s. The demand for hard drives is Q = 17 – P. They both have MC = 2 and no fixed cost so AT erified that together the firms maximize their (combined) profit by each making 3.75 hard profit does Seagate make with this cartel agreement? $ inued) Is the cartel agreement a Nash equilibrium? , Seagate wants to decrease production

s. The demand for hard drives is Q = 17 – P. They both have MC = 2 and no fixed cost so AT erified that together the firms maximize their (combined) profit by each making 3.75 hard profit does Seagate make with this cartel agreement? $ inued) Is the cartel agreement a Nash equilibrium? , Seagate wants to decrease production

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter13: best-practice Tactics: Game Theory

Section: Chapter Questions

Problem 3E

Related questions

Question

this question is one question with several parts

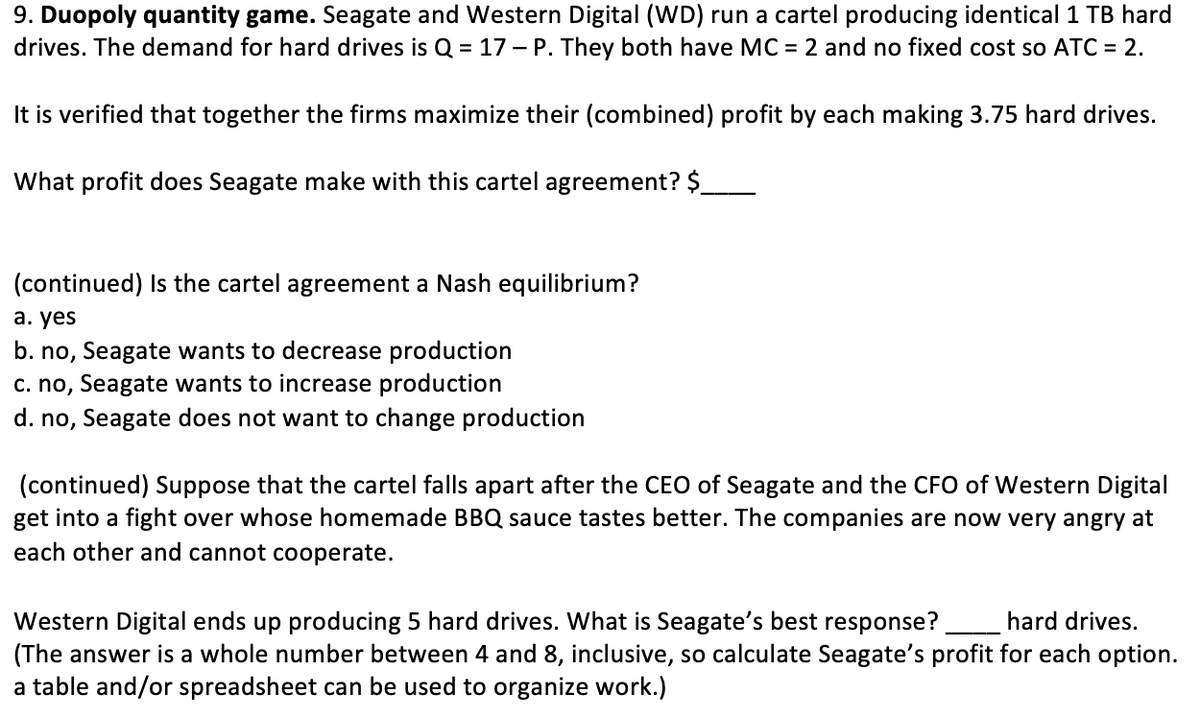

Transcribed Image Text:9. Duopoly quantity game. Seagate and Western Digital (WD) run a cartel producing identical 1 TB hard

drives. The demand for hard drives is Q = 17 – P. They both have MC = 2 and no fixed cost so ATC = 2.

It is verified that together the firms maximize their (combined) profit by each making 3.75 hard drives.

What profit does Seagate make with this cartel agreement? $_

(continued) Is the cartel agreement a Nash equilibrium?

а. yes

b. no, Seagate wants to decrease production

c. no, Seagate wants to increase production

d. no, Seagate does not want to change production

(continued) Suppose that the cartel falls apart after the CEO of Seagate and the CFO of Western Digital

get into a fight over whose homemade BBQ sauce tastes better. The companies are now very angry at

each other and cannot cooperate.

Western Digital ends up producing 5 hard drives. What is Seagate's best response?

(The answer is a whole number between 4 and 8, inclusive, so calculate Seagate's profit for each option.

a table and/or spreadsheet can be used to organize work.)

hard drives.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc