Question 1 You have been presented with the Statement of Financial Position for Liffey Ltd below. Statement of Financial Position as at 31st Dec Non-Current Assets: 2019 2018 € Freehold Land 44,000 21,500 94,000 Plant & Equipment Furniture & Fittings 55,200 78,000 227,200 33,500 99,000 Current Assets: 27,400 51,200 Trade Receivables 28,500 56,580 Inventory Bank 27,890 112,970 14,000 92,600 Total Assets 340,170 191,600 Equity and Liabilities Equity: 95,000 5,000 25,000 125,000 Ordinary Share Capital Share Premium Retained Earnings 175,000 20,000 30,000 225,000 Non-Current Liabilities Bank loan 60,000 30,000 Current Liabilities: Taxation 16,400 18,000 Dundalk Institute of Technology May 2021 Trade Payables 18,600 38,770 340,170 191,600 Total Liabilities and Equity In addition, you have been provided with the following information: 1) Profit after tax for the year ended 31 December 2020 was €5,000 2) There was no interest charge but there was a tax charge of €6,500 for the year 3) Depreciation charges for 2020 were as follows a. Plant & Machinery €14,000 b. Fixtures and Fittings €21,000 4) There was no disposal of Non-current assets during 2020 You are required to Prepare the Cashflow statement for Liffey Ltd. for year ended 31" Dec 2020

Question 1 You have been presented with the Statement of Financial Position for Liffey Ltd below. Statement of Financial Position as at 31st Dec Non-Current Assets: 2019 2018 € Freehold Land 44,000 21,500 94,000 Plant & Equipment Furniture & Fittings 55,200 78,000 227,200 33,500 99,000 Current Assets: 27,400 51,200 Trade Receivables 28,500 56,580 Inventory Bank 27,890 112,970 14,000 92,600 Total Assets 340,170 191,600 Equity and Liabilities Equity: 95,000 5,000 25,000 125,000 Ordinary Share Capital Share Premium Retained Earnings 175,000 20,000 30,000 225,000 Non-Current Liabilities Bank loan 60,000 30,000 Current Liabilities: Taxation 16,400 18,000 Dundalk Institute of Technology May 2021 Trade Payables 18,600 38,770 340,170 191,600 Total Liabilities and Equity In addition, you have been provided with the following information: 1) Profit after tax for the year ended 31 December 2020 was €5,000 2) There was no interest charge but there was a tax charge of €6,500 for the year 3) Depreciation charges for 2020 were as follows a. Plant & Machinery €14,000 b. Fixtures and Fittings €21,000 4) There was no disposal of Non-current assets during 2020 You are required to Prepare the Cashflow statement for Liffey Ltd. for year ended 31" Dec 2020

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 46E: OBJECTIVE 6 Exercise 1-46 Income Statement ERS Inc. maintains and repairs office equipment. ERS had...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

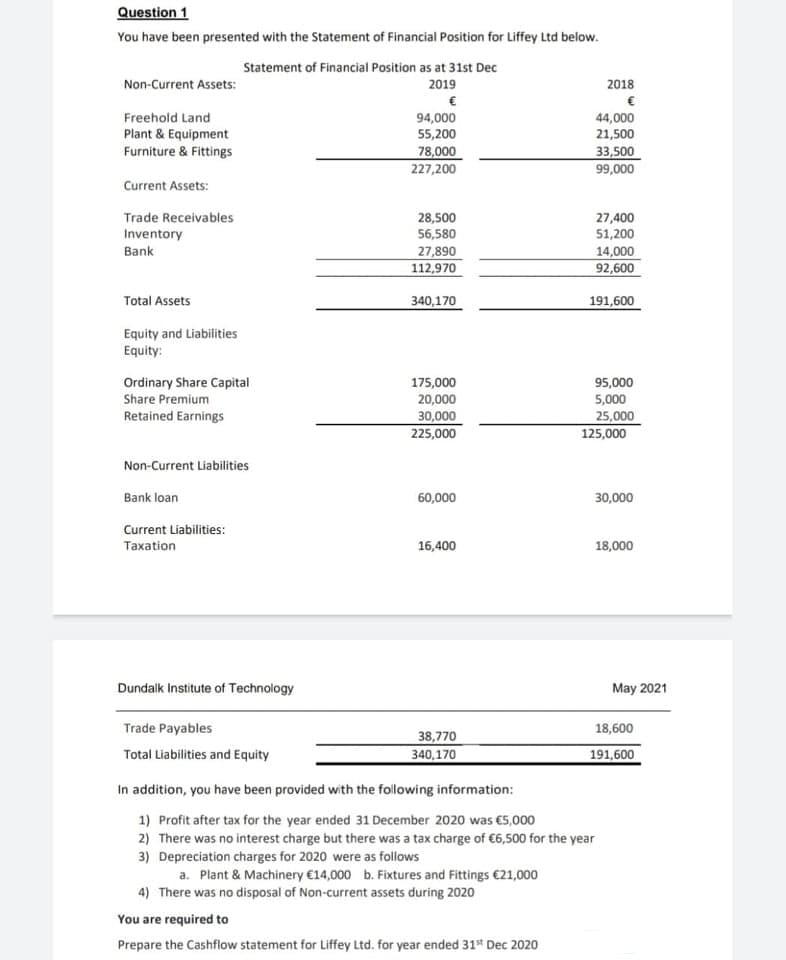

Transcribed Image Text:Question 1

You have been presented with the Statement of Financial Position for Liffey Ltd below.

Statement of Financial Position as at 31st Dec

Non-Current Assets:

2019

2018

€

Freehold Land

94,000

55,200

44,000

21,500

Plant & Equipment

Furniture & Fittings

78,000

227,200

33,500

99,000

Current Assets:

Trade Receivables

28,500

56,580

27,400

51,200

Inventory

14,000

92,600

Bank

27,890

112,970

Total Assets

340,170

191,600

Equity and Liabilities

Equity:

Ordinary Share Capital

175,000

20,000

95,000

5,000

Share Premium

Retained Earnings

30,000

225,000

25,000

125,000

Non-Current Liabilities

Bank loan

60,000

30,000

Current Liabilities:

Тахation

16,400

18,000

Dundalk Institute of Technology

May 2021

Trade Payables

18,600

38,770

Total Liabilities and Equity

340,170

191,600

In addition, you have been provided with the following information:

1) Profit after tax for the year ended 31 December 2020 was €5,000

2) There was no interest charge but there was a tax charge of €6,500 for the year

3) Depreciation charges for 2020 were as follows

a. Plant & Machinery €14,000 b. Fixtures and Fittings €21,000

4) There was no disposal of Non-current assets during 2020

You are required to

Prepare the Cashflow statement for Liffey Ltd. for year ended 31* Dec 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning