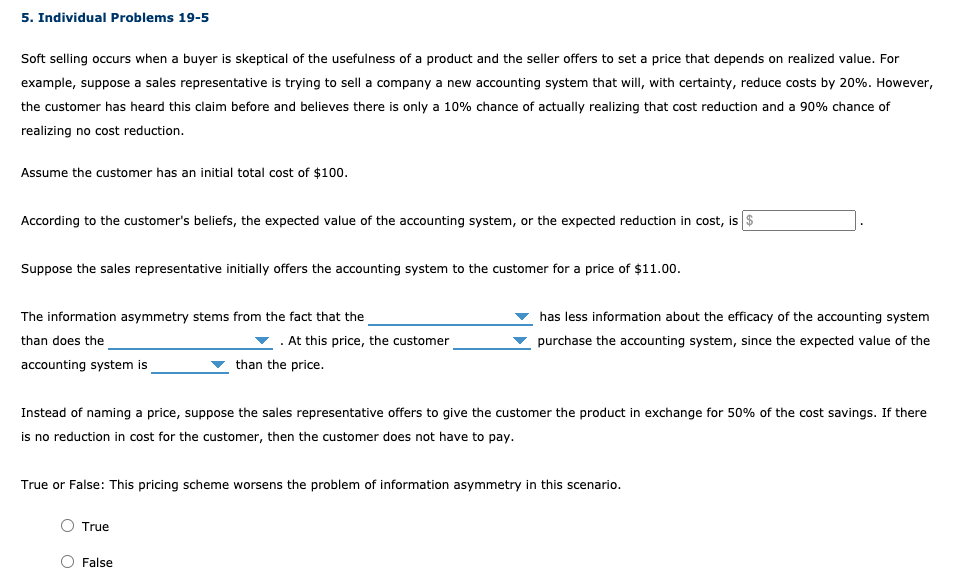

Soft selling occurs when a buyer is skeptical of the usefulness of a product and the seller offers to set a price that depends on realized value. For example, suppose a sales representative is trying to sell a company a new accounting system that will, with certainty, reduce costs by 20%. However, the customer has heard this claim before and believes there is only a 10% chance of actually realizing that cost reduction and a 90% chance of realizing no cost reduction. Assume the customer has an initial total cost of $100. According to the customer's beliefs, the expected value of the accounting system, or the expected reduction in cost, is $ Suppose the sales representative initially offers the accounting system to the customer for a price of $11.00. The information asymmetry stems from the fact that the has less information about the efficacy of the accounting system . At this price, the customer than does the purchase the accounting system, since the expected value of the accounting system is than the price. Instead of naming a price, suppose the sales representative offers to give the customer the product in exchange for 50% of the cost savings. If there is no reduction in cost for the customer, then the customer does not have to pay. True or False: This pricing scheme worsens the problem of information asymmetry in this scenario. True False

Soft selling occurs when a buyer is skeptical of the usefulness of a product and the seller offers to set a price that depends on realized value. For example, suppose a sales representative is trying to sell a company a new accounting system that will, with certainty, reduce costs by 20%. However, the customer has heard this claim before and believes there is only a 10% chance of actually realizing that cost reduction and a 90% chance of realizing no cost reduction. Assume the customer has an initial total cost of $100. According to the customer's beliefs, the expected value of the accounting system, or the expected reduction in cost, is $ Suppose the sales representative initially offers the accounting system to the customer for a price of $11.00. The information asymmetry stems from the fact that the has less information about the efficacy of the accounting system . At this price, the customer than does the purchase the accounting system, since the expected value of the accounting system is than the price. Instead of naming a price, suppose the sales representative offers to give the customer the product in exchange for 50% of the cost savings. If there is no reduction in cost for the customer, then the customer does not have to pay. True or False: This pricing scheme worsens the problem of information asymmetry in this scenario. True False

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter3: Demand Analysis

Section: Chapter Questions

Problem 2.3CE

Related questions

Question

Please see the image below and help answer the questions.

Transcribed Image Text:5. Individual Problems 19-5

Soft selling occurs when a buyer is skeptical of the usefulness of a product and the seller offers to set a price that depends on realized value. For

example, suppose a sales representative is trying to sell a company a new accounting system that will, with certainty, reduce costs by 20%. However,

the customer has heard this claim before and believes there is only a 10% chance of actually realizing that cost reduction and a 90% chance of

realizing no cost reduction.

Assume the customer has an initial total cost of $100.

According to the customer's beliefs, the expected value of the accounting system, or the expected reduction in cost, is $

Suppose the sales representative initially offers the accounting system to the customer for a price of $11.00.

The information asymmetry stems from the fact that the

than does the

has less information about the efficacy of the accounting system

. At this price, the customer

purchase the accounting system, since the expected value of the

accounting system is

than the price.

Instead of naming a price, suppose the sales representative offers to give the customer the product in exchange for 50% of the cost savings. If there

is no reduction in cost for the customer, then the customer does not have to pay.

True or False: This pricing scheme worsens the problem of information asymmetry in this scenario.

True

O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning