statement and statement of retained earnings for the year ended December 31, 2020. Fine Porter Inc. he adjusted trial balance for Fine Porter Inc as of Degember 31, 2020, is shown below. Prepare de statement and statement of retained earnines for the vear ended December 31, 2020. Fine Forer an Adjusted Trial Balance December 31, 2020 Debit $30,500 Credit ounts receivable 23,200 plies 3,950 paid insurance 2,600 ipment 48,500 umulated depreciation-equipment $18,800 ounts payable 3,500 arned service revenue 8,700 1,650 ry payable 24,000 nmon shares 20,000 ined earnings 6,000 dends 70,300 ice revenue

statement and statement of retained earnings for the year ended December 31, 2020. Fine Porter Inc. he adjusted trial balance for Fine Porter Inc as of Degember 31, 2020, is shown below. Prepare de statement and statement of retained earnines for the vear ended December 31, 2020. Fine Forer an Adjusted Trial Balance December 31, 2020 Debit $30,500 Credit ounts receivable 23,200 plies 3,950 paid insurance 2,600 ipment 48,500 umulated depreciation-equipment $18,800 ounts payable 3,500 arned service revenue 8,700 1,650 ry payable 24,000 nmon shares 20,000 ined earnings 6,000 dends 70,300 ice revenue

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 7P: Complex Income Statement The following items were derived from Woodbine Circle Corporations adjusted...

Related questions

Question

Transcribed Image Text:statement and statement of retained earnings for the year ended December 31, 2020. Fine Porter Inc.

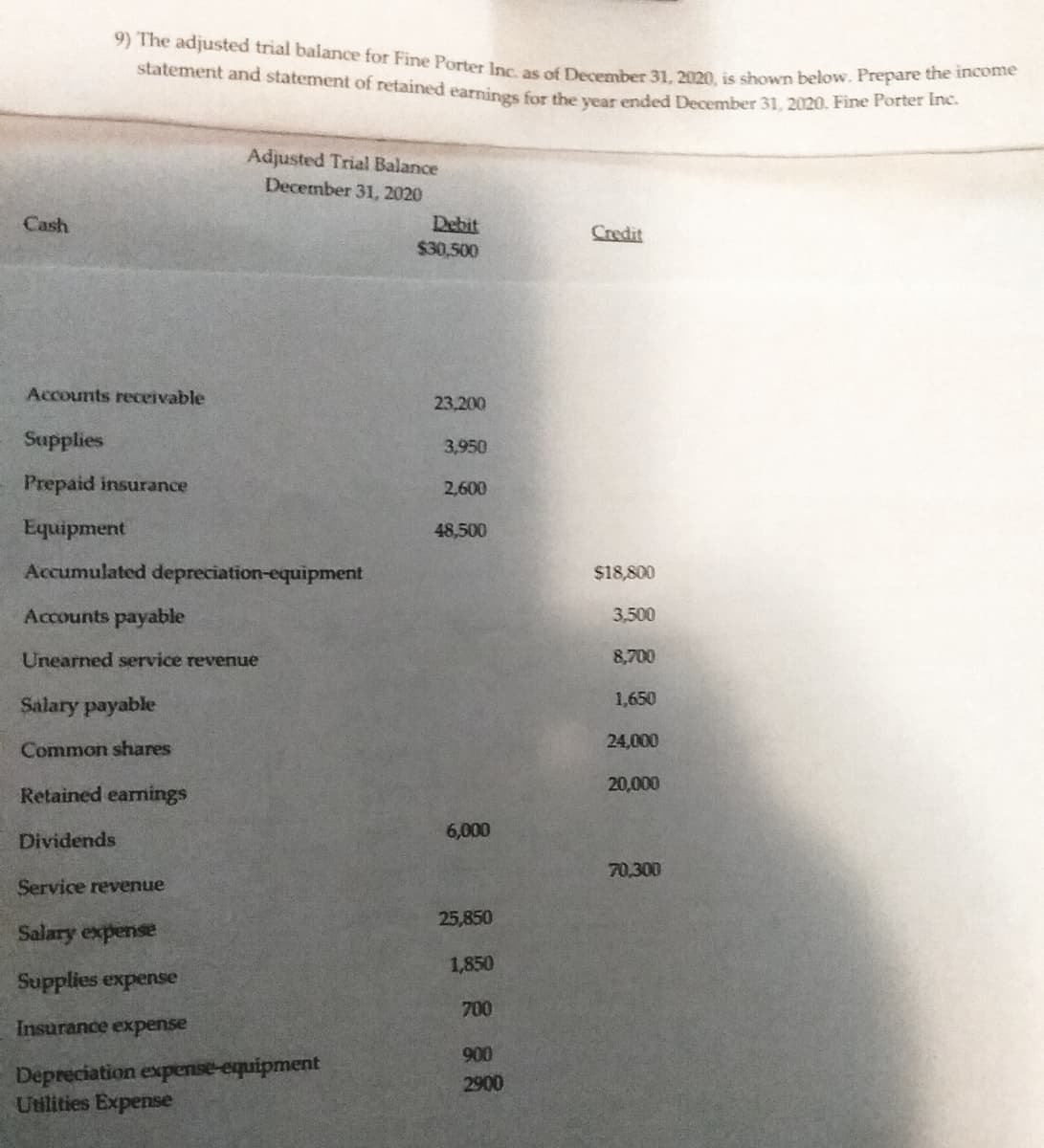

9) The adjusted trial balance for Fine Porter Inc. as of December 31, 2020, is shown below. Prepare the income

Adjusted Trial Balance

December 31, 2020

Cash

Debit

Credit

$30,500

Accounts receivable

23,200

Supplies

3,950

Prepaid insurance

2,600

Equipment

48,500

Accumulated depreciation-equipment

$18,800

Accounts payable

3,500

Unearned service revenue

8,700

Salary payable

1,650

24,000

Common shares

20,000

Retained earnings

Dividends

6,000

70,300

Service revenue

25,850

Salary expense

1,850

Supplies expense

700

Insurance expense

900

Depreciation expense-equipment

Utilities Expense

2900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College