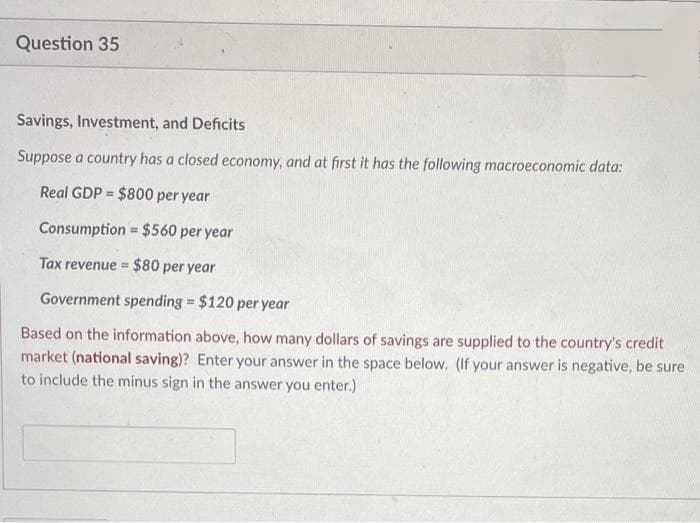

Savings, Investment, and Deficits Suppose a country has a closed economy, and at first it has the following macroeconomic data: Real GDP = $800 per year %3D Consumption = $560 per year %3D Tax revenue = $80 per year Government spending = $120 per year %3D Based on the information above, how many dollars of savings are supplied to the country's credit market (national saving)? Enter your answer in the space below. (If your answer is negative, be su to include the minus sign in the answer you enter.)

Q: Why is a Cobb-Douglas production function useful for analyzing economic growth?

A: Economic growth is defined as an increase or improvement over time in the inflation-adjusted market ...

Q: Assume that this is the cost function for a perfectly competitive firm: Cost (q) = 5 q² + 20 For thi...

A: Answer: The following formulas will be used: AVC=VCqAFC=FCqATC=TCq (TC=total cost)MC=dTCdqVC=TC-F...

Q: In the BOP accounts, what are the four basic components of the current account? How can information ...

A: Four basic components of current account in BOP include: Goods Services Income and Current transfe...

Q: What did Frederick Engels believe about the family and society

A: A society is a group of people who interact with one another on a regular basis, or a large social g...

Q: Techware Incorporated is considering the introduction of two new software products to the market. Th...

A: Techware Incorporated had four choices present: either none of the two items, present item 1, presen...

Q: What is Adam Smith’s view on “accumulation of wealth”? What does he say “must be done with the wea...

A: According to adam smith, the needs of an individual lead to a self-interest behavior that creates so...

Q: Suppose the economy currently has an inflation rate of 7%. Moreover, the slope of the economy's Phil...

A: For a classical model of Phillips Curve we assume that the production function in economy is only a ...

Q: Which one of the following best demonstrates the principles of free markets economics? O A lumber co...

A: The free market is an economic system that is based on supply and demand and has little or no govern...

Q: Who did John Maynard Keynes advise with his economic theory?

A: The macroeconomic economic theory of total expenditure in the economy and its consequences on output...

Q: Saudi Arabia has huge oil reserves, but relies on the United States for oil rigs to extract the oil....

A: Given: Saudi Arabia has huge oil reserves. It relies on U.S.A for oil rigs to extract the oil.

Q: Each year, Johan typically does all his own landscaping and yard work. He spends $204 per year on mu...

A:

Q: When a factor market has only one demander of labor, the market is labeled a (n) (A) Natural monopol...

A: In economics, a monopsony is a market structure in which a single buyer substantially controls the m...

Q: The ___ is the nominal interest rate minus the rate of inflation. Question 13 options: real...

A: the real inflqtion rate could be calculated as:Real interest rate =1+ Nominal interest rate1+ inflat...

Q: 11. (Originally #7 on Homework #3) Consider a consumer with the following information: At the optima...

A: Consumer equilibrium is the equilibrium that is achieved where the budget line is equal to the margi...

Q: Refer to the graph shown. Within which section(s) of the production function is marginal product dec...

A: Here, the given graph shows the production function of a firm to explain the different phases of the...

Q: Problem No. 1 On his son's seventh birthday, the father started to make annual uniform deposits of P...

A: Given that, Father started to make annual uniform deposits of P10,000 on the Sons account from his s...

Q: We need to know the profitability of a business model: - 3 x machines (beauty machines) - Each machi...

A: In the mentioned question we have been asked the total expected income for the week.

Q: the returns to scale for the following production functions: q = K.34L.34 q = KLM

A: DISCLAIMER “Since you have asked multiple question, we will solve the first 3 question for you. If ...

Q: What are Milton Friedman economic theory’s general principles?

A: Answer -

Q: Illustrate general equilibrium and the Laffer curve in the context of a repre- sentative consumer wi...

A: Utility function : U = ln(C) + ln (L) C = w(1-t)(h - L) + p (Budget Constraint ) (we take pie ...

Q: Employment Total Product Product Price $ 4 1 12 4 22 4 3. 30 4. 4. 36 4 5. 40 4 6. 42 Refer to the g...

A: In the mentioned question we have been asked how many employees will the firm hire. Given, cost = $2...

Q: True or False? In the presence of a positive externality, a Pigouvian subsidy results in less consu...

A: Positive externality refers to the situation when the action of an individual contributes positively...

Q: Supply: -35 + 35P Demand: 205 -25P Where P is the price of good = {1,2,3,4,5,6,7,8} a. Plot and dete...

A:

Q: ___ are now the largest single component of the supply side of GDP, representing over half of GDP. ...

A: Gross domestic product refers to total goods and services produced within the economy within the giv...

Q: Jan Aart Scholte (2000: 15-17) has argued that at least five broad definitions of ‘globalization’ ca...

A: Globalization, according to Jan Aart Scholte, is defined as "internationalization."Globalization is ...

Q: balances of fiat money worth y goods. 1+ Vi+1 a. Use the equality of supply and demand in the money ...

A: Fiat money is a government-issued currency that is not backed by a commodity such as gold. Fiat mone...

Q: With regards to Solow-Swan Model in economics, what does exogenous growth mean and what factors can ...

A: The Solow–Swan model,that is also known as the exogenous growth model, is a long-run economic growth...

Q: Ty, George, Joe, and Ted are potential buyers of a rare Ho ill buy either one card or zero cards. Ty...

A: Answer given below,

Q: 15) For any cost function, you can find min ATC by etting ATC = and solving for q. %3D

A: Average total cost = total cost/ quantity

Q: bread(B) with raw wheat (W). The production functions are: Cereal: C = 28WC – 1.5WC2 Bread: B = 65WB...

A:

Q: A device costs P20,000. After 7 years, it is expected to be worth P6,000. Using the SL method, find ...

A: Given: Cost of device=P 20000 Value after 7 years=P 6000

Q: What were John Maynard Keynes economic theory’s general principles and who did he advise?

A: Keynesian economics is based on John Maynard Keynes' thesis that rather than letting the free market...

Q: If there is a $120,000 investment on a project and the profits generates $180,0000, what is the retu...

A: G Given,Investment=$120,000Profit=$180,000Now we know that,ROI=Net profitCost of investmentx100There...

Q: (12) Suppose all firms in a monopolistically competitive industry were merged into one large firm. W...

A: Monopolistically competitive industry is an industry where there are many buyers and sellers in the ...

Q: r Jack’s farm current situation that includes MC, ATC, and AVC, labeling all relevant points on axes...

A: The correct answer is given in the second step.

Q: Exercise I.1 The figure below shows the utility function of a representative individual as a functio...

A: According to question government must tax 50% of utility for any individual . So , Person with incom...

Q: Could someone answer this for me please You estimate a simple linear regression model using a sample...

A: Answer: As it is mentioned : Y= 97.25 +19.74*X(3.86) (3.42 interval estimate =99%

Q: What can increase the standard of living in the Malthusian model?

A: Before the industrial revolution, the Malthusian economy was the economic system that characterised ...

Q: Q1. a List down different type of interests and their related formulae. b. Collect one example for e...

A: Q1. a. Type of interests Simple interest: P x R x T100Compound interest: A=P(1 + rn)n Accrued Intere...

Q: Average total cost is equal to:

A: Total cost is the sum of total variable cost and total fixed cost i.e., TC = TVC + TFC Total cost me...

Q: Problem 2. Consider the following Phillips Curve n = En – 0.6(u – 0.05) a) Explain the above Philips...

A: When represented or charted graphically, the Phillips curve illustrates an inverse relationship betw...

Q: Figure 8-8 Suppose the government imposes a $10 per unit tax on a good. Price 24 22+ 20 18 Supply 16...

A: Tax in any economy creates the dead weight loss which is the sum of loss in consumer and producer su...

Q: What are the relationships between TP, MP and AP curves?

A: The additional quantity of output produced as a result of using more input is referred to as margina...

Q: How do you calculate private closed economy GDP?

A: A closed economy represents a market system where no trade with other countries take place.

Q: Describe the definition of cost-benefit analysis.

A: A cost benefit analysis is sufficient in case a firm which have small capital expenditures and small...

Q: 9. With the Second MD Curve, would the Central Bank need to change the Money Supply by more or less ...

A: The money supply is determined by the central bank of the country. The central bank increases or dec...

Q: What happens to the market for loanable funds when interest rates increase? Planned investments incr...

A: Answer: An increase in the interest rate will lead to a decrease in the quantity demanded of loanabl...

Q: A man wants to make 14% nominal interest compounded semiannually on a bond investment. How much shou...

A: The interest rate before inflation is referred to as the nominal interest rate. If a loan's marketed...

Q: Learning Task 7: List down some daily activities and tell how these contribute to climate change. Al...

A: Climate change is a very debated topic in the global scenario and human activities are one of the re...

Q: Cash flows related to three mutually exclusive capital equipment projects are given in table below. ...

A: First Compute the net income in alternative A, using the equatioñ as shown below:- Net income = In...

Step by step

Solved in 2 steps

- onsider the following data (in billion $) for a country in a particular year: (assume this country has Zero Transfer Payment Personal consumption expenditure (C) 200 Exports (x) 10 Government Purchases of goods and services (G) 120 Imports (m) 15 Gross Domestic Product (Y) 1800 Taxes 20 d. What is the value of gross investment? e. What is the value of net export? f. Is the country lending to or borrowing from rest of the world? g. Dose the government has deficit, balance or surplus budget? h. What is the amount of investment financed by national saving? i. What is the amount of investment financed by borrowing from rest of the world? J. What is the meaning of transfer paymentConsider the following data (in billion $) for a country in a particular year: (assume this country has Zero Transfer Payment Personal consumption expenditure (C) 200 Exports (x) 10 Government Purchases of goods and services (G) 120 Imports (m) 15 Gross Domestic Product (Y) 1800 Taxes 20 d. What is the value of gross investment? e. What is the value of net export? f. Is the country lending to or borrowing from rest of the world? g. Dose the government has deficit, balance or surplus budget? h. What is the amount of investment financed by national saving? i. What is the amount of investment financed by borrowing from rest of the world? J. What is the meaning of transfer paymentConsider the following data referring to any economy that has no foreign relations:GDPmp = 6000Disposable Income of the private sector (DIs.priv.)= 5100Budget Deficit = 200Private consumption = 100 Calculate the amount of:a) Public spending.b) Private savings (Spriv).c) Investment.

- (iii)Explain what is meant by the current account multiplier in relation to a fiscal expansion, giving the appropriate equation.Question Consider that the Ghanaian economy is a small and close, which is characterised by the following. AD=C+I+G+NX C=a+bY* Y*=disposal income T=T0 I=I0 G=G0 Md/P=Ld(Y,i) Ms=money supply ,which is given . AD=Aggregate demand ,C=consumption,G=Government expenditure ,T=Tax,P= Pricelevel,I=Investment,NX=Netexports (a) Consider an increase in Government spending ∆ > .Assume for now that both price and expected price are fixed. Also assume that government does not implement any other policy than the increase in Government spending. What is the effect of this policy on the goods market? (b) What is the effect on equilibrium in the money market? Present your answer in swells labelled diagram, showing both money supply and demand before the policy was implemented, and that after the policy was implemented in the same graph. (c) Solve for equilibrium in the goods market. d) Suppose the policy change is rather a increase in real money supply not a decrease in government spending.What…What will be the effect of “contractionary fiscal policy of abroad” on net export, saving and interest rate? Show your answer with the help of graph and also properly explain

- What will be the effect of “contractionary fiscal policy of home” on net export, saving and interest rate? Show your answer with the help of graph and also properly explainWrite out the equation for desired national savings. What changesto desired national saving and desired national consumption happen whengovernment spending increases, funded by an increase in taxes? Why doesconsumption change by less than G?Question Need help calculating this one. Please show all work. Hints: Equilibrium Condition is S=I. If economy is open r=r*. Assume that in a small open economy where full employment always prevails, national saving is 300. a. If domestic investment is given by I = 400 – 20r, where r is the real interest rate in percent, what would the equilibrium interest rate be if the economy were closed? b. If the economy is open and the world interest rate is 10 percent, what will investment be? c. What will the current account surplus or deficit be? What will net capital outflow be? Assume that in a small open economy where full employment always prevails, national saving is 300. a. If domestic investment is given by I = 400 – 20r, where r is the real interest rate in percent, what would the equilibrium interest rate be if the economy were closed? b. If the economy is open and the world interest rate is 10 percent, what will…

- Suppose the following equations represents a closed economy: Y= C + I + G Y = 4000 G = 500 T = 500 C = 500 + 0.7 (Y – T) I = 1000 – 40r In this economy, compute the value of consumption (C), private saving, public saving, and national saving. Also, find the equilibrium interest rate (r). Now suppose that government spending (G) rises (expansionary fiscal policy) to 300. Compute private saving, public saving, and national saving. Also, find the new equilibrium interest rate (r). In part (b), due to expansionary fiscal policy (increase in government spending), which of the two other components of aggregate demand changes, C or I? Why? (Hint: Note the real interest rate)A closed economy is represented by: Y = C+1+G C = 20+0.85YD G = 300 YD = Y-T T = 0.2Y I = 165-36i Md = 0.5Y-100i M3 = 750 a)Calculate equilibrium values of income and interest rate b)Calculate equilibrium values of income and interest rate if public expenditures increase by 8, enhanced by public debt c)Calculate equilibrium values of income and interest rate if public expenditures increase by 8 is enhance by money supply d)Provide a graphical representation of your resultsGiven the numbers below, a. show that the country has a twin deficit?b. Find the output Y? c. Find the private saving, public saving, and national saving?d. Find the net exports?Tax: T= 500 dollars.Gov’t spending: G= 700 dollars.Disposable income Yd = 900 dollars.Consumption: C= 400 dollars.Investment: I= 500 dollars