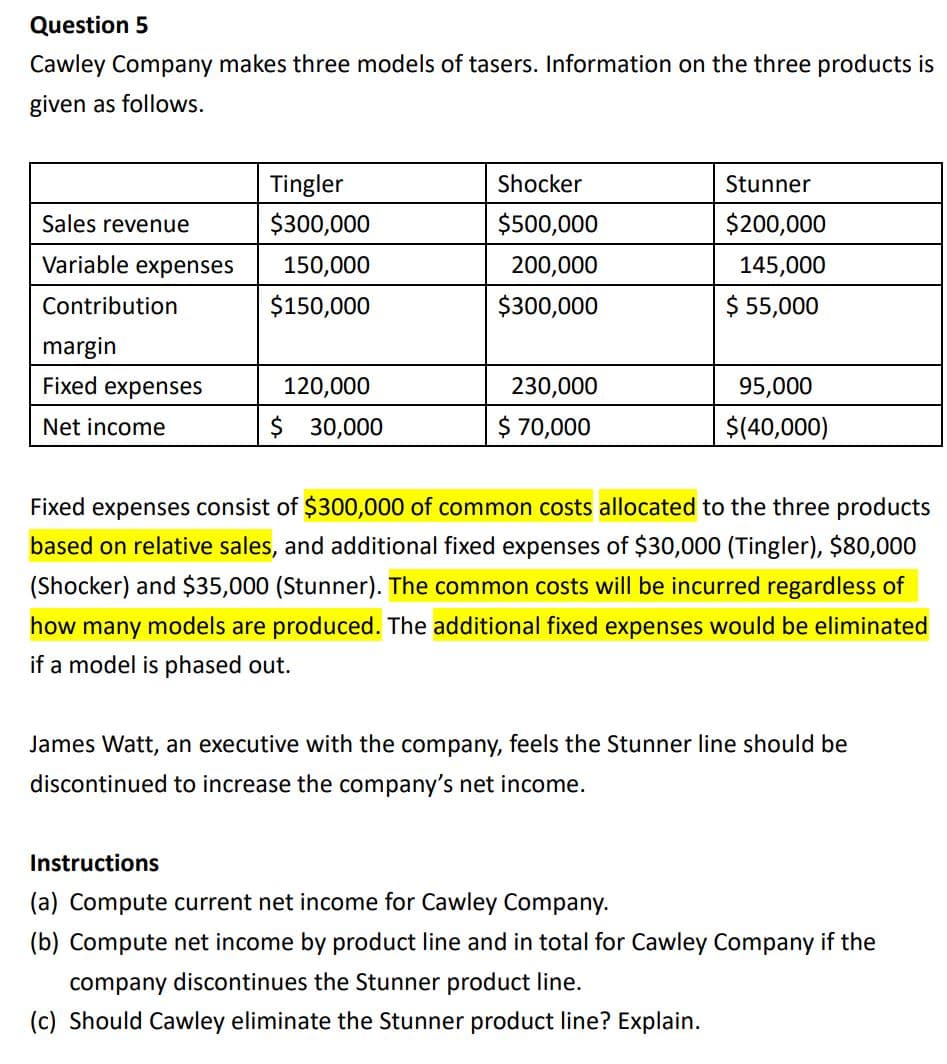

Question 5 Cawley Company makes three models of tasers. Information on the three products is given as follows. Tingler Shocker Stunner Sales revenue $300,000 $500,000 $200,000 Variable expenses 150,000 200,000 145,000 Contribution $150,000 $300,000 $ 55,000 margin Fixed expenses 120,000 230,000 95,000 Net income $ 30,000 $ 70,000 $(40,000) Fixed expenses consist of $300,000 of common costs allocated to the three products based on relative sales, and additional fixed expenses of $30,000 (Tingler), $80,000 (Shocker) and $35,000 (Stunner). The common costs will be incurred regardless of how many models are produced. The additional fixed expenses would be eliminated if a model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. Instructions (a) Compute current net income for Cawley Company. (b) Compute net income by product line and in total for Cawley Company if the company discontinues the Stunner product line. (c) Should Cawley eliminate the Stunner product line? Explain.

Question 5 Cawley Company makes three models of tasers. Information on the three products is given as follows. Tingler Shocker Stunner Sales revenue $300,000 $500,000 $200,000 Variable expenses 150,000 200,000 145,000 Contribution $150,000 $300,000 $ 55,000 margin Fixed expenses 120,000 230,000 95,000 Net income $ 30,000 $ 70,000 $(40,000) Fixed expenses consist of $300,000 of common costs allocated to the three products based on relative sales, and additional fixed expenses of $30,000 (Tingler), $80,000 (Shocker) and $35,000 (Stunner). The common costs will be incurred regardless of how many models are produced. The additional fixed expenses would be eliminated if a model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. Instructions (a) Compute current net income for Cawley Company. (b) Compute net income by product line and in total for Cawley Company if the company discontinues the Stunner product line. (c) Should Cawley eliminate the Stunner product line? Explain.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter14: The Balanced Scorecard And Corporate Social Responsibility

Section: Chapter Questions

Problem 2PA: Strategic initiatives and CSR Get Hitched Inc. is a production company that is in the process of...

Related questions

Question

Transcribed Image Text:Question 5

Cawley Company makes three models of tasers. Information on the three products is

given as follows.

Tingler

Shocker

Stunner

Sales revenue

$300,000

$500,000

$200,000

Variable expenses

150,000

200,000

145,000

Contribution

$150,000

$300,000

$ 55,000

margin

Fixed expenses

120,000

230,000

95,000

Net income

$ 30,000

$ 70,000

$(40,000)

Fixed expenses consist of $300,000 of common costs allocated to the three products

based on relative sales, and additional fixed expenses of $30,000 (Tingler), $80,000

(Shocker) and $35,000 (Stunner). The common costs will be incurred regardless of

how many models are produced. The additional fixed expenses would be eliminated

if a model is phased out.

James Watt, an executive with the company, feels the Stunner line should be

discontinued to increase the company's net income.

Instructions

(a) Compute current net income for Cawley Company.

(b) Compute net income by product line and in total for Cawley Company if the

company discontinues the Stunner product line.

(c) Should Cawley eliminate the Stunner product line? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub