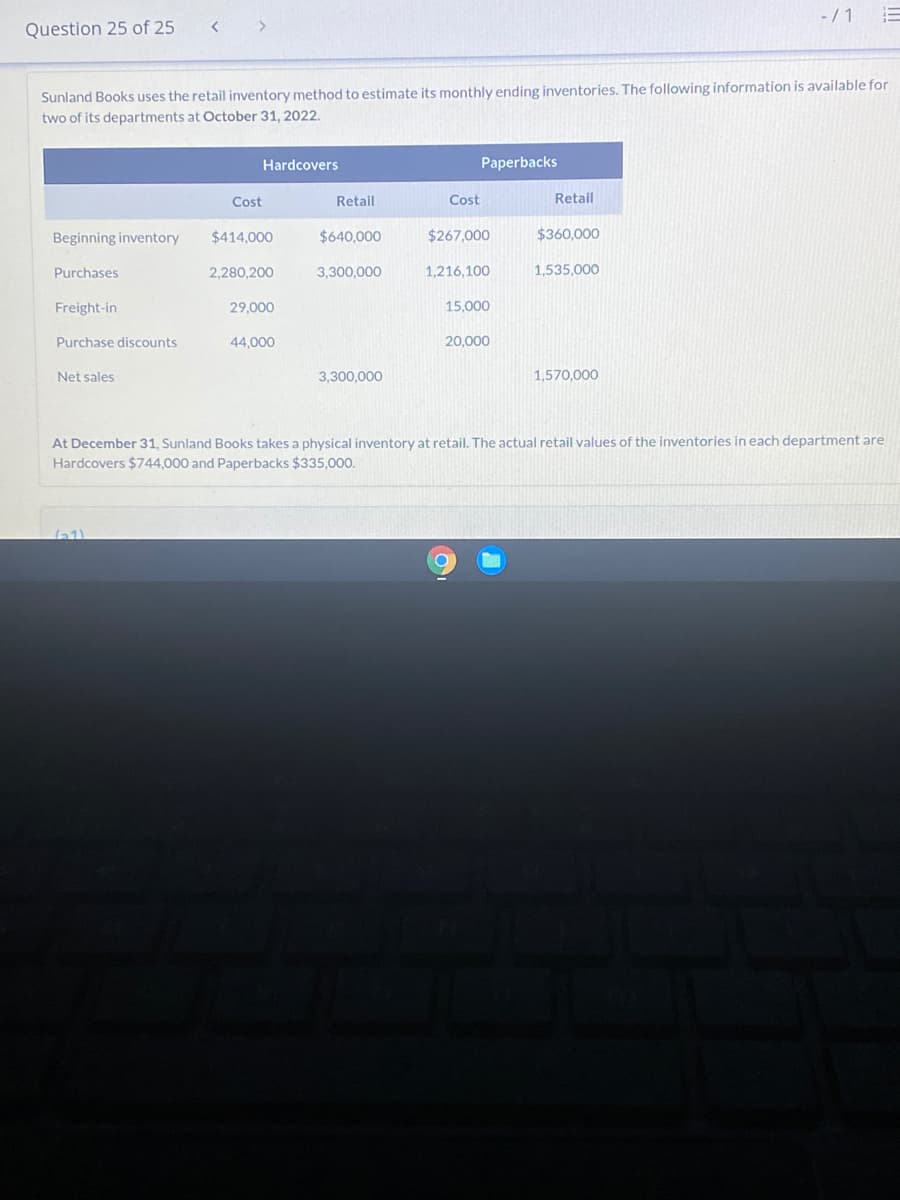

Sunland Books uses the retail inventory method to estimate its monthly ending inventories. The following information is available wo of its departments at October 31, 2022. Hardcovers Paperbacks Cost Retail Cost Retail Beginning inventory $414,000 $640,000 $267,000 $360,000 Purchases 2,280,200 3,300,000 1,216,100 1,535,000 Freight-in 29,000 15,000 Purchase discounts 44,000 20,000 Net sales 3,300,000 1,570,000 At December 31, Sunland Books takes a physical inventory at retail. The actual retail values of the inventories in each department a Hardcovers $744,000 and Paperbacks $335,000.

Sunland Books uses the retail inventory method to estimate its monthly ending inventories. The following information is available wo of its departments at October 31, 2022. Hardcovers Paperbacks Cost Retail Cost Retail Beginning inventory $414,000 $640,000 $267,000 $360,000 Purchases 2,280,200 3,300,000 1,216,100 1,535,000 Freight-in 29,000 15,000 Purchase discounts 44,000 20,000 Net sales 3,300,000 1,570,000 At December 31, Sunland Books takes a physical inventory at retail. The actual retail values of the inventories in each department a Hardcovers $744,000 and Paperbacks $335,000.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Topic Video

Question

Transcribed Image Text:-/ 1

Question 25 of 25

Sunland Books uses the retail inventory method to estimate its monthly ending inventories. The following information is available for

two of its departments at October 31, 2022.

Hardcovers

Paperbacks

Cost

Retail

Cost

Retail

Beginning inventory

$414,000

$640,000

$267,000

$360.000

Purchases

2,280,200

3,300,000

1,216,100

1.535,000

Freight-in

29,000

15.000

Purchase discounts

44,000

20.000

Net sales

3,300,000

1,570,000

At December 31, Sunland Books takes a physical inventory at retail. The actual retail values of the inventories in each department are

Hardcovers $744,000 and Paperbacks $335,000.

Transcribed Image Text:Question 25 of 25

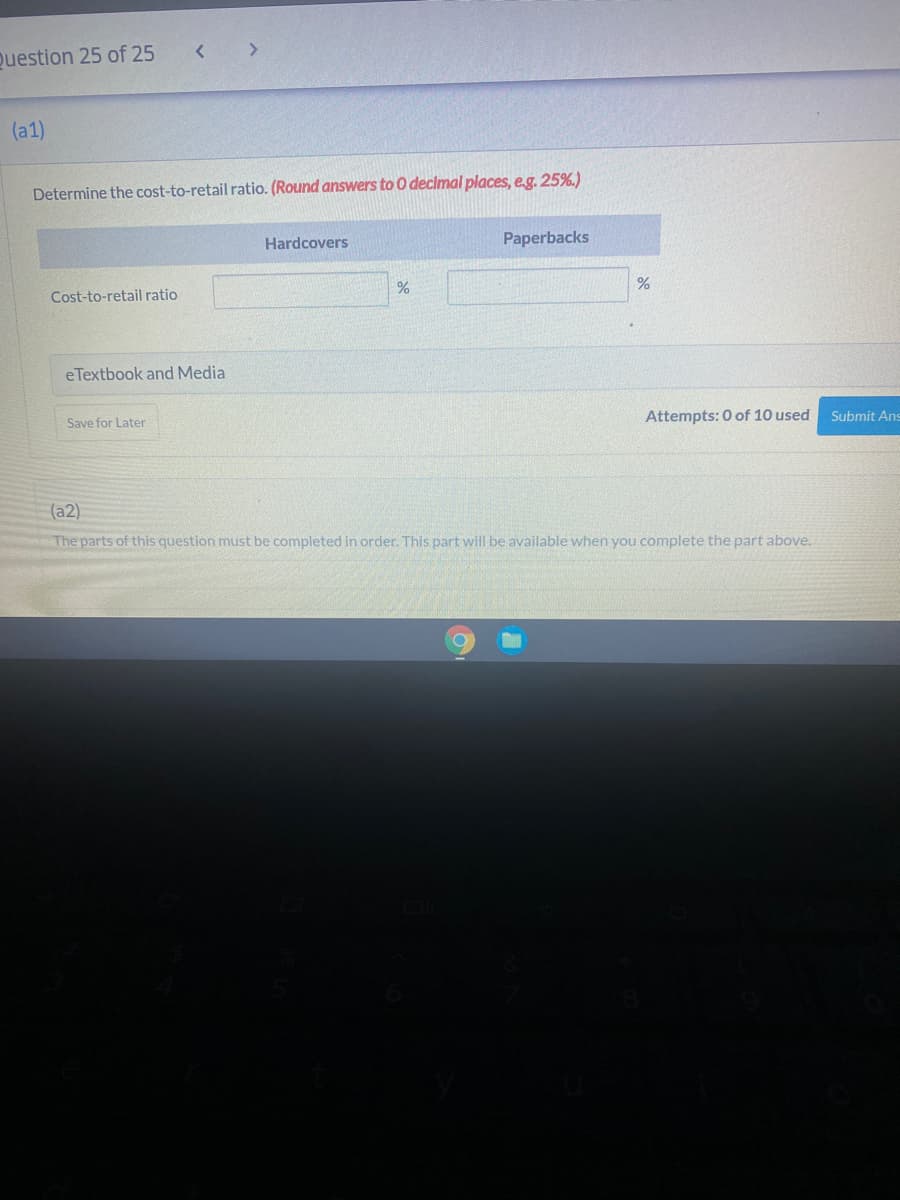

(a1)

Determine the cost-to-retail ratio. (Round answers to 0 decimal places, eg. 25%.)

Hardcovers

Paperbacks

Cost-to-retail ratio

eTextbook and Media

Save for Later

Attempts: 0 of 10 used

Submit Ans

(a2)

The parts of this question must be completed in order. This part will be available when you complete the part above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning