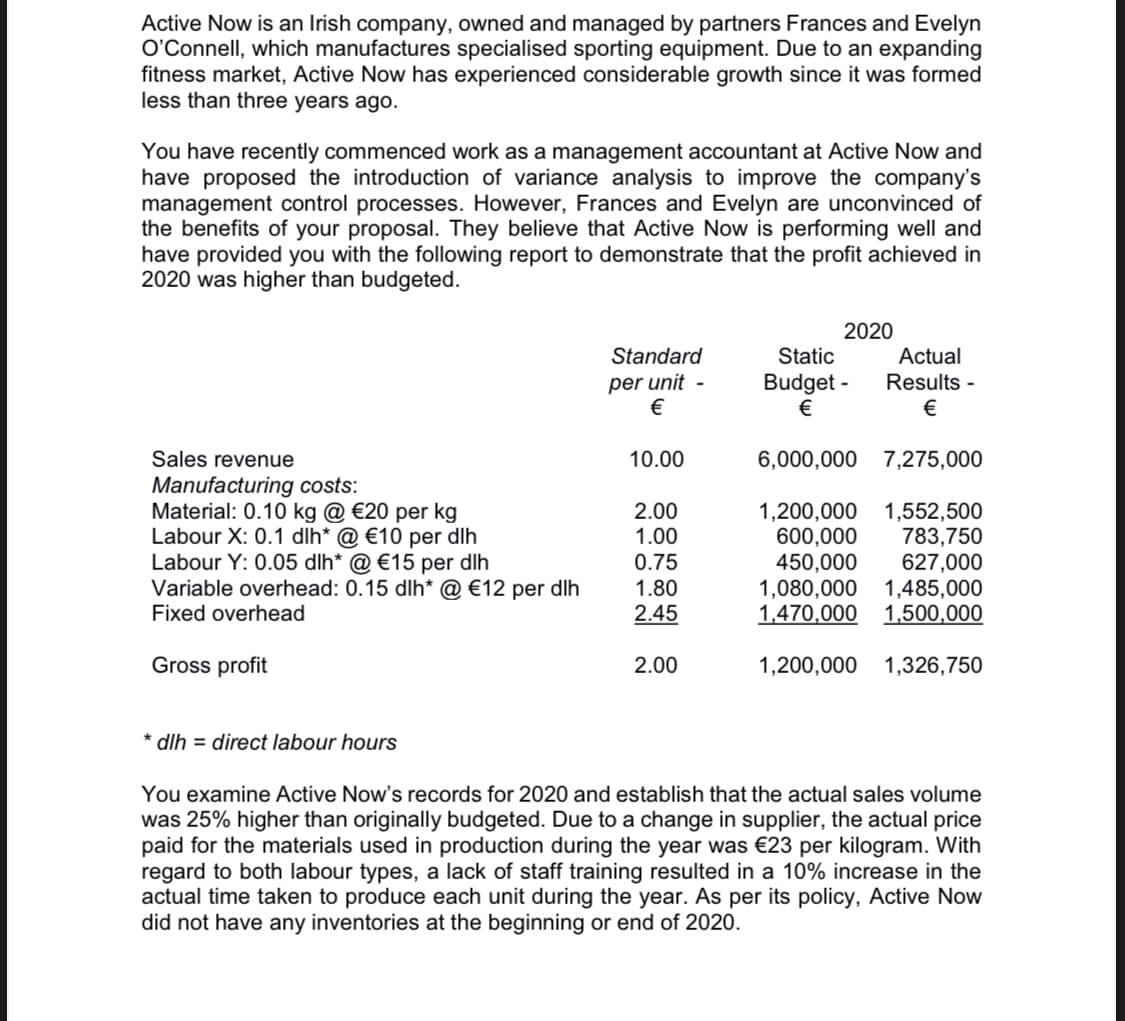

Requirements: Q1 (a) Prepare a statement that reconciles the budgeted gross profit for Active Now in 2020 (as per the static budget) to the actual gross profit earned in the year, showing sales and cost variances in as much detail as the information permits.

Q: (b) Another team member who is preparing the Budgeted Balance Sheet for the business forthe same…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: The following production and cost information is for X Company for 2019: Budgeted 10,600…

A: 1) Static budget: Particulars Amount $ Variable cost (10,600 x 9.13) 96,778 Fixed cost…

Q: Required: (b) Another team member who is preparing the Budgeted Balance Sheet for the…

A: Budgets are the estimates or forecasts that are made for a future period of time. These are the…

Q: Reso tubes was preparing a budgeted income statement for 2019 and has accumulated the following…

A: Net income can be calculated by subtracting the cost of goods sold and other expenses like…

Q: Prepare a budgeted multiple-step income statement for 2022. CORONADO INDUSTRIES Budgeted Income…

A: In the context of the given question, we are required to prepare a budgeted income statement for…

Q: The budgeted indirect cost rate is calculated Select one : OA at the end of the year OB at the end…

A: The budgeted indirect cost rate refers to the rate used to allocate the overheads of the business to…

Q: 5. Formulate Projected Financial Statements (As of December 31, 2021) a. Budgeted Cost of Goods…

A: Income statement: A financial statement used for recording the revenue generated by the company and…

Q: Consider the following June actual ending balances and July 31, 2024 budgeted amounts for Octovios:…

A: Balance sheet is prepared with a view to show the financial position of the entity in the form of…

Q: Match each definition with its related term by selecting the appropriate term in the dropdown…

A:

Q: Create own budget for the month of April 2021. This must include Fixed and Variable expenditure…

A:

Q: Prepare a budgeted income statement. Round your answers to the nearest dollar. Italian Exports, Inc.…

A: Solution:- Given, The information were obtained from the financial records of Italian Exports, Inc.,…

Q: (a) Prepare a schedule showing the computation of cost of goods sold for 2020. (b) Prepare a…

A: Cost Of Goods Sold: Cost of goods sold is the direct costs of producing the goods sold by a…

Q: Required: a) Using the information provided prepare a flexible budget statement for 27,000 units for…

A: Budget: A budget is an estimation to determine the income that will be earned and expenses that will…

Q: 1. Prepare the following budgets for March 2012: a. Revenues budget b. Production budget in units c.…

A: Hi! Thank you for the question. As per the honor code, We are allowed to answer three sub-parts at a…

Q: A. What are the total expected cash collections for the year under revised budget ? B. What is the…

A: Budget: A budget is an estimation to determine the income that will be earned and expenses that will…

Q: Required: i) Prepare the Cash Budget by month for the first quarter of 2016. Identify and comment on…

A: A Cash budget is a plan of the cash inflows and cash outflows over a period of time. A Cash budget…

Q: Review the attached budget report that includes current month, YTD, the annualized YTD projections,…

A: Break Even point is the case when there is NO PROFIT and NO LOSS. In other words it is the minimum…

Q: A. In May 2020, the budget committee of Alia, Inc. assembles the following data in preparation of…

A: Budgeted merchandise to be purchased means value of merchandise which is to be sold to outside…

Q: Assume that a company provided the following excerpts of information from its flexible budget…

A: Flexible budgets is that type of budget which changes or fluctuates with change in activity level.…

Q: Use the information provided above to prepare the following for Midas Enterprises Budgeted Statement…

A: Based on the statement of comprehensive income for the year 2021 and the statement of financial…

Q: Cheatem Trading Company's master budget reflects budgeted sales information for the month of March,…

A: Sales Budgeted : It's financial plan that estimates a company's total sales in a specific time…

Q: A company is planning to prepare Budget for the year 2022. In the budgeting and planning process,…

A: The strategic plan is the planning report that specifies the organizational goal, the procedure of…

Q: b) Evaluate all alternatives (or combinations given the budget) to determine the best (financially)…

A: The method of distributing overhead expenses to cost objects based on a sound rationale is known as…

Q: . Prepare a flexible budget performance report for 2019. (Indicate the effect of each varlance by…

A: Comparison and Analysis of actual result with flexible results help in evaluation and making…

Q: Consider the following June actual ending balances and July 31, 2024 budgeted amounts for Octovios:…

A: All amounts are in dollars ($).

Q: Required: Prepare the company's budgeted income statement for the year.

A: Income statement refers to a statement which shows the revenue and expense of the company of a…

Q: What function does an annual budget serve as a part of a company's performance measurement system…

A: Budget is the estimation of the expenditure which will be incurred for the period for which budget…

Q: Prepare the following budgets for Syarikat Quantum Sdn. Bhd. for the year 2020: a. Sales Budget b.…

A: Direct Material Budget is a statement prepared to calculate the amount of materials that needs to be…

Q: Required: (a) Calculate the variable manufacturing overhead and fixed manufacturing overhead…

A:

Q: Woodruff Company prepared the following budgeted income statement for 2019: E (Click the icon to…

A: The budgets are prepared to evaluate the expenses or income may occur for a particular condition.

Q: Perform a sensitivity analysis on the budget for values from $5,000 to $35,000 inincrements of…

A: The following table is explaining about the recommended budget.

Q: Which of the following statements is true concerning the recording of a budget? At the beginning of…

A: Budget is the estimation by the individual, group or government at the beginning of the period to…

Q: Which budget activity at the start of each year is set as "zero"? Select one: a. Incremental…

A: Introduction: Budget: Budget means allocation and managing the funds to various activities. Based on…

Q: what should these amounts be

A: Trade payables are those payables of the company which the company have to pay which has resulted…

Q: a) Compute the monthly budgeted production and material purchases for January to March 2019. (b)…

A: Production Budget Particulars January February March Forecasted Unit Sales 16000 22000…

Q: Using a flexible budgeting approach how do I prepare a performance report for the current department…

A: Flexible Budget in Manufacturing overhead Using the flexible budget in the manufacturing overhead to…

Q: (b) Another team member who is preparing the Budgeted Balance Sheet for the business for the same…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: Today is November 1, 2021. A continuous budget for the period from November 1, 2021 through October…

A: The continuous budget is continuously revised and thus gives a more accurate picture of the…

Q: 1. What was the total overhead master (static) budget for 2021? 2. What was the total overhead…

A: For Solution 2: Total overhead flexible budget for 2021 means budgeted cost for actual production of…

Q: An accounting statement that presents predicted amounts of the company's assets, liabilities, and…

A: Balance sheet refers to the one of the financial statements which is prepared by the companies at…

Q: On the basis of the projected proceeding data and projections prepare the following for Year ended…

A: Budget means the quantitative expression of figures for the future period of time.

Q: Review the attached budget report that includes current month, YTD, the annualized YTD projections,…

A: An income statement is a financial statement that represents the financial performance of the…

Q: The personnel expenses in the planning budget for November would be closest to: Multiple Choice…

A: A budget is a financial plan which is associated with future. It could be prepared for the…

Q: A variant of fiscal-year budgeting whereby a 12 month projection into the future is maintained at…

A: SOLUTION- Continuous budgeting is the process of continually adding one more month to the end of a…

Q: oing the budget, what is projected first

A:

Answer Q1 a

Step by step

Solved in 2 steps with 2 images

- At the beginning of the last quarter of 20x1, Youngston, Inc., a consumer products firm, hired Maria Carrillo to take over one of its divisions. The division manufactured small home appliances and was struggling to survive in a very competitive market. Maria immediately requested a projected income statement for 20x1. In response, the controller provided the following statement: After some investigation, Maria soon realized that the products being produced had a serious problem with quality. She once again requested a special study by the controllers office to supply a report on the level of quality costs. By the middle of November, Maria received the following report from the controller: Maria was surprised at the level of quality costs. They represented 30 percent of sales, which was certainly excessive. She knew that the division had to produce high-quality products to survive. The number of defective units produced needed to be reduced dramatically. Thus, Maria decided to pursue a quality-driven turnaround strategy. Revenue growth and cost reduction could both be achieved if quality could be improved. By growing revenues and decreasing costs, profitability could be increased. After meeting with the managers of production, marketing, purchasing, and human resources, Maria made the following decisions, effective immediately (end of November 20x1): a. More will be invested in employee training. Workers will be trained to detect quality problems and empowered to make improvements. Workers will be allowed a bonus of 10 percent of any cost savings produced by their suggested improvements. b. Two design engineers will be hired immediately, with expectations of hiring one or two more within a year. These engineers will be in charge of redesigning processes and products with the objective of improving quality. They will also be given the responsibility of working with selected suppliers to help improve the quality of their products and processes. Design engineers were considered a strategic necessity. c. Implement a new process: evaluation and selection of suppliers. This new process has the objective of selecting a group of suppliers that are willing and capable of providing nondefective components. d. Effective immediately, the division will begin inspecting purchased components. According to production, many of the quality problems are caused by defective components purchased from outside suppliers. Incoming inspection is viewed as a transitional activity. Once the division has developed a group of suppliers capable of delivering nondefective components, this activity will be eliminated. e. Within three years, the goal is to produce products with a defect rate less than 0.10 percent. By reducing the defect rate to this level, marketing is confident that market share will increase by at least 50 percent (as a consequence of increased customer satisfaction). Products with better quality will help establish an improved product image and reputation, allowing the division to capture new customers and increase market share. f. Accounting will be given the charge to install a quality information reporting system. Daily reports on operational quality data (e.g., percentage of defective units), weekly updates of trend graphs (posted throughout the division), and quarterly cost reports are the types of information required. g. To help direct the improvements in quality activities, kaizen costing is to be implemented. For example, for the year 20x1, a kaizen standard of 6 percent of the selling price per unit was set for rework costs, a 25 percent reduction from the current actual cost. To ensure that the quality improvements were directed and translated into concrete financial outcomes, Maria also began to implement a Balanced Scorecard for the division. By the end of 20x2, progress was being made. Sales had increased to 26,000,000, and the kaizen improvements were meeting or beating expectations. For example, rework costs had dropped to 1,500,000. At the end of 20x3, two years after the turnaround quality strategy was implemented, Maria received the following quality cost report: Maria also received an income statement for 20x3: Maria was pleased with the outcomes. Revenues had grown, and costs had been reduced by at least as much as she had projected for the two-year period. Growth next year should be even greater as she was beginning to observe a favorable effect from the higher-quality products. Also, further quality cost reductions should materialize as incoming inspections were showing much higher-quality purchased components. Required: 1. Identify the strategic objectives, classified by the Balanced Scorecard perspective. Next, suggest measures for each objective. 2. Using the results from Requirement 1, describe Marias strategy using a series of if-then statements. Next, prepare a strategy map. 3. Explain how you would evaluate the success of the quality-driven turnaround strategy. What additional information would you like to have for this evaluation? 4. Explain why Maria felt that the Balanced Scorecard would increase the likelihood that the turnaround strategy would actually produce good financial outcomes. 5. Advise Maria on how to encourage her employees to align their actions and behavior with the turnaround strategy.As CEO of Riverside Marine, Rachel Moore knows it is important to control costs and to respond quickly to changes in the highly competitive boat-building industry. When Gerbig Consulting proposes that Riverside Marine invest in an ERP system, she forms a team to evaluate the proposal: the plant engineer, the plant foreman, the systems specialist, the human resources director, the marketing director, and the management accountant. A month later, the management accountant Miles Cobalt reports that the team and Gerbig estimate that if Riverside Marine implements the ERP system, it will incur the following costs: Costs of the Project a.$390,000 in software costs b. $85,000 to customize the ERP software and load Riverside Marine'sdata into the new ERP system c. $112,000 for employee training Benefits of the Project a. More efficient order processing should lead to savings of $185,000. b. Streamlining the manufacturing process so that it maps into the ERP…Blue is the controller at the Acme Shoe Company, a large manufacturing company located in Franklin, Pennsylvania. Acme has many divisions, and the performance of each division has typically been evaluated using a return on investment (ROI) formula. The return on investment is calculated by dividing profit by the book value of total assets.In a meeting yesterday with Bob Burn, the company president, Blue warned that this return on investment measure might not be accurately reflecting how well the divisions are doing. Blue is concerned that by using profits and the book value of assets, division managers might be engaging in some short-term finagling to show the highest possible return. Bob concurred and asked what other numbers they could use to evaluate division performance.Blue said, ‘‘I’m not sure, Bob. Net income is not a good number for evaluation purposes. Because we allocate a lot of overhead costs to the divisions on what some managers consider an arbitrary basis, net…

- Blue is the controller at the Acme Shoe Company, a large manufacturing companylocated in Franklin, Pennsylvania. Acme has many divisions, and the performance ofeach division has typically been evaluated using a retum on investment (ROI)formula. The return on investment is caleulated by dividing profit by the book value of total assets.In a meeting yesterday with Bob Burn, the compuny president, Blue warned that thisreturn on investment measure might not be accurately rellecting how well thedivisions are doing. Blue is concerned that by using profits and the book value ofussets, division managers might be engaging in some short-term finagling to show the highest possible return. Bob concurred and asked what other numbers they could use to evaluate division performance.Blue said,T'm not sure, Bob. Net income isn't a good number for evaluationpurposes. Becuse we allocate a lot of overhead costs to the divisions on what somemanagers consider an arbitrary basis, net income won't work as a…A seminar was recently attended by the Managing Director of XYZ Manufacturing Company Limited located at Sheffield. The focus of the seminar was “optimising scarce resources utility in a manufacturing setting with particular reference to linear programming”. On his return to his base, he called for a meeting with the Management to share his experience from the seminar and the impact this will have on the decision by the Board to produce two major products in the years ahead. A group of external research experts had previously been commissioned and the following represents information from the research carried out by them The expected products are “Best” and “Smart” with expected costs statistics as follows: Best £ Smart £ Material costs (5kg@£50/kg) 250 (3kg@£50/kg) 150 Labour costs Machinery time (4 hours @£15/Hr) 60 (2hours @£15/Hr) 30 Other Processing Time (4 hours @£10/hr) 40 (5hours@£10/Hr) 50 The applicable pricing…Richins Company is considering the acquisition of a computerized manufacturing system. The new system has a built in quality function that increases the control over product specifications. An alarm sounds whenever the product falls outside the programmed specifications. An operator can then make some adjustments on the spot to restore the desired product quality. The system is expected to decrease the number of units scrapped because of poor quality. The system is also expected to decrease the amount of labor inputs needed. The production manager is pushing for the aquisition because he believes that productivity will be greatly enhanced - particularly when it comes to labor and material inputs. Output and input data follow. The data for the computerized system are projections. Current System Computerized System Output (units)…

- Company B uses a responsibility reporting system to measure the performance of its three investment centers: Planes, Taxis, and Limos. Segment performance is measured using a system of responsibility reports and return on investment calculations. The allocation of resources within the company and the segment managers’ bonuses are based in part on the results shown in these reports.Recently, the company was the victim of a computer virus that deleted portions of the company’s accounting records. This was discovered when the current period’s responsibility reports were being prepared. The printout of the actual operating results appeared as follows. Planes Taxis Limos Service revenue $ ? $450,000 $ ? Variable costs 5,000,000 ? 320,000 Contribution margin ? 180,000 380,000 Controllable fixed costs 1,500,000 ? ? Controllable margin ? 70,000 176,000 Average operating assets 25,000,000 ? 1,600,000 Return on investment 12% 10% ? InstructionsDetermine the missing pieces…Wolk Corporation is a highly automated manufacturing firm. The vice president of finance has decided that traditional standards are inappropriate for performance measures in an automated environment. Labor for this company is insignificant in terms of the total cost of production and tends to be fixed, material quality is considered more important than minimizing material cost, and customer satisfaction is the number one priority. As a result, delivery performance measures have been chosen to evaluate performance. The following information is considered typical of the time involved to complete customer orders. From time order is placed to time order received by manufacturing 18.0 days From time order is received by manufacturing to time production begins 9.0 days Inspection time 3.5 days Process (manufacturing) time 7.0 days Move time 4.5 days What is the production (manufacturing) lead time for this order? Multiple Choice 34 days. 16…In 20X1, Don Blackburn, president of Price Electronics, received a report indicating that quality costs were 31% of sales. Faced with increasing pressures from imported goods. Don resolved to take measures to improve the overall quality of the companys products. After hiring a consultant in 20X1, the company began an aggressive program of total quality control. At the end of 20X5, Don requested an analysis of the progress the company had made in reducing and controlling quality costs. The accounting department assembled the following data: Required: 1. Compute the quality costs as a percentage of sales by category and in total for each year. 2. Prepare a multiple-year trend graph for quality costs, both by total costs and by category. Using the graph, assess the progress made in reducing and controlling quality costs. Does the graph provide evidence that quality has improved? Explain. 3. Using the 20X1 quality cost relationships (assume all costs are variable), calculate the quality costs that would have prevailed in 20X4. By how much did profits increase in 20X4 because of the quality improvement program? Repeat for 20X5.

- At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: Required: 1. Compute the following measures for 20x1 and 20x3: a. Actual velocity and cycle time b. Percentage of total revenue from new customers (assume one unit per customer) c. Percentage of very satisfied customers (assume each customer purchases one unit) d. Market share e. Percentage change in actual product cost (for 20x3 only) f. Percentage change in days of inventory (for 20x3 only) g. Defective units as a percentage of total units produced h. Total hours of training i. Suggestions per production worker j. Total revenue k. Number of new customers 2. For the measures listed in Requirement 1, list likely strategic objectives, classified according to the four Balance Scorecard perspectives. Assume there is one measure per objective.Recently, Ulrich Company received a report from an external consulting group on its quality costs. The consultants reported that the companys quality costs total about 21 percent of its sales revenues. Somewhat shocked by the magnitude of the costs, Rob Rustin, president of Ulrich Company, decided to launch a major quality improvement program. For the coming year, management decided to reduce quality costs to 17 percent of sales revenues. Although the amount of reduction was ambitious, most company officials believed that the goal could be realized. To improve the monitoring of the quality improvement program, Rob directed Pamela Golding, the controller, to prepare monthly performance reports comparing budgeted and actual quality costs. Budgeted costs and sales for the first two months of the year are as follows: The following actual sales and actual quality costs were reported for January: Required: 1. Reorganize the monthly budgets so that quality costs are grouped in one of four categories: appraisal, prevention, internal failure, or external failure. (Essentially, prepare a budgeted cost of quality report.) Also, identify each cost as variable (V) or fixed (F). (Assume that no costs are mixed.) 2. Prepare a performance report for January that compares actual costs with budgeted costs. Comment on the companys progress in improving quality and reducing its quality costs.Galveston Pump Corporation is considering implementing a JIT production system. The new system would reduce current average inventory levels of $2,000,000 by 75%, but it would require a much greater dependency on the company’s core suppliers for on-time deliveries and high-quality inputs. The company’s operations manager, Frank Griswold, is opposed to the idea of a new JIT system because he is concerned that the new system (a) will be too costly to manage; (b) will result in too many stockouts; and (c) will lead to the layoff of his employees, several of whom are currently managing inventory. He believes that these layoffs will affect the morale of his entire production department. The management accountant, Bonnie Barrett, is in favor of the new system because of its likely cost savings. Frank wants Bonnie to rework the numbers because he is concerned that top management will give more weight to financial factors and not give due consideration to nonfinancial factors such as employee…