Securities Portfolio - Part B **Keep all calculations from this problem for Parts A, B & C** Herman Company has the following securities in its portfolio of trading equity securities on December 31, 2019: Cost 10,000 shs of Dean, common 5,000 shs of Lerner Corp., common $160,000 $139,000 Fair Value $182,000 $185,000 $342,000 $324,000 All of the securities had been purchased in 2019. In 2020, Herman completed the following securities transactions: March 1 April 1 Sold 5,000 shares of Lerner Corp., common at $32 less fees of $1,500. Bought 600 shares of White Stores, common at $50 plus fees of $550. What is the necessary entry for the sale of the Lerner Corp. stock on March 1st? Debit Cash, 160,000; Credit Trading Securities, 160,000 Debit Cash, 158,500; Credit Gain on Sale, 19,500; Credit Trading Securities, 139,000 Debit Cash, 158,000; Credit Trading Securities, 158,000 Debit Cash, 158,500; Debit Loss on Sale, 1,500; Credit Trading Securities, 160,000

Securities Portfolio - Part B **Keep all calculations from this problem for Parts A, B & C** Herman Company has the following securities in its portfolio of trading equity securities on December 31, 2019: Cost 10,000 shs of Dean, common 5,000 shs of Lerner Corp., common $160,000 $139,000 Fair Value $182,000 $185,000 $342,000 $324,000 All of the securities had been purchased in 2019. In 2020, Herman completed the following securities transactions: March 1 April 1 Sold 5,000 shares of Lerner Corp., common at $32 less fees of $1,500. Bought 600 shares of White Stores, common at $50 plus fees of $550. What is the necessary entry for the sale of the Lerner Corp. stock on March 1st? Debit Cash, 160,000; Credit Trading Securities, 160,000 Debit Cash, 158,500; Credit Gain on Sale, 19,500; Credit Trading Securities, 139,000 Debit Cash, 158,000; Credit Trading Securities, 158,000 Debit Cash, 158,500; Debit Loss on Sale, 1,500; Credit Trading Securities, 160,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 18E: Trading Securities Pear Investments began operations in 2020 and invests in securities classified as...

Related questions

Question

Do not give answer in image

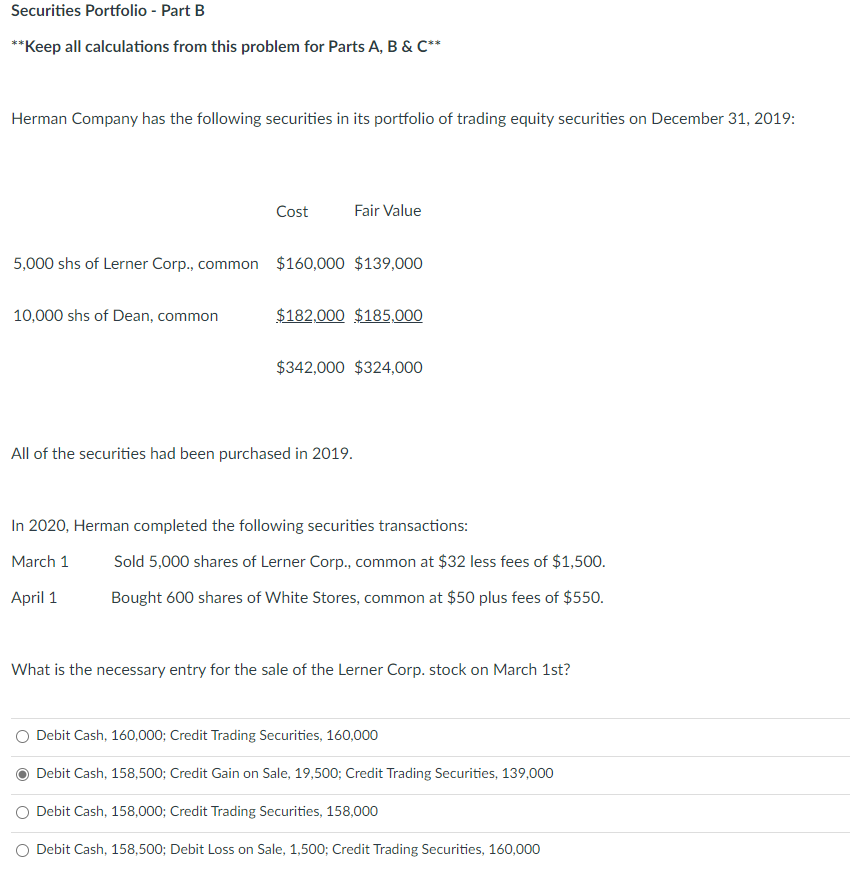

Transcribed Image Text:Securities Portfolio - Part B

**Keep all calculations from this problem for Parts A, B & C**

Herman Company has the following securities in its portfolio of trading equity securities on December 31, 2019:

Cost

10,000 shs of Dean, common

5,000 shs of Lerner Corp., common $160,000 $139,000

Fair Value

$182,000 $185,000

$342,000 $324,000

All of the securities had been purchased in 2019.

In 2020, Herman completed the following securities transactions:

March 1

April 1

Sold 5,000 shares of Lerner Corp., common at $32 less fees of $1,500.

Bought 600 shares of White Stores, common at $50 plus fees of $550.

What is the necessary entry for the sale of the Lerner Corp. stock on March 1st?

O Debit Cash, 160,000; Credit Trading Securities, 160,000

Debit Cash, 158,500; Credit Gain on Sale, 19,500; Credit Trading Securities, 139,000

O Debit Cash, 158,000; Credit Trading Securities, 158,000

O Debit Cash, 158,500; Debit Loss on Sale, 1,500; Credit Trading Securities, 160,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning