Sat 11:42 PM iew History Bookmarks Window Help v2.cengagenow.com Print Item Calculator eBook Asset turnover Three major segments of the transportation industry are motor carriers, such as Atlantic; railroads, such as Pacific; and transportation arrangement services, such as Mediterranean. Recent financial statement information for these three companies is shown as follows (in thousands of dollars): Atlantic Pacific Mediterranean Sales $354,724 $5,944,043 $1,426,290 Average total assets 886,810 1,213,070 475,430 a. Determine the asset turnover for all three companies. Round to one decimal place. Atlantic Pacific Mediterranean b. The ratio of sales to assets measures the number of sales dollars earned for each dollar of assets. The greater the number of sales dollars earned for every dollar of assets, the more efficient a firm is in using assets. Feedback Check My Work a. Divide sales by average total assets. b. Consider the differences among the three companies. Learning Objective 5. Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Grading JUL 13 P

Sat 11:42 PM iew History Bookmarks Window Help v2.cengagenow.com Print Item Calculator eBook Asset turnover Three major segments of the transportation industry are motor carriers, such as Atlantic; railroads, such as Pacific; and transportation arrangement services, such as Mediterranean. Recent financial statement information for these three companies is shown as follows (in thousands of dollars): Atlantic Pacific Mediterranean Sales $354,724 $5,944,043 $1,426,290 Average total assets 886,810 1,213,070 475,430 a. Determine the asset turnover for all three companies. Round to one decimal place. Atlantic Pacific Mediterranean b. The ratio of sales to assets measures the number of sales dollars earned for each dollar of assets. The greater the number of sales dollars earned for every dollar of assets, the more efficient a firm is in using assets. Feedback Check My Work a. Divide sales by average total assets. b. Consider the differences among the three companies. Learning Objective 5. Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Grading JUL 13 P

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter11: Liabilities: Bonds Payable

Section: Chapter Questions

Problem 11.4MAD: Analyze and compare Hilton and Marriott Hilton Worldwide Holdings, Inc. (HLT) and Marriott...

Related questions

Question

Transcribed Image Text:Sat 11:42 PM

iew

History Bookmarks Window Help

v2.cengagenow.com

Print Item

Calculator

eBook

Asset turnover

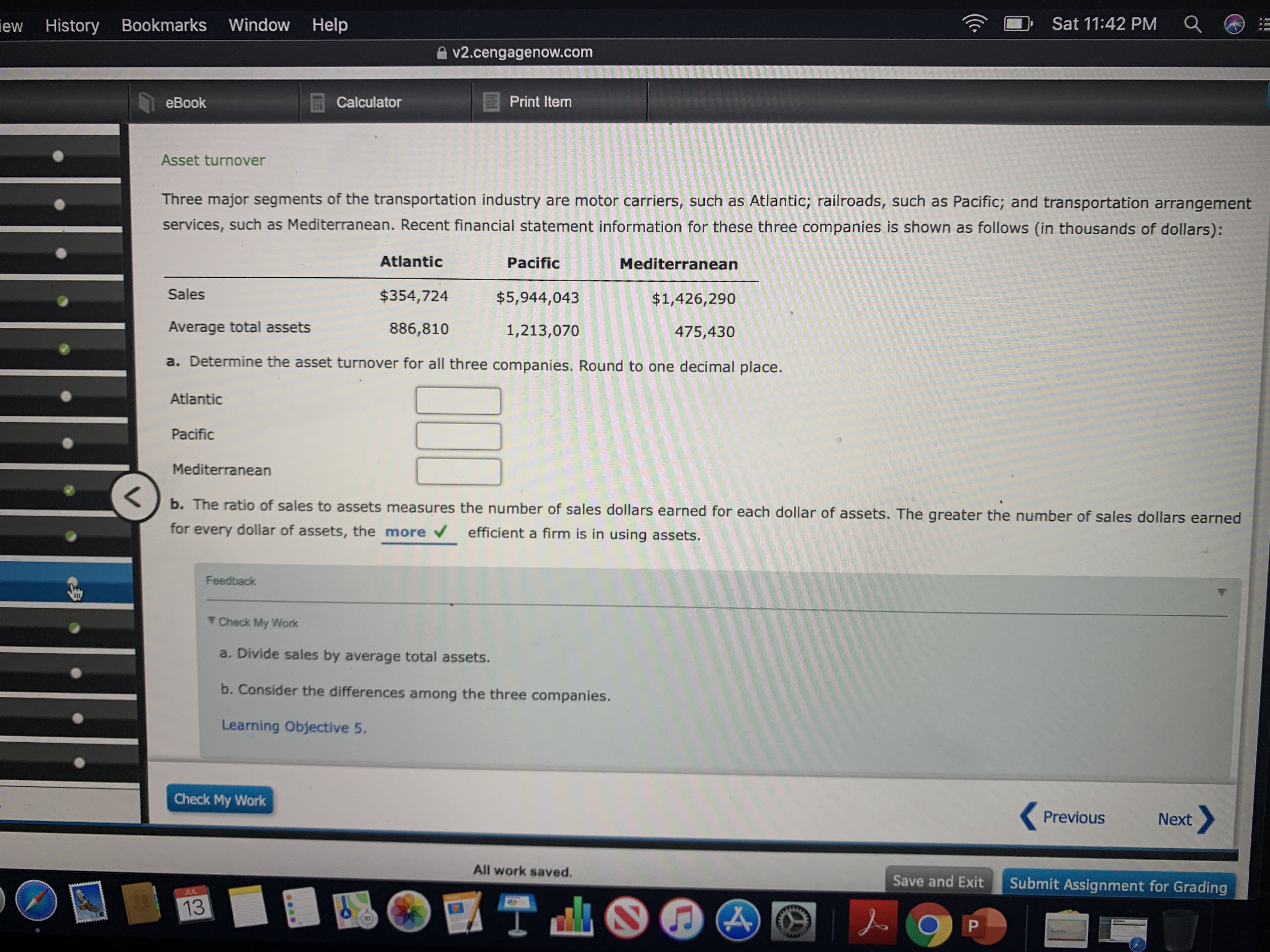

Three major segments of the transportation industry are motor carriers, such as Atlantic; railroads, such as Pacific; and transportation arrangement

services, such as Mediterranean. Recent financial statement information for these three companies is shown as follows (in thousands of dollars):

Atlantic

Pacific

Mediterranean

Sales

$354,724

$5,944,043

$1,426,290

Average total assets

886,810

1,213,070

475,430

a. Determine the asset turnover for all three companies. Round to one decimal place.

Atlantic

Pacific

Mediterranean

b. The ratio of sales to assets measures the number of sales dollars earned for each dollar of assets. The greater the number of sales dollars earned

for every dollar of assets, the more

efficient a firm is in using assets.

Feedback

Check My Work

a. Divide sales by average total assets.

b. Consider the differences among the three companies.

Learning Objective 5.

Check My Work

Previous

Next

All work saved.

Save and Exit

Submit Assignment for Grading

JUL

13

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning