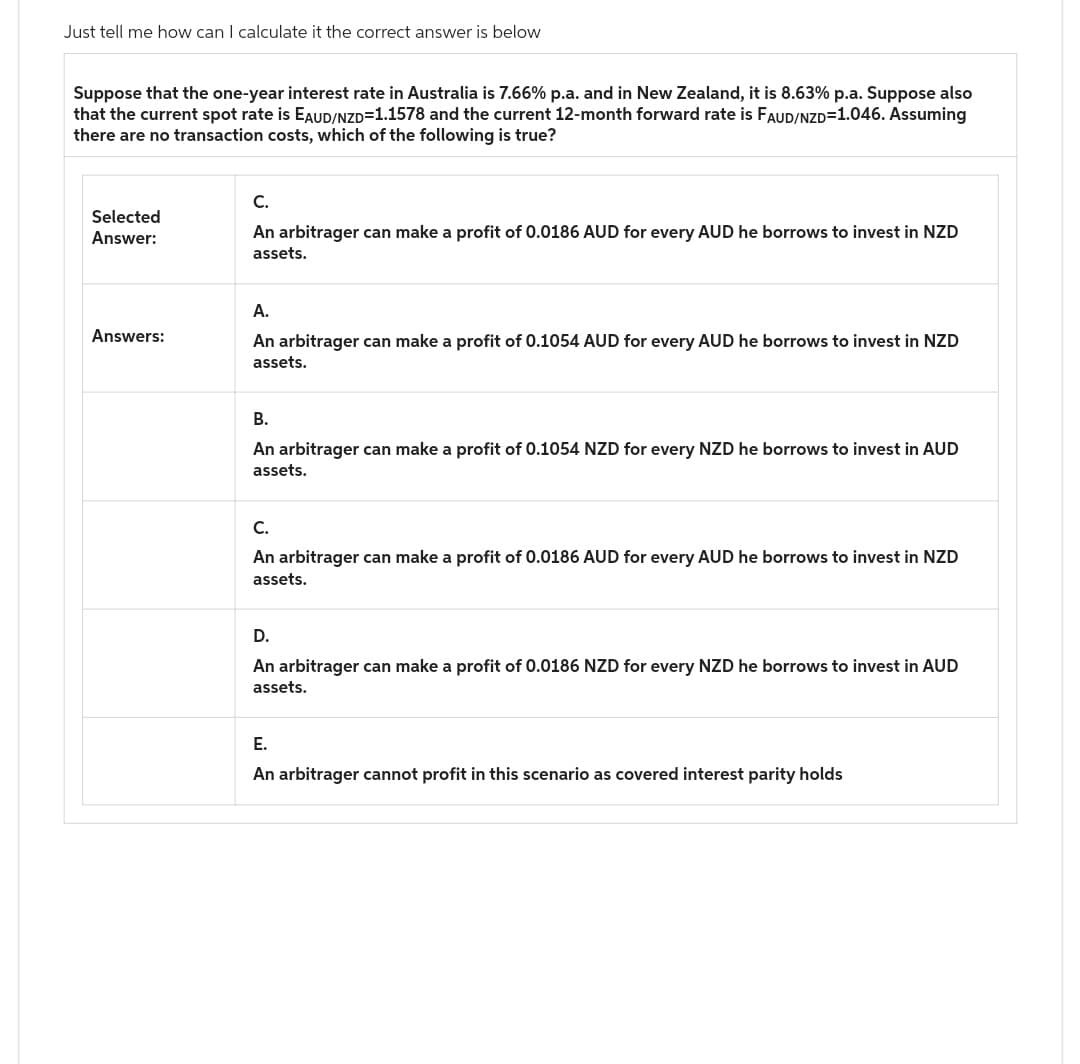

Suppose that the one-year interest rate in Australia is 7.66% p.a. and in New Zealand, it is 8.63% p.a. Suppose also that the current spot rate is EAUD/NZD=1.1578 and the current 12-month forward rate is FAUD/NZD=1.046. Assuming there are no transaction costs, which of the following is true? Selected Answer: Answers: C. An arbitrager can make a profit of 0.0186 AUD for every AUD he borrows to invest in NZD assets. A. An arbitrager can make a profit of 0.1054 AUD for every AUD he borrows to invest in NZD assets. B. An arbitrager can make a profit of 0.1054 NZD for every NZD he borrows to invest in AUD assets. C. An arbitrager can make a profit of 0.0186 AUD for every AUD he borrows to invest in NZD assets. D. An arbitrager can make a profit of 0.0186 NZD for every NZD he borrows to invest in AUD assets. E. An arbitrager cannot profit in this scenario as covered interest parity holds

Suppose that the one-year interest rate in Australia is 7.66% p.a. and in New Zealand, it is 8.63% p.a. Suppose also that the current spot rate is EAUD/NZD=1.1578 and the current 12-month forward rate is FAUD/NZD=1.046. Assuming there are no transaction costs, which of the following is true? Selected Answer: Answers: C. An arbitrager can make a profit of 0.0186 AUD for every AUD he borrows to invest in NZD assets. A. An arbitrager can make a profit of 0.1054 AUD for every AUD he borrows to invest in NZD assets. B. An arbitrager can make a profit of 0.1054 NZD for every NZD he borrows to invest in AUD assets. C. An arbitrager can make a profit of 0.0186 AUD for every AUD he borrows to invest in NZD assets. D. An arbitrager can make a profit of 0.0186 NZD for every NZD he borrows to invest in AUD assets. E. An arbitrager cannot profit in this scenario as covered interest parity holds

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.7P

Related questions

Question

Typed plzzz and Asap

Thanks

Transcribed Image Text:Just tell me how can I calculate it the correct answer is below

Suppose that the one-year interest rate in Australia is 7.66% p.a. and in New Zealand, it is 8.63% p.a. Suppose also

that the current spot rate is EAUD/NZD=1.1578 and the current 12-month forward rate is FAUD/NZD=1.046. Assuming

there are no transaction costs, which of the following is true?

Selected

Answer:

Answers:

C.

An arbitrager can make a profit of 0.0186 AUD for every AUD he borrows to invest in NZD

assets.

A.

An arbitrager can make a profit of 0.1054 AUD for every AUD he borrows to invest in NZD

assets.

B.

An arbitrager can make a profit of 0.1054 NZD for every NZD he borrows to invest in AUD

assets.

C.

An arbitrager can make a profit of 0.0186 AUD for every AUD he borrows to invest in NZD

assets.

D.

An arbitrager can make a profit of 0.0186 NZD for every NZD he borrows to invest in AUD

assets.

E.

An arbitrager cannot profit in this scenario as covered interest parity holds

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning