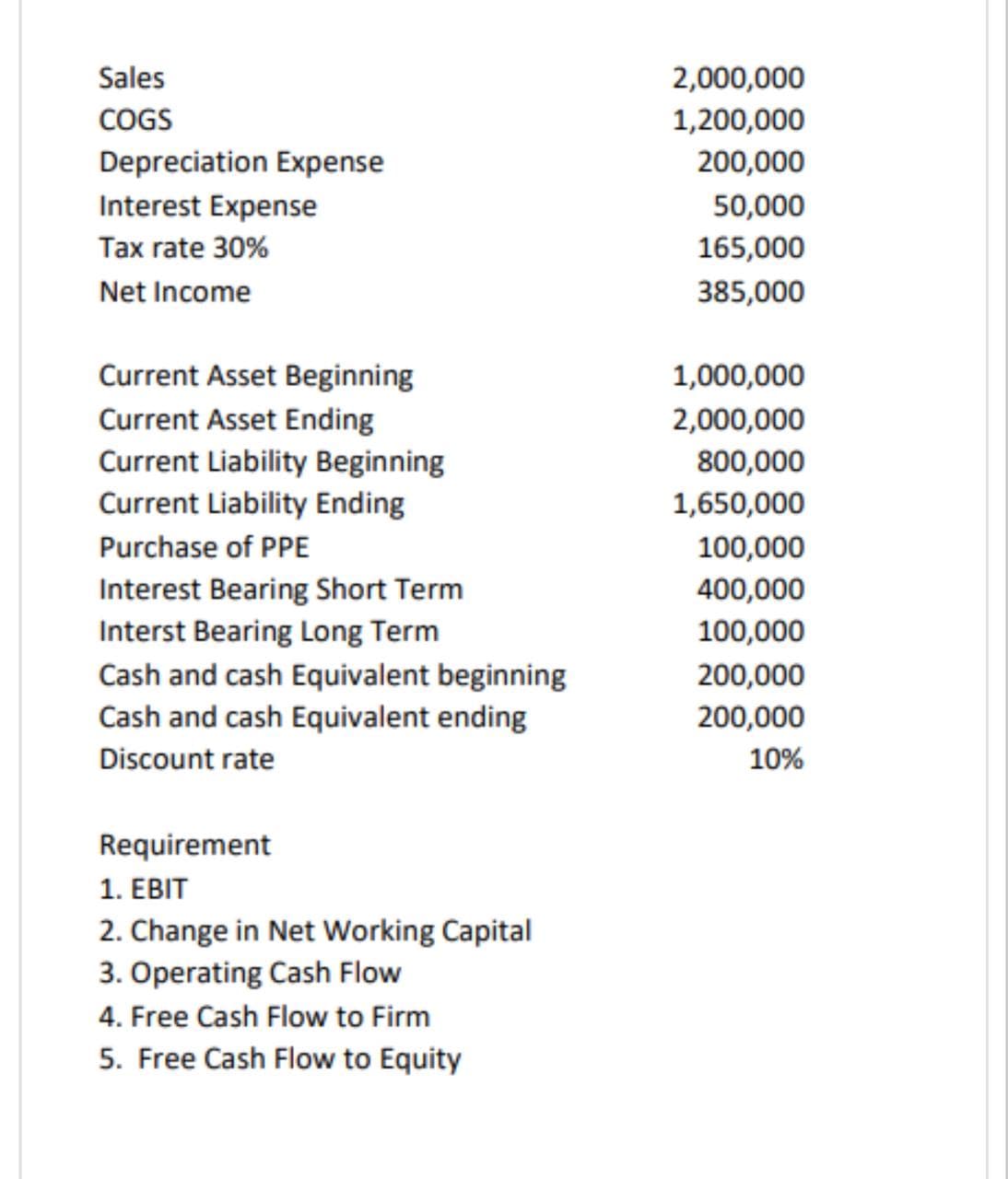

Sales COGS Depreciation Expense Interest Expense Tax rate 30% Net Income Current Asset Beginning Current Asset Ending Current Liability Beginning Current Liability Ending Purchase of PPE Interest Bearing Short Term Interst Bearing Long Term Cash and cash Equivalent beginning Cash and cash Equivalent ending Discount rate Requirement 1. EBIT 2. Change in Net Working Capital 3. Operating Cash Flow 4. Free Cash Flow to Firm 5. Free Cash Flow to Equity 2,000,000 1,200,000 200,000 50,000 165,000 385,000 1,000,000 2,000,000 800,000 1,650,000 100,000 400,000 100,000 200,000 200,000 10%

Sales COGS Depreciation Expense Interest Expense Tax rate 30% Net Income Current Asset Beginning Current Asset Ending Current Liability Beginning Current Liability Ending Purchase of PPE Interest Bearing Short Term Interst Bearing Long Term Cash and cash Equivalent beginning Cash and cash Equivalent ending Discount rate Requirement 1. EBIT 2. Change in Net Working Capital 3. Operating Cash Flow 4. Free Cash Flow to Firm 5. Free Cash Flow to Equity 2,000,000 1,200,000 200,000 50,000 165,000 385,000 1,000,000 2,000,000 800,000 1,650,000 100,000 400,000 100,000 200,000 200,000 10%

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 8EP

Related questions

Question

Transcribed Image Text:Sales

COGS

Depreciation Expense

Interest Expense

Tax rate 30%

Net Income

Current Asset Beginning

Current Asset Ending

Current Liability Beginning

Current Liability Ending

Purchase of PPE

Interest Bearing Short Term

Interst Bearing Long Term

Cash and cash Equivalent beginning

Cash and cash Equivalent ending

Discount rate

Requirement

1. EBIT

2. Change in Net Working Capital

3. Operating Cash Flow

4. Free Cash Flow to Firm

5. Free Cash Flow to Equity

2,000,000

1,200,000

200,000

50,000

165,000

385,000

1,000,000

2,000,000

800,000

1,650,000

100,000

400,000

100,000

200,000

200,000

10%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning