Should Marston Manufacturing Company accept or reject the project? O Reject the project O Accept the project On what grounds do you base your accept-reject decision? O Division L's project should be accepted, since its return is greater than the risk-based cost of capital for the division. O Division L's project should be accepted, because its return is less than the risk-based cost of capital for the division.

Should Marston Manufacturing Company accept or reject the project? O Reject the project O Accept the project On what grounds do you base your accept-reject decision? O Division L's project should be accepted, since its return is greater than the risk-based cost of capital for the division. O Division L's project should be accepted, because its return is less than the risk-based cost of capital for the division.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter11: Performance Evaluation And Decentralization

Section: Chapter Questions

Problem 32E: Use the following information for Exercises 11-31 and 11-32: Washington Company has two divisions:...

Related questions

Question

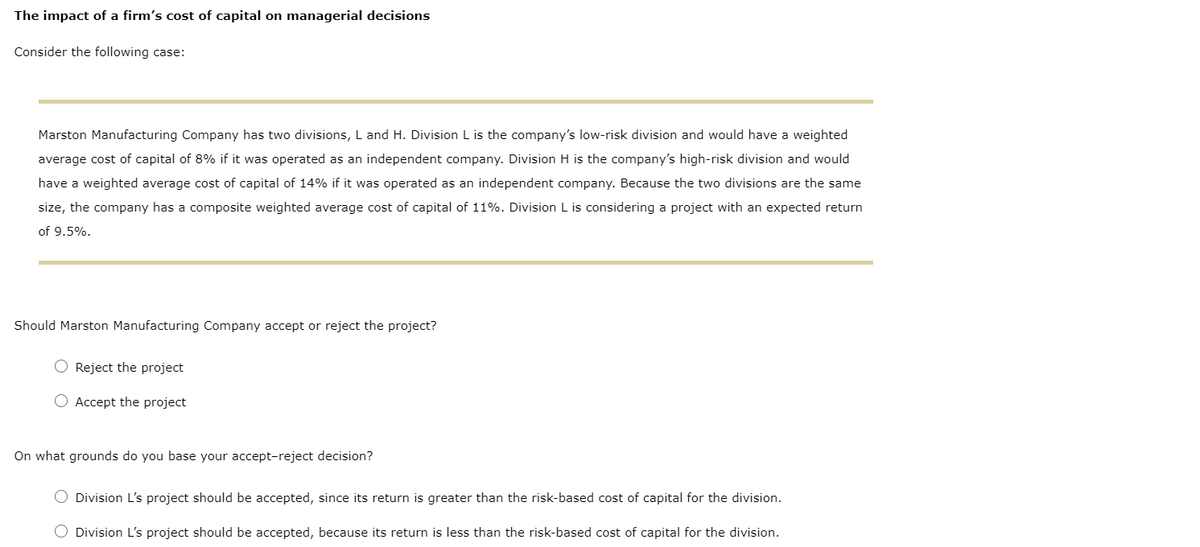

Transcribed Image Text:The impact of a firm's cost of capital on managerial decisions

Consider the following case:

Marston Manufacturing Company has two divisions, L and H. Division L is the company's low-risk division and would have a weighted

average cost of capital of 8% if it was operated as an independent company. Division H is the company's high-risk division and would

have a weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same

size, the company has a composite weighted average cost of capital of 11%. Division L is considering a project with an expected return

of 9.5%.

Should Marston Manufacturing Company accept or reject the project?

O Reject the project

O Accept the project

On what grounds do you base your accept-reject decision?

O Division L's project should be accepted, since its return is greater than the risk-based cost of capital for the division.

O Division L's project should be accepted, because its return is less than the risk-based cost of capital for the division.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,