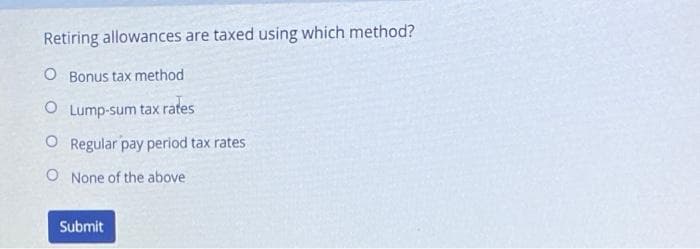

Retiring allowances are taxed using which methou? O Bonus tax method O Lump-sum tax rates O Regular pay period tax rates

Retiring allowances are taxed using which methou? O Bonus tax method O Lump-sum tax rates O Regular pay period tax rates

Chapter27: The Federal Gift And Estate Taxes

Section: Chapter Questions

Problem 5DQ

Related questions

Question

Transcribed Image Text:Question

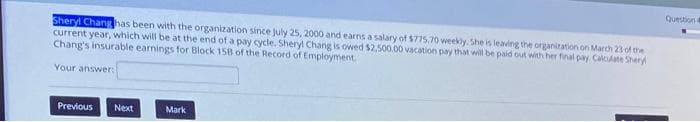

Sheryl Chang has been with the organization since july 25, 2000 and earns a salary of $775.70 weekly. She is leaving the organiration on March 23 of the

current year, which will be at the end of a pay cycle. Sheryl Chang is owed $2,500.00 vacation pay that wil be paid out with her final pay Calclate Shery

Chang's insurable earnings for Block 158 of the Record of Employment

Your answer:

Previous

Next

Mark

Transcribed Image Text:Retiring allowances are taxed using which method?

O Bonus tax method

O Lump-sum tax rates

O Regular pay period tax rates

O None of the above

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT