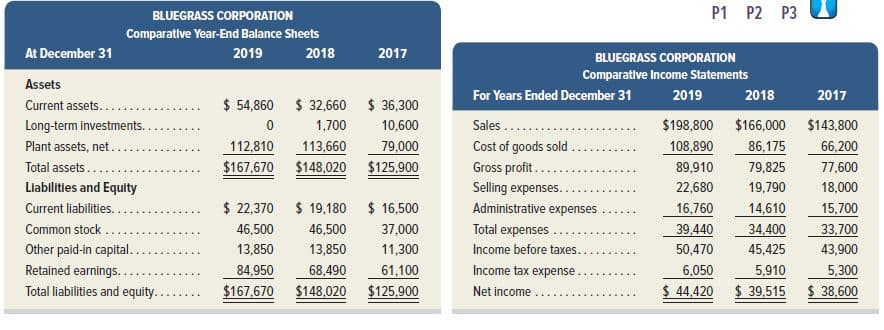

P1 P2 P3 U BLUEGRASS CORPORATION Comparative Year-End Balance Sheets At December 31 2019 2018 2017 BLUEGRASS CORPORATION Comparative Income Statements Assets For Years Ended December 31 2019 2018 2017 Current assets.. $ 54,860 $ 32,660 $ 36,300 Sales .... Long-term investments.. Plant assets, net.. 1,700 10,600 $198,800 $166,000 $143,800 112,810 79,000 66.200 113,660 $148,020 $125,900 Cost of goods sold 108,890 86,175 Total assets.. $167,670 Gross profit... 89,910 79,825 77,600 Llabilitles and Equlty Selling expenses.. 22,680 19,790 18,000 Current liabilities. $ 22,370 $ 19,180 $ 16,500 Administrative expenses 16,760 14,610 15,700 Common stock ... 46,500 46,500 37,000 Total expenses . 39,440 34,400 33,700 Other paid-in capital. 13,850 13,850 11,300 Income before taxes.. 50,470 45,425 43,900 Retained earnings... 84,950 68,490 61,100 Income tax expense 6,050 5,910 5,300 $ 38,600 Total liabilities and equity... $167,670 $148,020 $125,900 Net income $ 44,420 $ 39,515

P1 P2 P3 U BLUEGRASS CORPORATION Comparative Year-End Balance Sheets At December 31 2019 2018 2017 BLUEGRASS CORPORATION Comparative Income Statements Assets For Years Ended December 31 2019 2018 2017 Current assets.. $ 54,860 $ 32,660 $ 36,300 Sales .... Long-term investments.. Plant assets, net.. 1,700 10,600 $198,800 $166,000 $143,800 112,810 79,000 66.200 113,660 $148,020 $125,900 Cost of goods sold 108,890 86,175 Total assets.. $167,670 Gross profit... 89,910 79,825 77,600 Llabilitles and Equlty Selling expenses.. 22,680 19,790 18,000 Current liabilities. $ 22,370 $ 19,180 $ 16,500 Administrative expenses 16,760 14,610 15,700 Common stock ... 46,500 46,500 37,000 Total expenses . 39,440 34,400 33,700 Other paid-in capital. 13,850 13,850 11,300 Income before taxes.. 50,470 45,425 43,900 Retained earnings... 84,950 68,490 61,100 Income tax expense 6,050 5,910 5,300 $ 38,600 Total liabilities and equity... $167,670 $148,020 $125,900 Net income $ 44,420 $ 39,515

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.3BE

Related questions

Question

Required

1. Compute each year’s

2. Express the income statement data in common-size percents. Round percents to two decimals.

3. Express the

decimals.

Analysis Component

4. Comment on any significant relations revealed by the ratios and percents computed.

Transcribed Image Text:P1 P2 P3 U

BLUEGRASS CORPORATION

Comparative Year-End Balance Sheets

At December 31

2019

2018

2017

BLUEGRASS CORPORATION

Comparative Income Statements

Assets

For Years Ended December 31

2019

2018

2017

Current assets..

$ 54,860 $ 32,660 $ 36,300

Sales ....

Long-term investments..

Plant assets, net..

1,700

10,600

$198,800 $166,000 $143,800

112,810

79,000

66.200

113,660

$148,020 $125,900

Cost of goods sold

108,890

86,175

Total assets..

$167,670

Gross profit...

89,910

79,825

77,600

Llabilitles and Equlty

Selling expenses..

22,680

19,790

18,000

Current liabilities.

$ 22,370 $ 19,180

$ 16,500

Administrative expenses

16,760

14,610

15,700

Common stock ...

46,500

46,500

37,000

Total expenses .

39,440

34,400

33,700

Other paid-in capital.

13,850

13,850

11,300

Income before taxes..

50,470

45,425

43,900

Retained earnings...

84,950

68,490

61,100

Income tax expense

6,050

5,910

5,300

$ 38,600

Total liabilities and equity...

$167,670

$148,020

$125,900

Net income

$ 44,420

$ 39,515

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning