Complete a schedule that reflects a ratio analysis of (2017,2018,2019,2020 ). Compute the ratios discussed in the chapter.(Profitability, Activity Ratios, Tests of Liquidity, Tests of Solvency and Market Tests ? 2-Based on the data given, prepare a comparative written evaluation of the ratio analyses (and any other available information) and give your recommended choice with the supporting explanation.

Complete a schedule that reflects a ratio analysis of (2017,2018,2019,2020 ). Compute the ratios discussed in the chapter.(Profitability, Activity Ratios, Tests of Liquidity, Tests of Solvency and Market Tests ? 2-Based on the data given, prepare a comparative written evaluation of the ratio analyses (and any other available information) and give your recommended choice with the supporting explanation.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

1- Complete a schedule that reflects a ratio analysis of (2017,2018,2019,2020 ). Compute the ratios discussed in

the chapter.(Profitability, Activity Ratios, Tests of Liquidity, Tests of Solvency and Market Tests ?

2-Based on the data given,

prepare a comparative written evaluation of the ratio analyses (and any other available information)

and give your recommended choice with the supporting explanation.

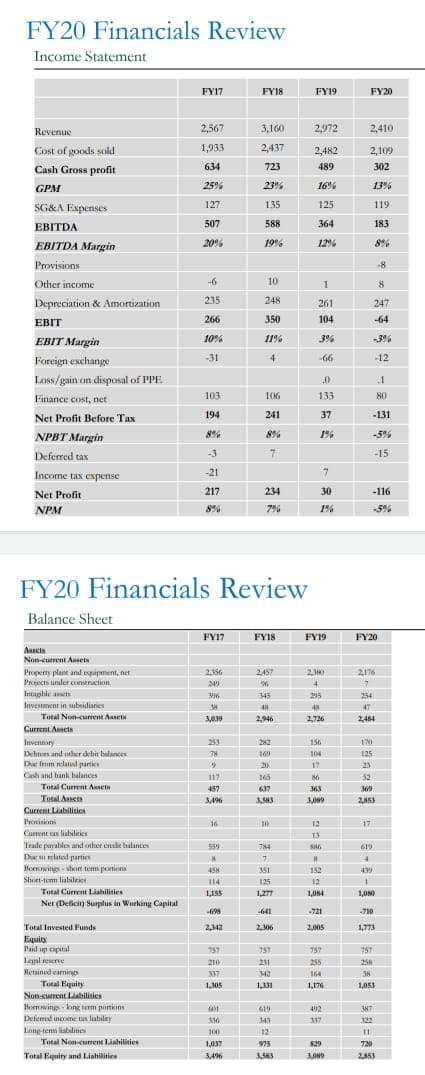

Transcribed Image Text:FY20 Financials Review

Income Statement

FY17

FY18

FY19

FY20

Revenue

2,567

3,160

2,972

2,410

Cost of goods sold

1,933

2,437

2,482

2,109

Cash Gross profit

634

723

489

302

GPM

25%

23%

16%

13%

127

135

125

119

SG&A Expenses

507

588

364

183

EBITDA

EBITDA Margin

20%

19%

12%

8%

Provisions

-8

Other income

-6

10

8

235

248

Depreciation & Amortization

261

247

266

350

104

-64

EBIT

EBIT Margin

10%

11%

3%

-3%

-31

4

66

-12

Foreign exchange

Loss/gain on disposal of PPE

Finance cost, net

103

106

133

80

Net Profit Before Tax

194

241

37

-131

NPBT Margin

8%

8%

1%

-5%

Deferred tax

-3

-15

Income tax expense

-21

Net Profit

217

234

30

-116

NPM

8%

7%

1%

-5%

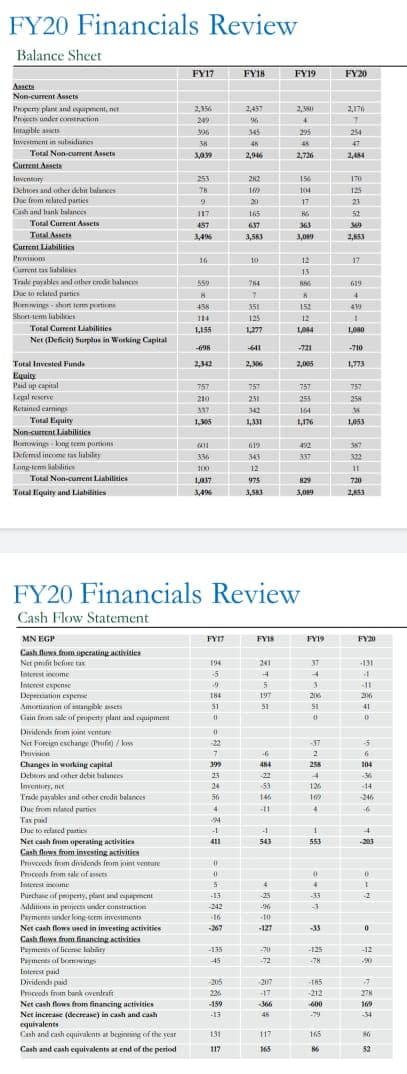

FY20 Financials Review

Balance Sheet

FY17

FYIS

FY19

FY20

Aascta

Non-curent Ansets

Propeny plant and espipment, net

Projects under conieruction

Intaghle as

Investment in ubnidianes

2156

2457

230

2176

249

4.

45

215

254

47

Total Non-curent Asset

3,039

2946

2726

244

Current Ancis

Inventory

253

156

170

Dehtors and uther dehit balances

Da from elated partics

169

104

125

17

21

Cash and hank halances

117

165

52

Total Current Ansetn

457

637

363

369

Total Asscts

3,496

3,009

Current Liabilities

Ienisions

16

12

17

Current an liabilities

13

Trade payalles and other credie halances

Dar related partien

Hoenwings - shon tem ponions

55

T84

619

7.

45H

152

439

Short-tem liahileic

114

125

12

Total Current Liabilities

L155

1,277

1,04

1,00

Net (Deficit) Surplus in Wurking Capital

4/98

-641

-721

710

Total Invested Funds

2,342

205

1,773

Equity

Pail up capital

Legal resene

Retained eamings

757

7S7

757

757

21

211

255

258

337

342

164

38

Total Equity

Non-curent Liabilitics

Homwings - kong term purtikins

Defemal income tas liabiley

Lang-tenn lablities

Total Non-curent Liahilities

1,305

131

1,176

1,053

410

412

343

17

100

12

1,037

975

829

720

Total Equity and Liabilities

3,496

3.583 109 2AS3

Transcribed Image Text:FY20 Financials Review

Balance Sheet

FY17

FY18

FY19

FY20

Ascta

Non-current Assets

I'rpeny plant and epipment, net

Peiects under cotraction

Intagble act

2,156

2437

2,176

249

345

205

254

Investment in subsidianes

47

Tutal Non-cunent Assets

2,946

2,726

2,44

Current Anseta

Inventury

253

212

156

170

Debtoes and other debit balances

78

16

104

125

Dae fmm elated panies

20

17

23

Cah and hank halances

117

165

52

Total Current Assets

457

637

363

Total Assets

3,46

3,563

3.089

2,853

Current Liabilities

Provision

16

10

12

17

Curment tas lishilities

Trale payables and other ede halances

Due n elated parties

Hornwing shut em pertion

Shoet-tem liabileies

13

559

619

456

351

153

4

114

125

12

Total Current Liahilisies

L155

1,277

LO4

1,080

Net (Deficit) Surplus in Working Capital

698

641

-721

-710

Tutal Invested Funde

2.342

2.306

2,005

1,773

Equity

Paid up capital

757

757

757

757

Legal reserve

210

251

255

258

Retained camings

337

342

164

35

Total Equiry

Nin current Liabilities

Bomwing kang tem portions

Defemud incme tas liabiley

1,05

1,31

1,176

L053

619

492

387

336

343

337

322

Lang-tenn lablitis

100

12

Total Non-cunent Liabilities

LA37

975

829

720

Total Equity and Liabilities

3.496

1.SKI 109 2.853

3,089

FY20 Financials Review

Cash Flow Statement

MN EGP

FYT

FYIS

FY19

FY20

Cash luwa fnm.upetating activities

Net pnifit hefore tax

194

241

37

-131

Interst income

5

Interest espense

Deperciation espeme

Amortization of itangble isets

Gain fnm sale of peiperty plant and espuipment

11

184

197

51

51

41

Dividends from jint venture

Net Forcign eschange (Pifi) / ko

Pruvnitn

-22

-37

-17

-5

2

Changes in working capital

199

484

258

104

Debeors und other debit hulances

23

22

-36

Imentuey, net

Trade payables and other credit balances

Due fnm nlaned parties

Tax pail

Due to rtated parties

24

53

126

-14

56

146

169

246

11

94

Net cash from operating activities

Cash flows from investing activitien

Pruveeds fom dividends fem jnint vennae

411

543

553

-203

Pruceods from sale of asses

Interrst ncome

Purchane of peiperty, plant and equpment

Additions in peuies under cunstruction

-13

-25

33

242

-3

Paymenes under long-term investments

-16

10

Net cash flows ed in investing activities

267

-127

-33

Cash flows fnm financing activities

Paymenes of lieme lahity

Payments of bomwings

-135

-125

-12

45

-72

-7H

Interest paid

Dividends paid

Pruceods from bank oventraft

Net cash flows from financing activities

Net increase (decrease) in cash and cash

equivalents

Cash and cash cquivaknts at beginning of the yoar

205

-207

-TH5

226

17

-212

27H

-159

366

-600

169

-13

-79

34

131

117

165

Cash and cash equivalents at end of the period

117

165

52

一

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning