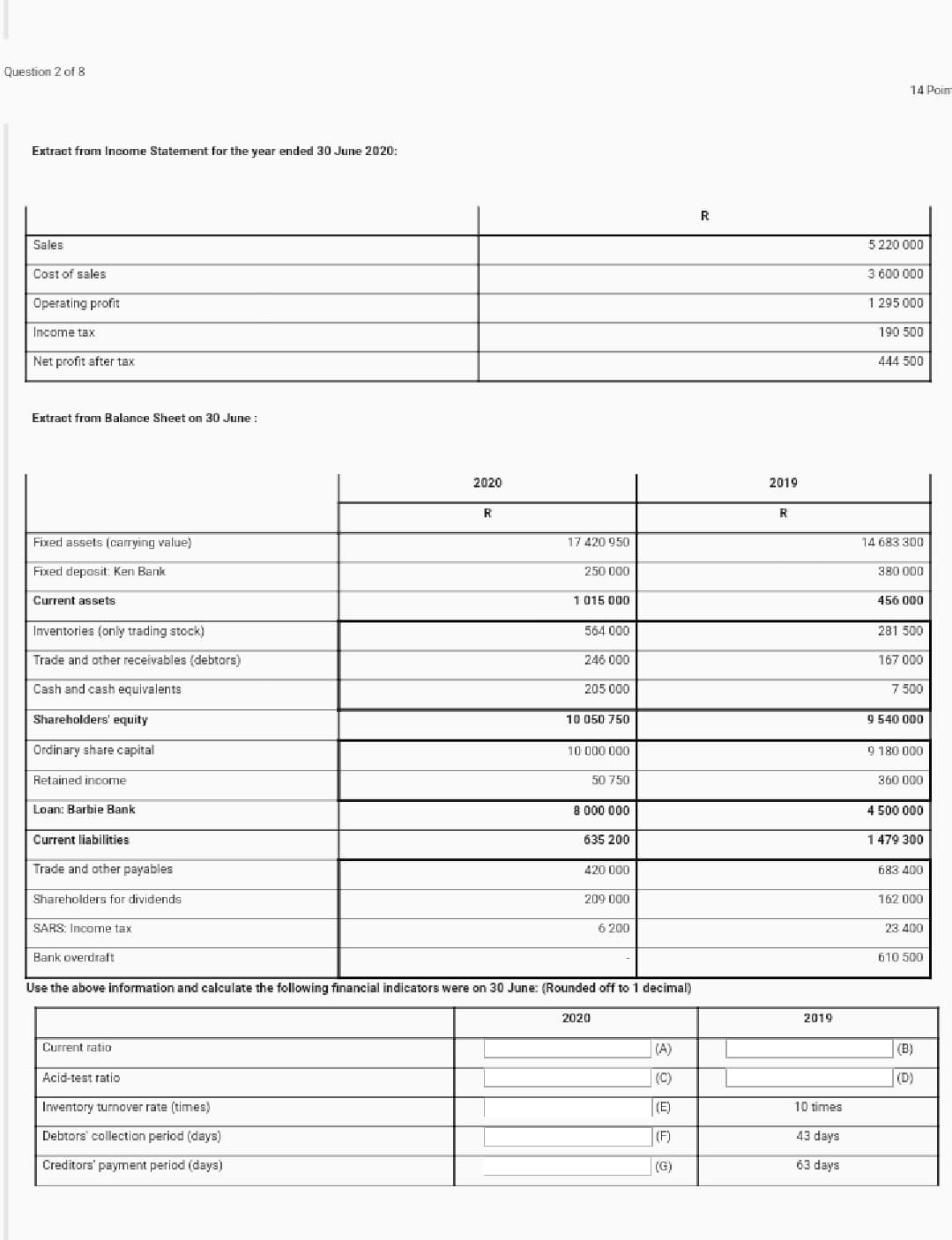

Question 2 of 8 14 Poin Extract from Income Statement for the year ended 30 June 2020: R Sales 5 220 000 Cost of sales 3 600 000 Operating profit 1 295 000 Income tax 190 500 Net profit after tax 444 500 Extract from Balance Sheet on 30 June : 2020 2019 R R Fixed assets (carrying value) 17 420 950 14 683 300 Fixed deposit: Ken Bank 250 000 380 000 Current assets 1015 000 456 000 Inventories (only trading stock) 564 000 281 500 Trade and other receivables (debtors) 246 000 167 000 Cash and cash equivalents 205 000 7 500 Shareholders' equity 10 050 750 9 540 000 Ordinary share capital 10 000 000 9 180 000 Retained income 50 750 360 000 Loan: Barbie Bank 8 000 000 4 500 000 Current liabilities 635 200 1 479 300 Trade and other payables 420 000 683 400 Shareholders for dividends 209 000 162 000 SARS: Income tax 6 200 23 400 Bank overdraft 610 500 Use the above information and calculate the following financial indicators were on 30 June: (Rounded off to 1 decimal) 2020 2019 Current ratio (A) (B) Acid-test ratio (C) |(D) Inventory turnover rate (times) (E) 10 times Debtors' collection period (days) (F) 43 days Creditors' payment period (days) (G) 63 days

Question 2 of 8 14 Poin Extract from Income Statement for the year ended 30 June 2020: R Sales 5 220 000 Cost of sales 3 600 000 Operating profit 1 295 000 Income tax 190 500 Net profit after tax 444 500 Extract from Balance Sheet on 30 June : 2020 2019 R R Fixed assets (carrying value) 17 420 950 14 683 300 Fixed deposit: Ken Bank 250 000 380 000 Current assets 1015 000 456 000 Inventories (only trading stock) 564 000 281 500 Trade and other receivables (debtors) 246 000 167 000 Cash and cash equivalents 205 000 7 500 Shareholders' equity 10 050 750 9 540 000 Ordinary share capital 10 000 000 9 180 000 Retained income 50 750 360 000 Loan: Barbie Bank 8 000 000 4 500 000 Current liabilities 635 200 1 479 300 Trade and other payables 420 000 683 400 Shareholders for dividends 209 000 162 000 SARS: Income tax 6 200 23 400 Bank overdraft 610 500 Use the above information and calculate the following financial indicators were on 30 June: (Rounded off to 1 decimal) 2020 2019 Current ratio (A) (B) Acid-test ratio (C) |(D) Inventory turnover rate (times) (E) 10 times Debtors' collection period (days) (F) 43 days Creditors' payment period (days) (G) 63 days

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 46E: OBJECTIVE 6 Exercise 1-46 Income Statement ERS Inc. maintains and repairs office equipment. ERS had...

Related questions

Question

Transcribed Image Text:Question 2 of 8

14 Poin

Extract from Income Statement for the year ended 30 June 2020:

R

Sales

5 220 000

Cost of sales

3 600 000

Operating profit

1 295 000

Income tax

190 500

Net profit after tax

444 500

Extract from Balance Sheet on 30 June :

2020

2019

R

R

Fixed assets (carrying value)

17 420 950

14 683 300

Fixed deposit: Ken Bank

250 000

380 000

Current assets

1015 000

456 000

Inventories (only trading stock)

564 000

281 500

Trade and other receivables (debtors)

246 000

167 000

Cash and cash equivalents

205 000

7 500

Shareholders' equity

10 050 750

9 540 000

Ordinary share capital

10 000 000

9 180 000

Retained income

50 750

360 000

Loan: Barbie Bank

8 000 000

4 500 000

Current liabilities

635 200

1 479 300

Trade and other payables

420 000

683 400

Shareholders for dividends

209 000

162 000

SARS: Income tax

6 200

23 400

Bank overdraft

610 500

Use the above information and calculate the following financial indicators were on 30 June: (Rounded off to 1 decimal)

2020

2019

Current ratio

(A)

(B)

Acid-test ratio

(C)

|(D)

Inventory turnover rate (times)

(E)

10 times

Debtors' collection period (days)

(F)

43 days

Creditors' payment period (days)

(G)

63 days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT