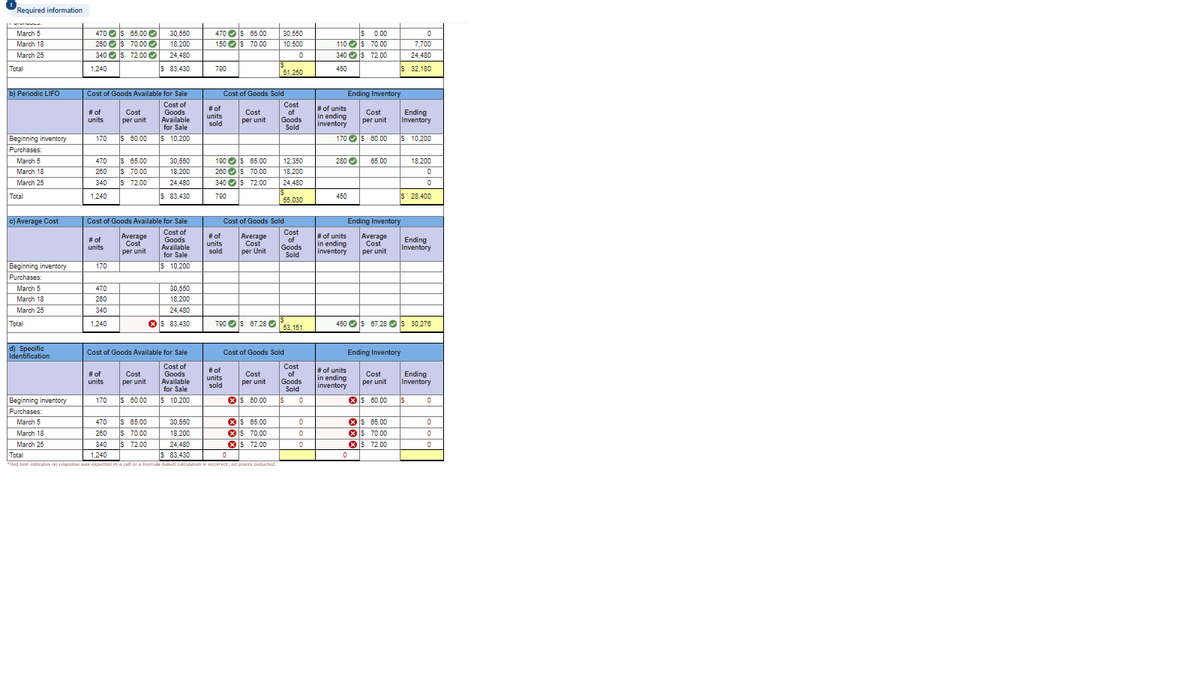

Required information [The following information applies to the questions displayed below) Warnerwoods Company uses a periodic lInventory system. it entered into the following purchases and sales transactions for March. Date ACtivaties Uits Acouired at Cost 170 units se per unit 470 units ses jer unit Uits Sold at Retall Mar. I beginning inventory Mar. S Purchase Mar. Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales 400 unitse ss per unit 200 unitse S per unit 340 units 2 jer unit ,240 units 100 unitse sies per unit 790 units Totals For specific identification, the March 9 sale consisted of 90 units from beginning inventory and 400 units from the March 5 purchase; the March 29 sale consisted of 110 units from the March 18 purchase and 190 units from the March 25 purchase. 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (C) weighted average, and (a) specific identification. (Round your average cost per unit to 2 decimal places.)

Required information [The following information applies to the questions displayed below) Warnerwoods Company uses a periodic lInventory system. it entered into the following purchases and sales transactions for March. Date ACtivaties Uits Acouired at Cost 170 units se per unit 470 units ses jer unit Uits Sold at Retall Mar. I beginning inventory Mar. S Purchase Mar. Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales 400 unitse ss per unit 200 unitse S per unit 340 units 2 jer unit ,240 units 100 unitse sies per unit 790 units Totals For specific identification, the March 9 sale consisted of 90 units from beginning inventory and 400 units from the March 5 purchase; the March 29 sale consisted of 110 units from the March 18 purchase and 190 units from the March 25 purchase. 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (C) weighted average, and (a) specific identification. (Round your average cost per unit to 2 decimal places.)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section: Chapter Questions

Problem 2AP

Related questions

Question

Transcribed Image Text:Required information

s 0.00

470 Os 65.00 O

260 Os 70.00 O

340 Os 72.00 O

470 Os 65.00

150 OS 70.00

March 5

30,550

30,550

18,200

110 Os 70.00

340 Os 72.00

March 18

10,500

7,700

March 25

24,480

24,480

$ 83,430

IS

51,250

S 32,180

Total

1,240

790

450

b) Periodic LIFO

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Cost of

Goods

Available

Cost

of

Goods

Sold

# of units

in ending

inventory

# of

# of

units

Cost

Cost

Cost

units

sold

Ending

Inventory

per unit

per unit

per unit

for Sale

Beginning inventory

170

S 80.00

$ 10,200

170 OS 60.00

S 10,200

Purchases:

s 65.00

s 70.00

s 72.00

190 OS 65.00

280 OS 70.00

March 5

470

30,550

12,350

280 O

65.00

18.200

March 18

260

18,200

18,200

340 Os 72.00

IS

55,030

March 25

340

24,480

24,480

Total

1,240

$ 83,430

790

450

S 28,400

c) Average Cost

| Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Average

Cost

Cost of

Goods

Available

Cost

of

# of

# of

units

units

sold

Average

Cost

Goods

Sold

# of units

in ending

inventory

Average

Cost

per unit

Ending

Inventory

per unit

per Unit

for Sale

Beginning inventory

170

$ 10,200

Purchases:

March 5

470

30,550

March 18

260

18,200

March 25

340

24,480

Total

1,240

Os 83,430

790 Os 67.28 O

450 Os 67.28 Os 30,276

53,151

d) Specific

Identification

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Cost of

Goods

Available

for Sale

Cost

of

Goods

Sold

# of

units

Cost

per unit

# of

units

Cost

per unit

# of units

in ending

inventory

Cost

Ending

Inventory

per unit

sold

s 80.00

Os 0.00

Beginning inventory

Purchases:

170

$ 10,200

IS

*$ 60.00

IS

s 65.00

s 70.00

Os 65.00

Os 70.00

Os 72.00

March 5

O$ 85.00

Os 70.00

470

30,550

March 18

260

18,200

March 25

340

S 72.00

24,480

8$ 72.00

Total

1,240

$ 83,430

*Red text indicates no reiponse was expected in a call ar a formula-based calculation is incorrect; no points deducted.

![Reguired information

[The following information applies to the questions clisplayed below.]

Warnerwoods Company uses a perlodic Inventory system. It entered Into the following purchases and sales transactions

for March.

Units Acquired at Cost

178 units e $6e per unit

470 units e $65 per unit

Date

Activities

Units Sold at Retail

Mar.

1 Beginning inventory

Mar. 5 Purchase

Mar. 9 Sales

Mar. 18 Purchase

490 units e $95 per unit

260 units e $7e per unit

340 units e $72 per unit

Mar. 25 Purchase

Mar. 29 Sales

300 units e $1e5 per unit

Totals

1,240 units

790 units

For specific Identification, the March 9 sale consisted of 90 units from beginning Inventory and 400 units from the March 5

purchase; the March 29 sale consisted of 110 units from the March 18 purchase and 190 units from the March 25 purchase.

3. Compute the cost assigned to ending Inventory using (a) FIFO. (b) LIFO. (C) weighted average, and (d) specific Identification. (Round

your average cost per unit to 2 decimal places.)

a) Periodic FIFO

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Cost of

Goods

Cost

of

# of

# of units

# of

units

Cost

Cost

Cost

Available

for Sale

units

sold

Goods

Sold

in ending

inventory

Ending

Inventory

per unit

per unit

per unit

Beginning inventory

170 O S 80.00 O$

170 Os 60.00

s 0.00

10.200

10,200

Purchases:

470 Os 85.00 O

260 OS 70.00 O

340 Os 72.00 O

470 Os 05.00

150 Os 70.00

March 5

IS

110 OS 70.00

340 Os 72.00

30,550

30,550

0.00

March 18

18,200

10,500

7,700

March 25

24,480

24,480

$ 83,430

IS

51,250

S 32,180

Total

1,240

790

450

b) Periodic LIFO

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Cost of

Goods

Available

for Sale

# of

units

sold

Cost

of

Goods

Sold

# of units

# of

units

Cost

per unit

Cost

Cost

in ending

inventory

Ending

Inventory

per unit

per unit

Beginning inventory

170

S 80.00

$ 10,200

170 Os 60.00

S 10,200

Purchases:

March 5

280 O

S 85.00

Is 70.00

S 72.00

190 Os 65.00

260 OS 70.00

340 OS 72.00

470

30,550

12,350

65.00

18.200

March 18

260

18,200

18.200

March 25

340

24,480

24,480

Total

1,240

$ 83,430

790

450

s 28,400

55,030](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Ffe46867b-8e32-4051-86e0-c12e0211534e%2F9f3e3f93-6040-4f5c-8f9d-2509c6e78e86%2Frxd6hzh_processed.png&w=3840&q=75)

Transcribed Image Text:Reguired information

[The following information applies to the questions clisplayed below.]

Warnerwoods Company uses a perlodic Inventory system. It entered Into the following purchases and sales transactions

for March.

Units Acquired at Cost

178 units e $6e per unit

470 units e $65 per unit

Date

Activities

Units Sold at Retail

Mar.

1 Beginning inventory

Mar. 5 Purchase

Mar. 9 Sales

Mar. 18 Purchase

490 units e $95 per unit

260 units e $7e per unit

340 units e $72 per unit

Mar. 25 Purchase

Mar. 29 Sales

300 units e $1e5 per unit

Totals

1,240 units

790 units

For specific Identification, the March 9 sale consisted of 90 units from beginning Inventory and 400 units from the March 5

purchase; the March 29 sale consisted of 110 units from the March 18 purchase and 190 units from the March 25 purchase.

3. Compute the cost assigned to ending Inventory using (a) FIFO. (b) LIFO. (C) weighted average, and (d) specific Identification. (Round

your average cost per unit to 2 decimal places.)

a) Periodic FIFO

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Cost of

Goods

Cost

of

# of

# of units

# of

units

Cost

Cost

Cost

Available

for Sale

units

sold

Goods

Sold

in ending

inventory

Ending

Inventory

per unit

per unit

per unit

Beginning inventory

170 O S 80.00 O$

170 Os 60.00

s 0.00

10.200

10,200

Purchases:

470 Os 85.00 O

260 OS 70.00 O

340 Os 72.00 O

470 Os 05.00

150 Os 70.00

March 5

IS

110 OS 70.00

340 Os 72.00

30,550

30,550

0.00

March 18

18,200

10,500

7,700

March 25

24,480

24,480

$ 83,430

IS

51,250

S 32,180

Total

1,240

790

450

b) Periodic LIFO

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Cost of

Goods

Available

for Sale

# of

units

sold

Cost

of

Goods

Sold

# of units

# of

units

Cost

per unit

Cost

Cost

in ending

inventory

Ending

Inventory

per unit

per unit

Beginning inventory

170

S 80.00

$ 10,200

170 Os 60.00

S 10,200

Purchases:

March 5

280 O

S 85.00

Is 70.00

S 72.00

190 Os 65.00

260 OS 70.00

340 OS 72.00

470

30,550

12,350

65.00

18.200

March 18

260

18,200

18.200

March 25

340

24,480

24,480

Total

1,240

$ 83,430

790

450

s 28,400

55,030

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,