing overhead cost (total) .

$640,000

Required:

1. Assume that the company uses absorption costing.

a. Determine the unit product cost.

b. Prepare an income statement for the month.

2. Assume that the company uses variable costing.

a. Determine the unit product cost.

b. Prepare a contribution format income statement for the month.

3. Explain the reason for any difference in the ending inventory balances under the two

costing methods and the impact of this difference on reported net operating income.

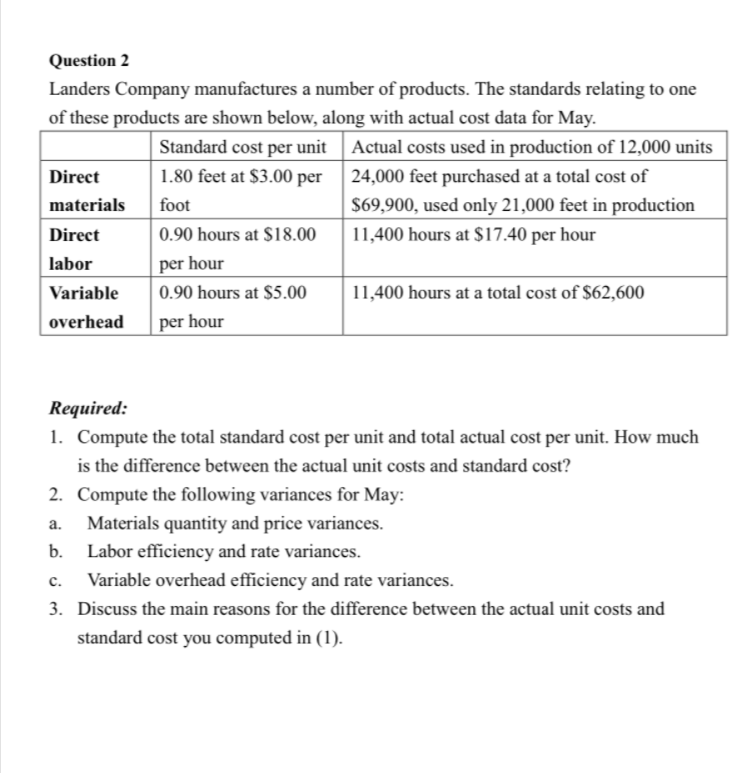

Transcribed Image Text:Question 2

Landers Company manufactures a number of products. The standards relating to one

of these products are shown below, along with actual cost data for May.

Standard cost per unit Actual costs used in production of 12,000 units

1.80 feet at $3.00 per 24,000 feet purchased at a total cost of

$69,900, used only 21,000 feet in production

Direct

materials

foot

Direct

0.90 hours at $18.00

11,400 hours at $17.40 per hour

labor

per hour

Variable

0.90 hours at $5.00

11,400 hours at a total cost of $62,600

overhead

per hour

Required:

1. Compute the total standard cost per unit and total actual cost per unit. How much

is the difference between the actual unit costs and standard cost?

2. Compute the following variances for May:

a.

Materials quantity and price variances.

b.

Labor efficiency and rate variances.

с.

Variable overhead efficiency and rate variances.

3. Discuss the main reasons for the difference between the actual unit costs and

standard cost you computed in (1).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub