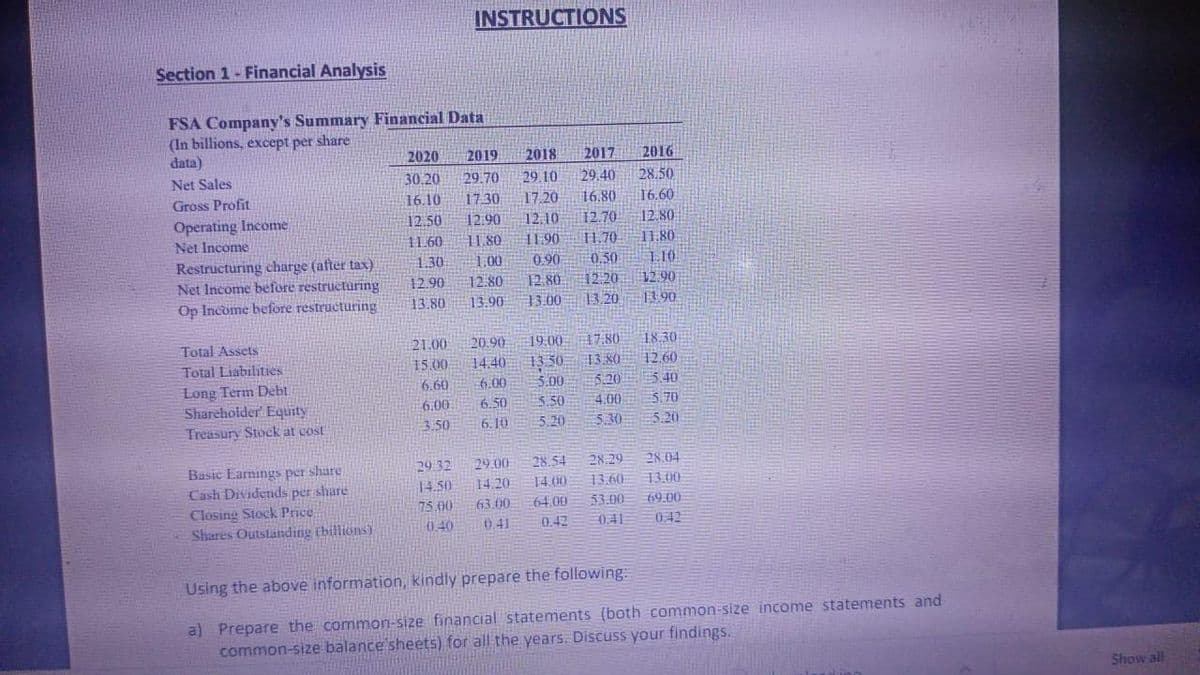

Section 1- Financial Analysis FSA Company's Summary Financial Data (In billions, except per share data) 2020 2019 2018 2017 2016 Net Sales 30.20 29.70 28.50 29.40 16.80 29 10 Gross Profit 16.10 17.30 17.20 16.60 Operating Income Net Income 12.50 12.90 12.10 12.70 12.80 11.60 11.80 11.80 I1.70 0.50 11.90 Restructuring charge (after tax) Net Income before restructuring Op Income before restructuring 1.30 1.00 0.90 L10 12.90 12.80 12.80 12.20 12.90 13.80 13.90 33.00 13 20 13 90 Total Assets 21.00 20.90 19.00 17.80 18.30 13,50 5.00 3 50 Total Liabilities 12.60 15,00 6.60 14.40 13.80 Long Term Debt Shareholder Equity 6.00 5.20 5.40 6.00 6.50 4.00 5.70 Treasury Stock at cost 3.50 6.10 5.20 5.30 5.20 29 32 29.00 28.54 28.29 28.04 Basic Earnings per share Cash Dividends per share 14.50 14.20 14.00 13.60 13,00 Closing Stock Price Shares Outstanding tbillions) 75,00 63.00 64 00 33.00 69.00 0.40 0.41 0.42 0.41 0.42 Using the above information, kindly prepare the following: a) Prepare the common-size financial statements (both common-size income statements and common-size balance'sheets) for all the years. Discuss your findings. Show

Section 1- Financial Analysis FSA Company's Summary Financial Data (In billions, except per share data) 2020 2019 2018 2017 2016 Net Sales 30.20 29.70 28.50 29.40 16.80 29 10 Gross Profit 16.10 17.30 17.20 16.60 Operating Income Net Income 12.50 12.90 12.10 12.70 12.80 11.60 11.80 11.80 I1.70 0.50 11.90 Restructuring charge (after tax) Net Income before restructuring Op Income before restructuring 1.30 1.00 0.90 L10 12.90 12.80 12.80 12.20 12.90 13.80 13.90 33.00 13 20 13 90 Total Assets 21.00 20.90 19.00 17.80 18.30 13,50 5.00 3 50 Total Liabilities 12.60 15,00 6.60 14.40 13.80 Long Term Debt Shareholder Equity 6.00 5.20 5.40 6.00 6.50 4.00 5.70 Treasury Stock at cost 3.50 6.10 5.20 5.30 5.20 29 32 29.00 28.54 28.29 28.04 Basic Earnings per share Cash Dividends per share 14.50 14.20 14.00 13.60 13,00 Closing Stock Price Shares Outstanding tbillions) 75,00 63.00 64 00 33.00 69.00 0.40 0.41 0.42 0.41 0.42 Using the above information, kindly prepare the following: a) Prepare the common-size financial statements (both common-size income statements and common-size balance'sheets) for all the years. Discuss your findings. Show

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 15.17EX: Profitability ratios The following selected data were taken from the financial statements of...

Related questions

Question

Transcribed Image Text:INSTRUCTIONS

Section 1- Financial Analysis

FSA Company's Summary Financial Data

(In billions, except per share

data)

2020

2019

2018

2017

2016

Net Sales

30.20

29.70

29.10

29.40

28.50

Gross Profit

16.10

17.30

17.20

16.80

16.60

Operating Income

Net Income

12.50

12.90

12.10

12.70

12.80

11.90

0.90

12.80

11.60

11.80

1.70

11.80

Restructuring charge (after tax)

Net Income before restructuring

Op Income before restructuring

1.30

1.00

0.50

L10

12.80

12.90

1390

12.90

12.20

13.80

13.90

13.00

13.20

17.80

20.90

14.40 13 50

5.00

Total Assets

21.00

19.00

18.30

Total Liabilities

15.00

13.80

12.60

Long Term Debt

Shareholder Equity

Treasury Stock at cost

6.60

6.00

6.00

5.20

5.40

6.50

5.70

5.50

5.20

4.00

3.50

6. 10

5.30

5.20

29 32

28.54

28 29

28.04

Basic Earnings per share.

Cash Dividends per share

29.00

14.50

14.20

14.00

13.60

13.00

53.00

Closing Stock Price

Shares Outstatiding (billions)

75.00

63.00

64.00

69.00

0.40

0.41

0.42

0,41

0 42

Using the above information, kindly prepare the following:

a) Prepare the common-size financial statements (both common-size income statements and

common-size balance sheets) for all the years. Discuss your findings.

Show all

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning