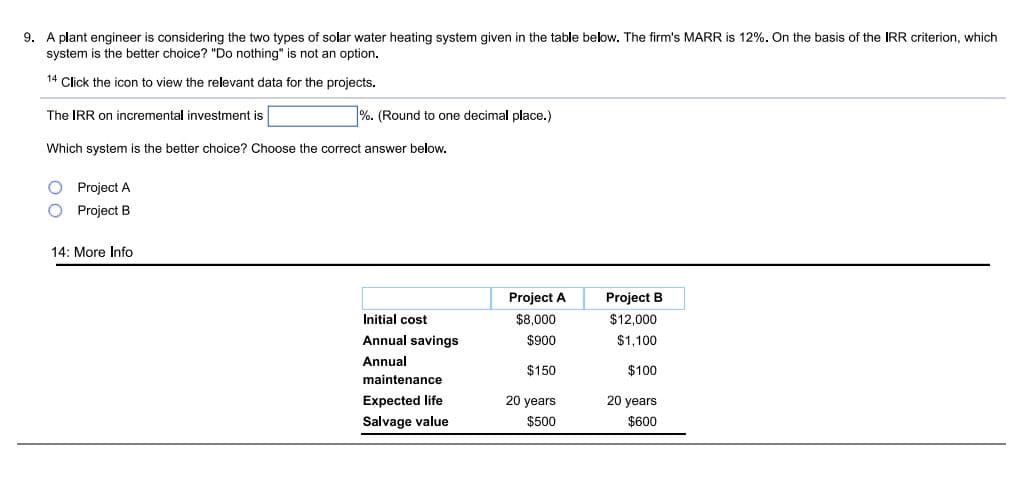

9. A plant engineer is considering the two types of solar water heating system given in the table below. The firm's MARR is 12%. On the basis of the IRR criterion, which system is the better choice? "Do nothing" is not an option. 14 Click the icon to view the relevant data for the projects. The IRR on incremental investment is %. (Round to one decimal place.) Which system is the better choice? Choose the correct answer below. O Project A O Project B 14: More Info Project A Project B Initial cost $8,000 $12,000 Annual savings $900 $1,100 Annual $150 $100 maintenance Expected life 20 years 20 years Salvage value $500 $600

9. A plant engineer is considering the two types of solar water heating system given in the table below. The firm's MARR is 12%. On the basis of the IRR criterion, which system is the better choice? "Do nothing" is not an option. 14 Click the icon to view the relevant data for the projects. The IRR on incremental investment is %. (Round to one decimal place.) Which system is the better choice? Choose the correct answer below. O Project A O Project B 14: More Info Project A Project B Initial cost $8,000 $12,000 Annual savings $900 $1,100 Annual $150 $100 maintenance Expected life 20 years 20 years Salvage value $500 $600

Chapter16: The Markets For Labor, Capital, And Land

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:9. A plant engineer is considering the two types of solar water heating system given in the table below. The firm's MARR is 12%. On the basis of the IRR criterion, which

system is the better choice? "Do nothing" is not an option.

14 Click the icon to view the relevant data for the projects.

The IRR on incremental investment is

%. (Round to one decimal place.)

Which system is the better choice? Choose the correct answer below.

Project A

Project B

14: More Info

Project A

Project B

Initial cost

$8,000

$12,000

Annual savings

$900

$1,100

Annual

$150

$100

maintenance

Expected life

20 years

20 years

Salvage value

$500

$600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning