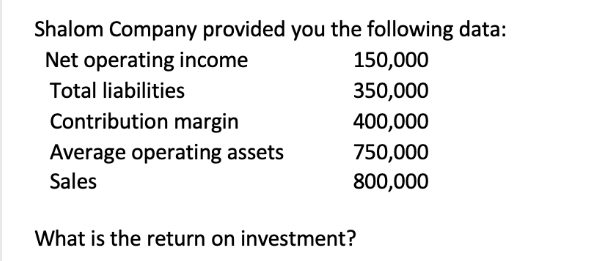

Shalom Company provided you the following data: Net operating income Total liabilities Contribution margin Average operating assets Sales 150,000 350,000 400,000 750,000 800,000 What is the return on investment?

Q: QUESTION 19 Consider the following balances from a company's budget: (this data will be used in Q13…

A: Cost of Goods Sold (COGS) is an accounting term that refers to the direct cost associated with…

Q: Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has…

A: Cash budget is the statement which is prepared by the entity for the purpose of estimating the cash…

Q: 27 4B) On April 25, 2022, the firm sold 360 units at £18,9 per unit. Assuming that the firm uses the…

A: INVENTORY VALUATION Inventory Valuation is a Method of Calculation of Value of Inventory at the End…

Q: Michard Corporation makes one product and it provided the following information to help prepare the…

A: Solution : Correct answer : (c) $ 13,12,500 Budgeted sales for may = Budgeted sales units * selling…

Q: 20. On January 1, 2021, Trade Company purchased 40,000 shares at P 100 per share to be held for…

A: Based on the given information, the initial measurement of the investment is as follows: Purchase…

Q: You have been appointed to assist the accountant of Catalyst (Pty) Ltd to prepare the financial…

A: Interest expense on the loan is calculated as 8% x R6,000,000 = R480,000 Preference dividends are…

Q: aldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions,…

A: Outsourcing is the process of engaging a third party to execute services or generate commodities…

Q: Tucker Inc. makes dog treats. The material to be purchased from the production budget is as follows:…

A: Lets understand the basics. Management prepares budget in order to estimate future profit and loss…

Q: Global Airways provides air transportation services between New York and Miami. A single New York to…

A: CVP analysis, or cost-volume-profit analysis, is a management accounting technique used to analyze…

Q: alvatore will contribute $640 to a mutual fund at the beginning of each calendar quarter. What will…

A: Value of mutual fund increases over the period of time due to increase in the prices of stocks over…

Q: Ay 4. Mosbius Design Company purchased a computers for $75,000 in 2013. It is estimated those…

A: Depreciation rate as per straight line 20% Depreciation rate as per double decline…

Q: Problem 9-7 (IAA) Sheraton Company reported the following information for the current year: Ending…

A: SCHEDULE OF COST OF GOODS MANUFACTURED Schedule Of Cost Of Goods Manufactured are those Cost Which…

Q: Novak Inc. is considering modernizing its production facility by investing in new equipment and…

A:

Q: A firm invested in equipment to improve its overall production in the beginning of year 1 ,paying 40…

A: To determine the effect on equity (retained earnings) in year 3, we need to first calculate the…

Q: 20. On January 1, 2021, Trade Company purchased 40,000 shares at P 100 per share to be held for…

A: At the time of purchasing the asset, any cost incurred at the initial level in support of the asset…

Q: Required information [The following information applies to the questions displayed below.] Morganton…

A: The budget is prepared to estimate the requirements for the period. The ending inventory for prior…

Q: Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's…

A: Answer:- Inventory:- The products and materials that a company keeps on hand with the intention of…

Q: Presented below is information taken from a bond investment amortization schedule with related fair…

A: Bond: A bond is a type of debt financial instrument with a maturity of two years or more.…

Q: What are the 5 transaction deemed sales? Give 10 Exempt Sale of Services

A: When a transaction is viewed as a sale even when no actual sale has occurred, this is referred to as…

Q: Additional information Net income for 2022 was $100.440 There were no gains or losses reported on…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: 2. What is the materials quantity variance for March? (Indicate the effect of each variance by…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. Variance…

Q: 29 01:05:13 Mc Graw Hill Net Zero Products, a wholesaler of sustainable raw materials, prepares the…

A: BAD DEBT EXPENSES If the Allowance for Doubtful Accounts has a Credit Balance then Bad debt Expense…

Q: Lionel is an unmarried law student at State University Law School, a qualified educational…

A: According to the IRS, Lionel may be able to deduct up to $2,500 of interest paid on a qualified…

Q: The controller of Bramble Company estimates sales and production for the first four months of 2022…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Sleeter Corporation makes one product and it provided the following information to help prepare the…

A: Introduction:- The production budget is prepared to estimate the number of units to be produced…

Q: Which of the following statements, relating to the auditor's responsibilities regarding subsequent…

A: Statement 1 is correct because auditors have a responsibility to perform procedures to identify…

Q: Kendall County entered into a lease agreement to finance computer equipment used in government…

A: Particulars Debit Credit 1 Lease receivable $2,068,563 Lease revenue $2,068,563…

Q: What would cause a business to have intangible assets on its financial statements?

A: A business can have two main types of assets on its balance sheet – tangible assets and intangible…

Q: Prepare the journal entry reflecting the payment to Starr Company assuming that the company made the…

A: Journal entries serve as the basis for an organization's accounting system. In the broadest…

Q: Derek is a general partner in Losing Records, LP. At the beginning of the year, Derek's tax basis in…

A: To determine Derek's adjusted tax basis in his partnership interest at the end of the year, we need…

Q: 21. A non-VAT business reported the following: Sales Cost of Sales Purchases, inclusive of VAT…

A: Tax payable refers to the amount of tax that an individual or business owes to the government for a…

Q: Suz-Anna is an partnership with two equal partners, Suzy and Anna. This year, Suz-Anna recorded the…

A: A partnership is a form of business organization where two or more people (partners) come together…

Q: From: Service department costs IT HR Total $ $ IT 151,600 $ 151,600 HR 247,860 $ 247,860 Publishing…

A: Lets understand the basics. The service department costs are allocated to operating departments…

Q: A paragrap stating your evaluation of companys performance and financial status fir quarter wnding…

A: Financial statement refers to the statements which states the position or performance of company in…

Q: references and citations for this please

A: Sports organisations have three options for raising money: public, private, and cooperative…

Q: Issued check 290 to Hospital Texaco for gas purchased for delivery trucks in the amount $389.95.…

A: Specialized journals in accounting are books of original entry used to record specific types of…

Q: Oriole Company's Work in Process-Painting account shows the following activity. 5/1 Balance 5/31…

A: Total units accounted for :— It is calculated by adding units in beginning WIP and units started and…

Q: Imperial Jewelers manufactures and sells a gold bracelet for $404.00. The company's accounting…

A: Relevant Cost :— It is the cost that is different in different alternatives. This cost is considered…

Q: Delta Company pays salaries and wages on the last day of each month. Payments made on December 31,…

A: The question presents a scenario where Delta Company pays salaries and wages to its employees on the…

Q: Cullumber Inc. began operations on January 1, 2023, and uses the FIFO method of pricing inventory.…

A: Recording of journal entry is required to make to record the change are as follows. FIFO - First…

Q: Lovington Corporation purchased 188,000 of the 840,0

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: Account Earnings (rev.) Cost of Const Labor Material Total Direct Cost Gross Profit Overhead Var.…

A: The cost of goods available for sale and net sales data from the current period are combined with…

Q: The following data were obtained from the books of JOYFUL CORPORATION: Accounts receivable, March…

A: To find the inventory at September 30, 2021, we can use the following formula: Gross profit = Sales…

Q: When Crossett Corporation was organized in January, Year 1, it immediately issued 4,400 shares of…

A: The cumulative preference shareholders have the right to receive the dividend in arrears before any…

Q: Cullumber Company is considering two alternatives. Alternative A will have revenues of $149,000 and…

A: Incremental Approach :— Under this approach, two different alternatives is compared. Comparison is…

Q: 2. When comparing MEAs with unequal lives, using the coterminated assumption means that we assume…

A: “Since you have posted multiple questions, we will provide the solution only to the first question…

Q: Abraham Phiri Enterprise Limited (APEL) has been importing and selling second hand motor vehicles…

A: The approach used to value the company's inventory is referred to as inventory valuation. There are…

Q: B. Manchester Company provided the following information on December 31, 2021: Employee income taxes…

A: Answer is option a) 8,100,000

Q: Installment Sale Zachary Davis owns several apartment buildings in Los Angeles and has an offer from…

A: Dear Zachary, Based on the information you provided, it appears that you have entered into an…

Q: Revenue: % of Completion On March 15, 20x3, Mayer Company entered into a 4 year project for the…

A: The contract revenue can be recognized using various methods as percentage completion or contract…

Step by step

Solved in 2 steps

- Define each of the following terms: Operating plan; financial plan Spontaneous liabilities; profit margin; payout ratio Additional funds needed (AFN); AFN equation; capital intensity ratio; self-supporting growth rate Forecasted financial statement approach using percentage of sales Excess capacity; lumpy assets; economies of scale Full capacity sales; target fixed assets to sales ratio; required level of fixed assetsThe following is selected financial data from Block Industries: How much does Block Industries have in current liabilities? A. $19,800 B. $18,300 C. $12,300 D. $25,800From the Google Finance site, use the DuPont analysis to determine the total assets turnover ratio for each of the peer companies. (Hint ROA = Profit margin Total assets turnover.) Once youve calculated each peers total assets turnover ratio, then you can use the DuPont analysis to calculate each peers equity multiplier.

- DIRECTION: Compute the following PROFITABILITY RATIOS Gross Margin= Gross Profit/Net Sales Net Profit Margin= Net Profit/ Net Sales Return on Equity= Profit/Shareholder's Equity Return on Asset= Profit/Total Asset TREND ANALYSIS Net Income Growth Rate Total Assets Growth Rate And also compute the percentage beside the columns December 31, December 31, PERCENTAGE 2021 2020 USD USD Assets Current assets Cash and cash equivalents 34,115,412 25,681,845 Short-term financial instruments 71,417,748 80,798,680 Short-term financial assets at amortized cost 2,944,705 2,409,853 Short-term financial assets at fair value through profit or loss 35,624 62,452 Trade receivables 35,585,565 27,065,012 Non-trade receivables 3,930,828 3,150,548 Prepaid expenses 2,042,001 1,980,685 Inventories 36,172,043 28,007,314 Other current assets 4,441,629 3,281,589 Assets held-for-sale - 812,370 Total Current Assets…Calculate the Rate of Return on Assets (ROA) for 2011. Disaggregate ROA into the profit margin for ROA and total assets turnover components. Calculate the Rate of Return on Common Stockholders’ Equity (ROCE) for 2011. Disaggregate ROCE into the profit margin for ROCE, total assets turnover and capital structure leverage components.Data for Uberto Company are presented in the following table of rates of return on investment and residual incomes: Invested Assets Income from Operations Return on Investment Minimum Return Minimum Acceptable Income from Operations Residual Income $780,000 $187,200 (a) 13% (b) (c) $620,000 (d) (e) (f) $74,400 $24,800 $330,000 (g) 14% (h) $36,300 (i) $250,000 $50,000 (j) 12% (k) (l) Determine the missing values, identified by the letters above. For all amounts, round to the nearest whole number. a. fill in the blank % b. $ fill in the blank c. $ fill in the blank d. $ fill in the blank e. fill in the blank % f. fill in the blank % g. $ fill in the blank h. fill in the blank % i. $ fill in the blank j. fill in the blank % k. $ fill in the blank l. $ fill in the blank

- d. Calculate the Efficiency ratio which includes the sales to total assets ratio, operating return on assets, return on assets, ROA Model, return on equity, and ROE ModelIn a DuPont analysis, what are the components of return on assets?a. Net Profit Margin Ratio and Debt Ratiob. Net Profit Margin Ratio and Leverage Ratioc. Net Profit Margin Ratio and Asset Turnover Ratiod. Asset Turnover Ratio and Leverage RatioUsing the statements provided Calculate the following liquidity ratios: Current ratio Quick ratio Calculate the following asset management ratios: Average collection period Inventory turnover Fixed asset turnover Total asset turnover Calculate the following financial leverage ratios Debt to equity ratio Long-term debt to equity Calculate the following profitability ratios: Gross profit margin Net profit margin Return on assets Return on stockholders’ equity For example: you should present it like the text, or as:Gross margin = 1,933 divided by 8,689 = 22.2% A competitor of ACME has for the same time period reported the following three ratios: Current ratio 1.52Long-term debt to equity .25 or 25%Net profit margin .08 or 8% Given these three ratios only which company is performing better on each ratio? Also overall who would you say has the best financial performance and position. Support your answer.

- Net working capital is defined as (select one): A. current assets minus current liabilities. B. a ratio measure of liquidity best used in cross-sectional analysis. C. current liabilities minus current assets. D. the portion of the firm's assets financed with short-term funds.Which of the following ratios is used to measure the profit earned on each dollar invested in a firm?a. return on sales ratio c. current ratiob. return on equity d. asset turnover ratioCompose a financial analysis based on your evaluation of the ratios. Comparison between 2020E ratios and industry averages - (c) Asset utilization ratios; (1) Are the 2020E ratios above, below, or equal to the industryaverages? 2) Is this a good thing or a bad thing for the company? and (3) What can be done to improve the weak ratios or to maintainthe strong ones? (d) Profitability ratios (1) Are the 2020E ratios above, below, or equal to the industryaverages? ( 2) Is this a good thing or a bad thing for the company? and (3) What can be done to improve the weak ratios or to maintainthe strong ones? (e) Market performance ratios. (1) Are the 2020E ratios above, below, or equal to the industryaverages? ( 2) Is this a good thing or a bad thing for the company? and (3) What can be done to improve the weak ratios or to maintainthe strong ones?