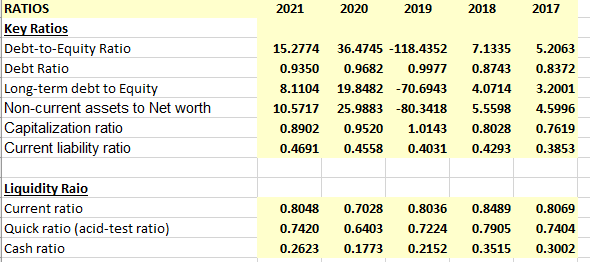

RATIOS 2021 2020 2019 2018 2017 Key Ratios Debt-to-Equity Ratio 15.2774 36.4745 -118.4352 7.1335 5.2063 Debt Ratio 0.9350 0.9682 0.9977 0.8743 0.8372 Long-term debt to Equity 8.1104 19.8482 -70.6943 4.0714 3.2001 Non-current assets to Net worth 10.5717 25.9883 -80.3418 5.5598 4.5996 Capitalization ratio Current liability ratio 0.8902 0.9520 1.0143 0.8028 0.7619 0.4691 0.4558 0.4031 0.4293 0.3853 Liquidity Raio Current ratio 0.8048 0.7028 0.8036 0.8489 0.8069 Quick ratio (acid-test ratio) 0.7420 0.6403 0.7224 0.7905 0.7404 Cash ratio 0.2623 0.1773 0.2152 0.3515 0.3002

RATIOS 2021 2020 2019 2018 2017 Key Ratios Debt-to-Equity Ratio 15.2774 36.4745 -118.4352 7.1335 5.2063 Debt Ratio 0.9350 0.9682 0.9977 0.8743 0.8372 Long-term debt to Equity 8.1104 19.8482 -70.6943 4.0714 3.2001 Non-current assets to Net worth 10.5717 25.9883 -80.3418 5.5598 4.5996 Capitalization ratio Current liability ratio 0.8902 0.9520 1.0143 0.8028 0.7619 0.4691 0.4558 0.4031 0.4293 0.3853 Liquidity Raio Current ratio 0.8048 0.7028 0.8036 0.8489 0.8069 Quick ratio (acid-test ratio) 0.7420 0.6403 0.7224 0.7905 0.7404 Cash ratio 0.2623 0.1773 0.2152 0.3515 0.3002

Chapter9: Projecting Financial Statements

Section: Chapter Questions

Problem 3bM

Related questions

Question

100%

Indicate the meaning of the ratios computed, is the business performing good or bad?

Transcribed Image Text:RATIOS

2021

2020

2019

2018

2017

Key Ratios

Debt-to-Equity Ratio

Debt Ratio

15.2774

36.4745 -118.4352

7.1335

5.2063

0.9350

0.9682

0.9977

0.8743

0.8372

Long-term debt to Equity

Non-current assets to Net worth

Capitalization ratio

Current liability ratio

8.1104

19.8482 -70.6943

4.0714

3.2001

10.5717

25.9883 -80.3418

5.5598

4.5996

0.8902

0.9520

1.0143

0.8028

0.7619

0.4691

0.4558

0.4031

0.4293

0.3853

Liquidity Raio

Current ratio

Quick ratio (acid-test ratio)

0.8048

0.7028

0.8036

0.8489

0.8069

0.7420

0.6403

0.7224

0.7905

0.7404

Cash ratio

0.2623

0.1773

0.2152

0.3515

0.3002

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you