Whether oligopoly is analyzed from a game theoretic framework or modeled as a cartel, the incentive and temptation to "cheat" is common to all of these approaches. While this amounted to confessing to a crime for Bonnie and Clyde, for the oligopolistic sellers "cheating" amounts to overproducing in an effort to gain profits. The problem, at least for the oligopolists, is that each seller is thinking along these same lines, and so all of the overproduction drives down the price of the output. Let's look at this with a numerical example. Suppose the market for high end kitchen utensils is dominated by two firms named Pete's Patented Peelers and Pat's Patented Parers. The demand for the entire market is seen in the following table. Assume that after incurring $1,000 of fixed costs in setting up production the Marginal Cost of producing one more unit for either of these producers is $5. First, find the price and quantity combination that would maximize industry profits if Pete and Pat essentially behaved as a cartel. Assuming they split the market evenly, what is each seller's quantity produced and what is each seller's profit? It may help to fill in columns for total and marginal revenue on your own.

Whether oligopoly is analyzed from a game theoretic framework or modeled as a cartel, the incentive and temptation to "cheat" is common to all of these approaches. While this amounted to confessing to a crime for Bonnie and Clyde, for the oligopolistic sellers "cheating" amounts to overproducing in an effort to gain profits. The problem, at least for the oligopolists, is that each seller is thinking along these same lines, and so all of the overproduction drives down the price of the output.

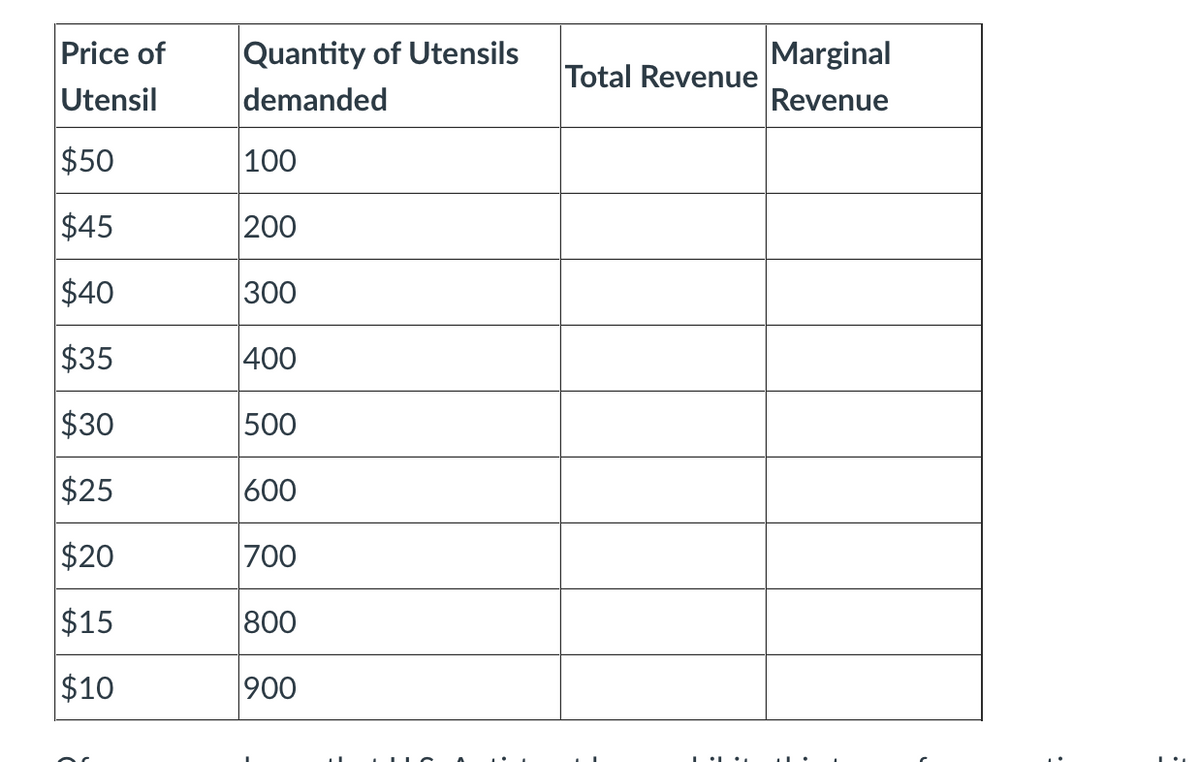

Let's look at this with a numerical example. Suppose the market for high end kitchen utensils is dominated by two firms named Pete's Patented Peelers and Pat's Patented Parers. The demand for the entire market is seen in the following table. Assume that after incurring $1,000 of fixed costs in setting up production the Marginal Cost of producing one more unit for either of these producers is $5. First, find the price and quantity combination that would maximize industry profits if Pete and Pat essentially behaved as a cartel. Assuming they split the market evenly, what is each seller's quantity produced and what is each seller's profit? It may help to fill in columns for total and marginal revenue on your own.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Show that if Pete increases production by 100 utensils he will earn more profit, assuming that Pat sticks with the quantity you found above, which is half of what would be produced if the industry were controlled by a

Next, calculate what profit each would make if Pat also cheats by producing 100 more utensils. Assuming that they both calculate that the other will "cheat" and produce at this higher amount, would either have an incentive to further overproduce? What would happen to either seller's profit by producing another 100 more units? If cheating beyond this point will drive down one's own profit, and thus is not in anyone's interest, could this point be called a "Nash" equilibrium?