Question 1 The following data have been estimated for two feasible investments, A and B, for which revenues as well as costs are known and which have different lives. If the minimum attractive rate of return is 8%, show which feasible alternative is more desirable by using NPW method. What is the difference in the NPW B-NPW (Not A-B) assuming repeatability? Ans. Sxxx.xx (STICK TO THE FORMAT) Alternative Investment Cost $ 4,500.00 $7,050.00 Annual Revenue $2,429.00 $2,506.00 Annual Cost $650.00 $1,488.00 Useful Life (Years) 12 Salvage Value $500.00 $930.00

Question 1 The following data have been estimated for two feasible investments, A and B, for which revenues as well as costs are known and which have different lives. If the minimum attractive rate of return is 8%, show which feasible alternative is more desirable by using NPW method. What is the difference in the NPW B-NPW (Not A-B) assuming repeatability? Ans. Sxxx.xx (STICK TO THE FORMAT) Alternative Investment Cost $ 4,500.00 $7,050.00 Annual Revenue $2,429.00 $2,506.00 Annual Cost $650.00 $1,488.00 Useful Life (Years) 12 Salvage Value $500.00 $930.00

Chapter16: The Markets For Labor, Capital, And Land

Section: Chapter Questions

Problem 12P

Related questions

Question

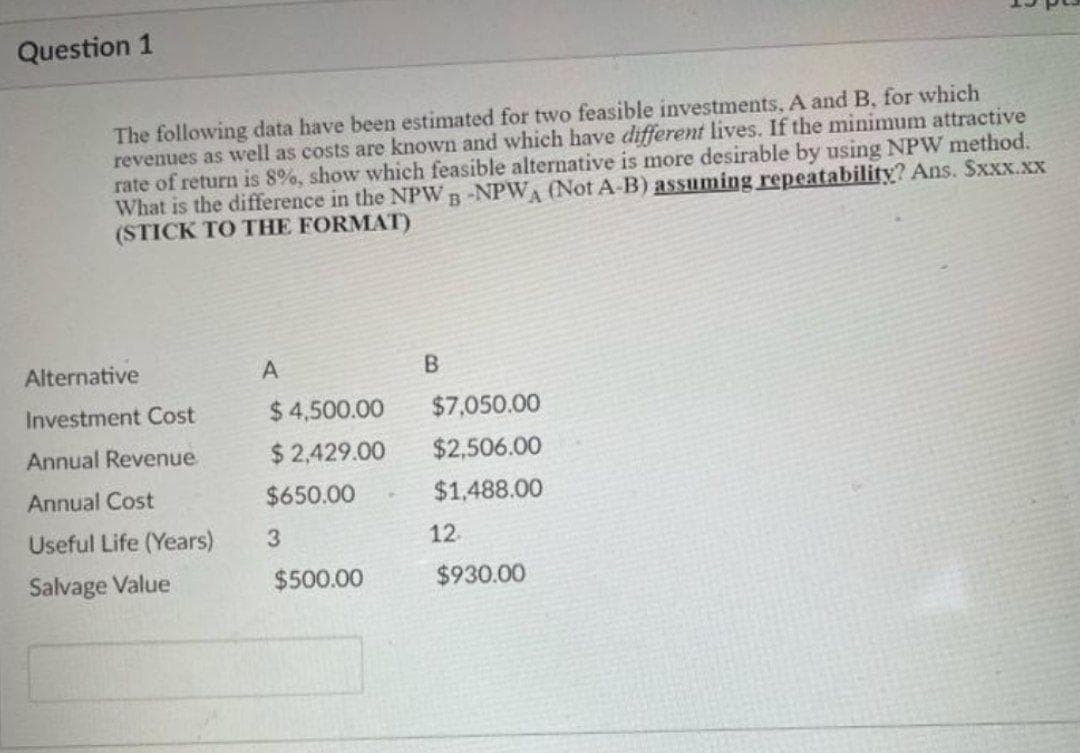

Transcribed Image Text:Question 1

The following data have been estimated for two feasible investments, A and B, for which

revenues as well as costs are known and which have different lives. If the minimum attractive

rate of return is 8%, show which feasible alternative is more desirable by using NPW method.

What is the difference in the NPWB-NPW (Not A-B) assuming repeatability? Ans. Sxxx.xx

(STICK TO THE FORMAT)

Alternative

A

B.

Investment Cost

$ 4,500.00

$7,050.00

Annual Revenue

$2,429.00

$2,506.00

Annual Cost

$650.00

$1,488.00

Useful Life (Years)

3

12

Salvage Value

$500.00

$930.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning