[The following information applies to the questions displayed below.] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. April 16 Purchased 6,000 shares of Gem Company stock at $25.50 per share. July 7 Purchased 3,000 shares of PepsiCo stock at $47.00 per share. Purchased 1,500 shares of Xerox stock at $19.00 per share. July 20 August 15 Received a $0.95 per share cash dividend on the Gem Company stock. August 28 Sold 3,000 shares of Gem Company stock at $32.25 per share. October 1 Received a $2.00 per December 15 Received a $1.10 per share cash dividend on the PepsiCo shares. share cash dividend on the remaining Gem Company shares. December 31 Received a $1.30 per share cash dividend on the PepsiCo shares. The year-end fair values per share are Gem Company, $27.75; PepsiCo, $44.25; and Xerox, $16.00. Problem 15-4A (Algo) Part 5 5. Identify the dollar increase or decrease from Rose's short-term stock investments on (a) its income statement for this year and (b) the equity section of its balance sheet at this year-end.

[The following information applies to the questions displayed below.] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. April 16 Purchased 6,000 shares of Gem Company stock at $25.50 per share. July 7 Purchased 3,000 shares of PepsiCo stock at $47.00 per share. Purchased 1,500 shares of Xerox stock at $19.00 per share. July 20 August 15 Received a $0.95 per share cash dividend on the Gem Company stock. August 28 Sold 3,000 shares of Gem Company stock at $32.25 per share. October 1 Received a $2.00 per December 15 Received a $1.10 per share cash dividend on the PepsiCo shares. share cash dividend on the remaining Gem Company shares. December 31 Received a $1.30 per share cash dividend on the PepsiCo shares. The year-end fair values per share are Gem Company, $27.75; PepsiCo, $44.25; and Xerox, $16.00. Problem 15-4A (Algo) Part 5 5. Identify the dollar increase or decrease from Rose's short-term stock investments on (a) its income statement for this year and (b) the equity section of its balance sheet at this year-end.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 21DQ

Related questions

Question

Dd.117.

![LU P4

[The following information applies to the questions displayed below.]

Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short-

term stock investments with insignificant influence.

April 16 Purchased 6,000 shares of Gem Company stock at $25.50 per share.

July 7 Purchased 3,000 shares of PepsiCo stock at $47.00 per share.

July 20 Purchased 1,500 shares of Xerox stock at $19.00 per share.

August 15 Received a $0.95 per share cash dividend on the Gem Company stock.

August 28 Sold 3,000 shares of Gem Company stock at $32.25 per share.

Received a $2.00 per

October 1

share cash dividend on the PepsiCo shares.

December 15 Received a $1.10 per share cash dividend on the remaining Gem Company shares.

December 31 Received a $1.30 per share cash dividend on the PepsiCo shares.

The year-end fair values per share are Gem Company, $27.75; PepsiCo, $44.25; and Xerox, $16.00.

Problem 15-4A (Algo) Part 5

5. Identify the dollar increase or decrease from Rose's short-term stock investments on (a) its income statement for this year and (b) the

equity section of its balance sheet at this year-end.

(a) Income statement for this year

(b) The equity section of its balance sheet at this year-end

$

Amount Increase or Decrease

39,150 Increase

Increase](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe2ee2641-7c60-4f65-a663-59c8b8b8fc04%2Fa4fa52bd-f5a0-4bf5-97c2-62eed429990a%2Fyq455jj_processed.png&w=3840&q=75)

Transcribed Image Text:LU P4

[The following information applies to the questions displayed below.]

Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short-

term stock investments with insignificant influence.

April 16 Purchased 6,000 shares of Gem Company stock at $25.50 per share.

July 7 Purchased 3,000 shares of PepsiCo stock at $47.00 per share.

July 20 Purchased 1,500 shares of Xerox stock at $19.00 per share.

August 15 Received a $0.95 per share cash dividend on the Gem Company stock.

August 28 Sold 3,000 shares of Gem Company stock at $32.25 per share.

Received a $2.00 per

October 1

share cash dividend on the PepsiCo shares.

December 15 Received a $1.10 per share cash dividend on the remaining Gem Company shares.

December 31 Received a $1.30 per share cash dividend on the PepsiCo shares.

The year-end fair values per share are Gem Company, $27.75; PepsiCo, $44.25; and Xerox, $16.00.

Problem 15-4A (Algo) Part 5

5. Identify the dollar increase or decrease from Rose's short-term stock investments on (a) its income statement for this year and (b) the

equity section of its balance sheet at this year-end.

(a) Income statement for this year

(b) The equity section of its balance sheet at this year-end

$

Amount Increase or Decrease

39,150 Increase

Increase

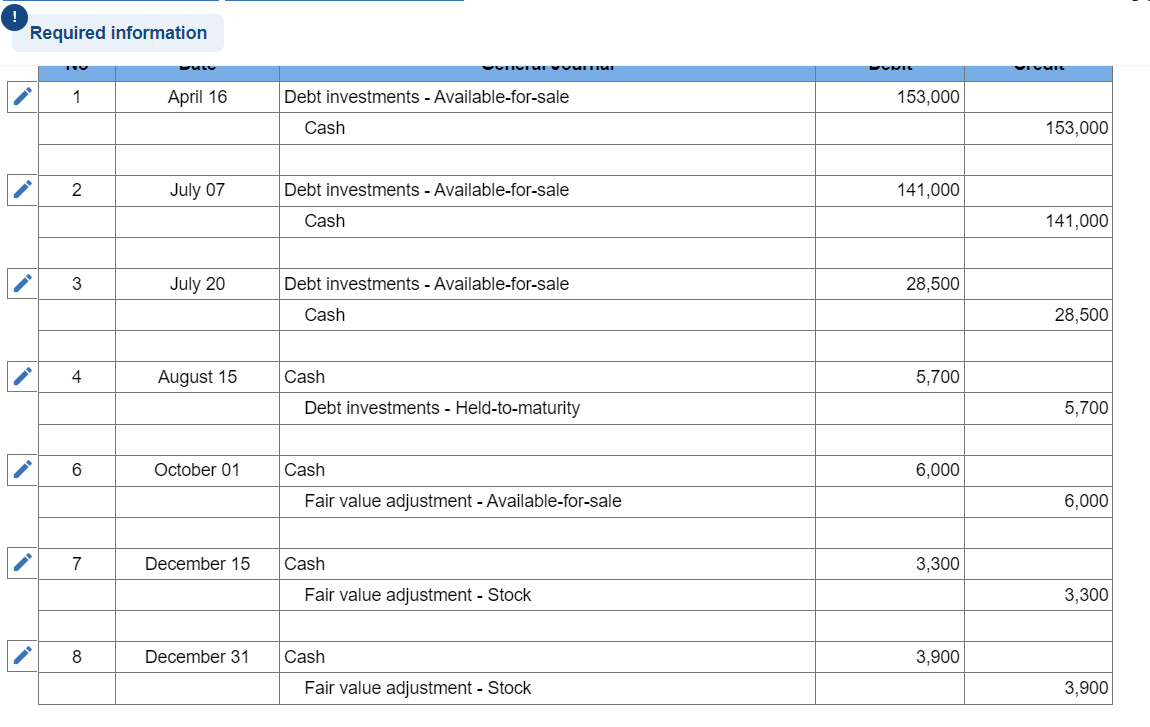

Transcribed Image Text:Required information

1

1

2

3

4

6

7

8

April 16

July 07

July 20

August 15

October 01

December 15

December 31

WYTIVEME SULTIMI

Debt investments - Available-for-sale

Cash

Debt investments - Available-for-sale

Cash

Debt investments - Available-for-sale

Cash

Cash

Debt investments - Held-to-maturity

Cash

Fair value adjustment - Available-for-sale

Cash

Fair value adjustment - Stock

Cash

Fair value adjustment - Stock

153,000

141,000

28,500

5,700

6,000

3,300

3,900

153,000

141,000

28,500

5,700

6,000

3,300

3,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning