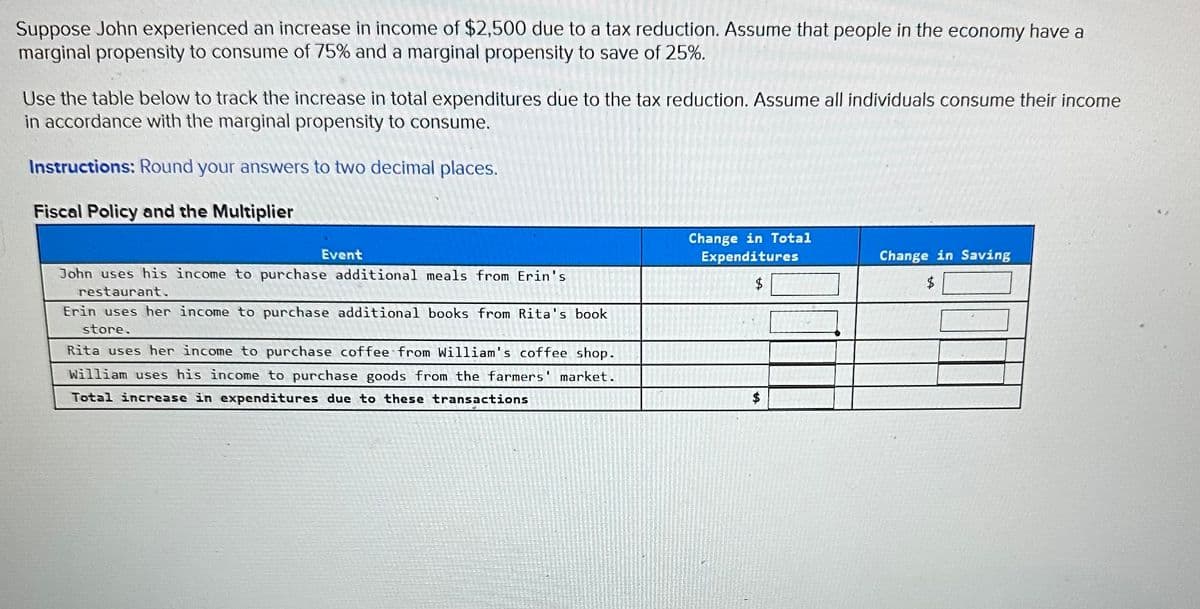

Suppose John experienced an increase in income of $2,500 due to a tax reduction. Assume that people in the economy have a marginal propensity to consume of 75% and a marginal propensity to save of 25%. Use the table below to track the increase in total expenditures due to the tax reduction. Assume all individuals consume their income in accordance with the marginal propensity to consume. Instructions: Round your answers to two decimal places. Fiscal Policy and the Multiplier Event John uses his income to purchase additional meals from Erin's restaurant. Erin uses her income to purchase additional books from Rita's book store. Rita uses her income to purchase coffee from William's coffee shop. William uses his income to purchase goods from the farmers' market. Total increase in expenditures due to these transactions Change in Total Expenditures $ Change in Saving

Suppose John experienced an increase in income of $2,500 due to a tax reduction. Assume that people in the economy have a marginal propensity to consume of 75% and a marginal propensity to save of 25%. Use the table below to track the increase in total expenditures due to the tax reduction. Assume all individuals consume their income in accordance with the marginal propensity to consume. Instructions: Round your answers to two decimal places. Fiscal Policy and the Multiplier Event John uses his income to purchase additional meals from Erin's restaurant. Erin uses her income to purchase additional books from Rita's book store. Rita uses her income to purchase coffee from William's coffee shop. William uses his income to purchase goods from the farmers' market. Total increase in expenditures due to these transactions Change in Total Expenditures $ Change in Saving

Chapter9: Demand-side Equilibrium: Unemployment Or Inflation?

Section9.A: The Simple Algebra Of Income Determination And The Multiplier

Problem 4TY

Related questions

Question

Transcribed Image Text:Suppose John experienced an increase in income of $2,500 due to a tax reduction. Assume that people in the economy have a

marginal propensity to consume of 75% and a marginal propensity to save of 25%.

Use the table below to track the increase in total expenditures due to the tax reduction. Assume all individuals consume their income

in accordance with the marginal propensity to consume.

Instructions: Round your answers to two decimal places.

Fiscal Policy and the Multiplier

Event

John uses his income to purchase additional meals from Erin's

restaurant.

Erin uses her income to purchase additional books from Rita's book

store.

Rita uses her income to purchase coffee from William's coffee shop.

William uses his income to purchase goods from the farmers' market.

Total increase in expenditures due to these transactions

Change in Total

Expenditures

$

$

Change in Saving

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning