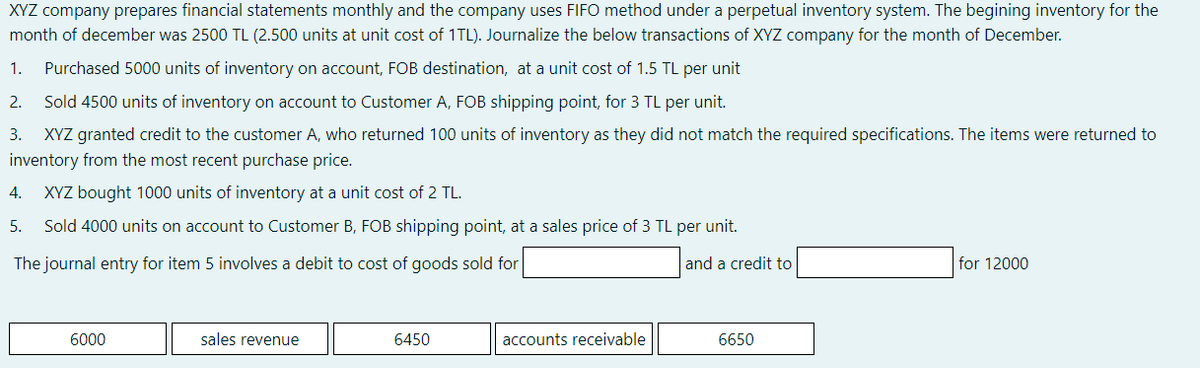

XYZ company prepares financial statements monthly and the company uses FIFO method under a perpetual inventory system. The begining inventory for the month of december was 2500 TL (2.500 units at unit cost of 1TL). Journalize the below transactions of XYZ company for the month of December. 1. Purchased 5000 units of inventory on account, FOB destination, at a unit cost of 1.5 TL per unit 2. Sold 4500 units of inventory on account to Customer A, FOB shipping point, for 3 TL per unit. 3. XYZ granted credit to the customer A, who returned 100 units of inventory as they did not match the required specifications. The items were returned to inventory from the most recent purchase price. 4. XYZ bought 1000 units of inventory at a unit cost of 2 TL. 5. Sold 4000 units on account to Customer B, FOB shipping point, at a sales price of 3 TL per unit. The journal entry for item 5 involves a debit to cost of goods sold for and a credit to for 12000 6000 sales revenue 6450 accounts receivable 6650

XYZ company prepares financial statements monthly and the company uses FIFO method under a perpetual inventory system. The begining inventory for the month of december was 2500 TL (2.500 units at unit cost of 1TL). Journalize the below transactions of XYZ company for the month of December. 1. Purchased 5000 units of inventory on account, FOB destination, at a unit cost of 1.5 TL per unit 2. Sold 4500 units of inventory on account to Customer A, FOB shipping point, for 3 TL per unit. 3. XYZ granted credit to the customer A, who returned 100 units of inventory as they did not match the required specifications. The items were returned to inventory from the most recent purchase price. 4. XYZ bought 1000 units of inventory at a unit cost of 2 TL. 5. Sold 4000 units on account to Customer B, FOB shipping point, at a sales price of 3 TL per unit. The journal entry for item 5 involves a debit to cost of goods sold for and a credit to for 12000 6000 sales revenue 6450 accounts receivable 6650

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.10MCP: Comparison of Inventory Costing Methods—Periodic System Bitten Companys inventory records show 600...

Related questions

Topic Video

Question

Transcribed Image Text:XYZ company prepares financial statements monthly and the company uses FIFO method under a perpetual inventory system. The begining inventory for the

month of december was 2500 TL (2.500 units at unit cost of 1TL). Journalize the below transactions of XYZ company for the month of December.

1.

Purchased 5000 units of inventory on account, FOB destination, at a unit cost of 1.5 TL per unit

2.

Sold 4500 units of inventory on account to Customer A, FOB shipping point, for 3 TL per unit.

3. XYZ granted credit to the customer A, who returned 100 units of inventory as they did not match the required specifications. The items were returned to

inventory from the most recent purchase price.

4.

XYZ bought 1000 units of inventory at a unit cost of 2 TL.

5.

Sold 4000 units on account to Customer B, FOB shipping point, at a sales price of 3 TL per unit.

The journal entry for item 5 involves a debit to cost of goods sold for

and a credit to

for 12000

6000

sales revenue

6450

accounts receivable

6650

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning