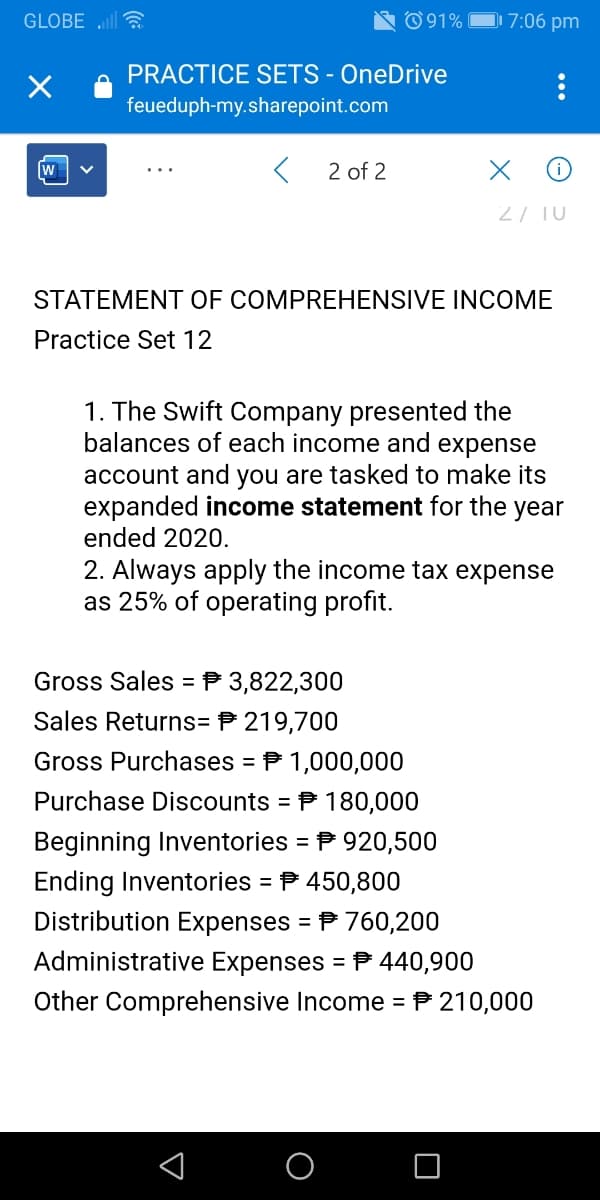

STATEMENT OF COMPREHENSIVE INCOME Practice Set 12 1. The Swift Company presented the balances of each income and expense account and you are tasked to make its expanded income statement for the year ended 2020. 2. Always apply the income tax expense as 25% of operating profit. Gross Sales = P 3,822,300 Sales Returns= P 219,700 Gross Purchases = P 1,000,000 Purchase Discounts = P 180,000 Beginning Inventories = P 920,500 %3D Ending Inventories = P 450,800 Distribution Expenses = P 760,200 Administrative Expenses = P 440,900 %3D Other Comprehensive Income = P 210,000

STATEMENT OF COMPREHENSIVE INCOME Practice Set 12 1. The Swift Company presented the balances of each income and expense account and you are tasked to make its expanded income statement for the year ended 2020. 2. Always apply the income tax expense as 25% of operating profit. Gross Sales = P 3,822,300 Sales Returns= P 219,700 Gross Purchases = P 1,000,000 Purchase Discounts = P 180,000 Beginning Inventories = P 920,500 %3D Ending Inventories = P 450,800 Distribution Expenses = P 760,200 Administrative Expenses = P 440,900 %3D Other Comprehensive Income = P 210,000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

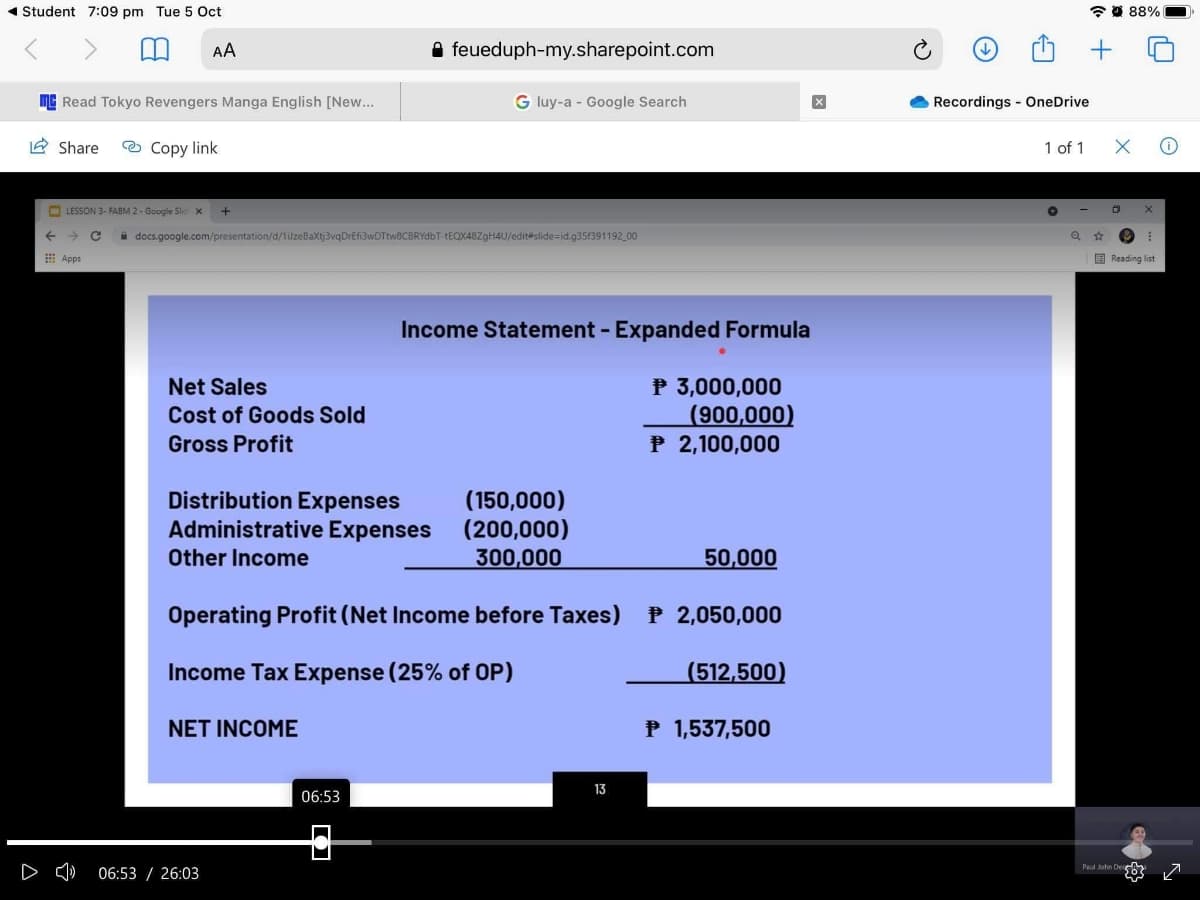

Make a expanded income statement

Also provided a formula for the expanded income statement.

Transcribed Image Text:GLOBE ll

© 91% |

D7:06 pm

PRACTICE SETS - OneDrive

feueduph-my.sharepoint.com

2 of 2

2/ TU

STATEMENT OF COMPREHENSIVE INCOME

Practice Set 12

1. The Swift Company presented the

balances of each income and expense

account and you are tasked to make its

expanded income statement for the year

ended 2020.

2. Always apply the income tax expense

as 25% of operating profit.

Gross Sales = P 3,822,300

Sales Returns= P 219,700

Gross Purchases = P 1,000,000

Purchase Discounts

P 180,000

%3D

Beginning Inventories = P 920,500

Ending Inventories = P 450,800

Distribution Expenses = P 760,200

Administrative Expenses = P 440,900

%3D

Other Comprehensive Income = P 210,000

Transcribed Image Text:1 Student 7:09 pm Tue 5 Oct

O 88%

AA

feueduph-my.sharepoint.com

MG Read Tokyo Revengers Manga English [New.

G luy-a - Google Search

O Recordings - OneDrive

2 Share

O Copy link

1 of 1

O LESSON 3- FABM 2 - Google Slic

->

i docs.google.com/presentation/d/1üzeBaXtj3vqDrEfi3wDTtw8CBRYdbT-TEQX48ZGH4U/edit#slide=id.g35f391192 00

E Apps

E Reading list

Income Statement - Expanded Formula

P 3,000,000

(900,000)

P 2,100,000

Net Sales

Cost of Goods Sold

Gross Profit

Distribution Expenses

Administrative Expenses (200,000)

Other Income

(150,000)

300,000

50,000

Operating Profit (Net Income before Taxes)

P 2,050,000

Income Tax Expense (25% of OP)

(512,500)

NET INCOME

P 1,537,500

13

06:53

06:53 / 26:03

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education