Requirements 1. Determine the amount that would be reported in ending merchandise inventory on November 15 using the FIFO inventory costing method. 2. Determine the amount that would be reported in ending merchandise inventory on November 15 using the LIFO inventory costing method. 3. Determine the amount that would be reported in ending merchandise inventory on November 15 using the weighted-average inventory costing method. Round all amounts to the nearest cent.

Requirements 1. Determine the amount that would be reported in ending merchandise inventory on November 15 using the FIFO inventory costing method. 2. Determine the amount that would be reported in ending merchandise inventory on November 15 using the LIFO inventory costing method. 3. Determine the amount that would be reported in ending merchandise inventory on November 15 using the weighted-average inventory costing method. Round all amounts to the nearest cent.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter6: Inventories

Section: Chapter Questions

Problem 2PB: LIFO perpetual inventory The beginning inventory for Dunne Co. and data on purchases and sales for a...

Related questions

Topic Video

Question

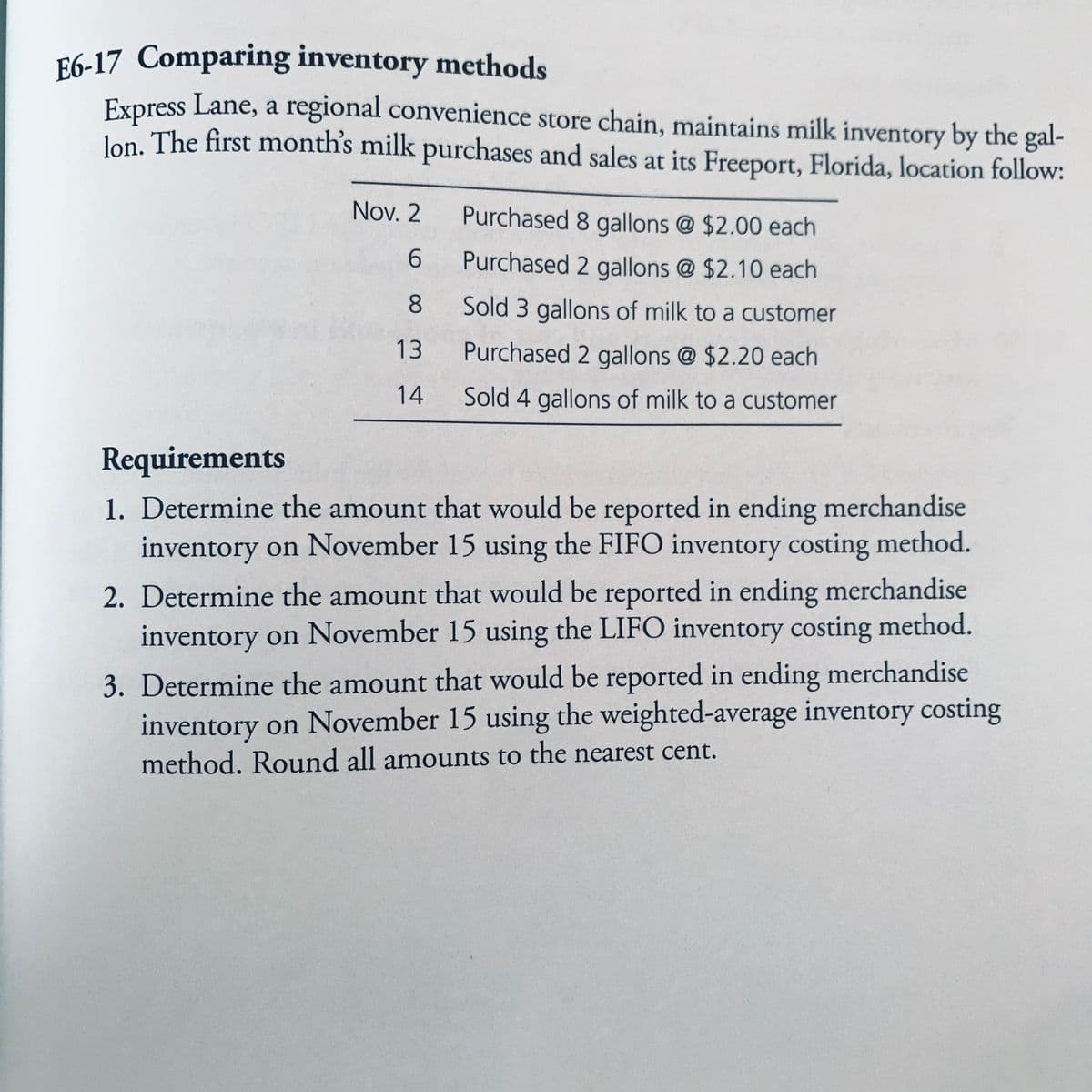

Transcribed Image Text:F6-17 Comparing inventory methods

Express Lane, a regional convenience store chain, maintains milk inventory by the gal-

Jon. The first month's milk purchases and sales at its Freeport, Florida, location follow:

Nov. 2

Purchased 8 gallons @ $2.00 each

Purchased 2 gallons @ $2.10 each

8

Sold 3 gallons of milk to a customer

13

Purchased 2 gallons @ $2.20 each

14

Sold 4 gallons of milk to a customer

Requirements

1. Determine the amount that would be reported in ending merchandise

inventory on November 15 using the FIFO inventory costing method.

2. Determine the amount that would be reported in ending merchandise

inventory on November 15 using the LIFO inventory costing method.

3. Determine the amount that would be reported in ending merchandise

inventory on November 15 using the weighted-average inventory costing

method. Round all amounts to the nearest cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,