Suppose you work in the HR department of a company that wants to hire production workers as independent contractors. What advice would you give management about this idea

Suppose you work in the HR department of a company that wants to hire production workers as independent contractors. What advice would you give management about this idea

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

2. Suppose you work in the HR department of a company that wants to hire production workers as independent contractors. What advice would you give management about this idea?

Transcribed Image Text:company

contos

vears,

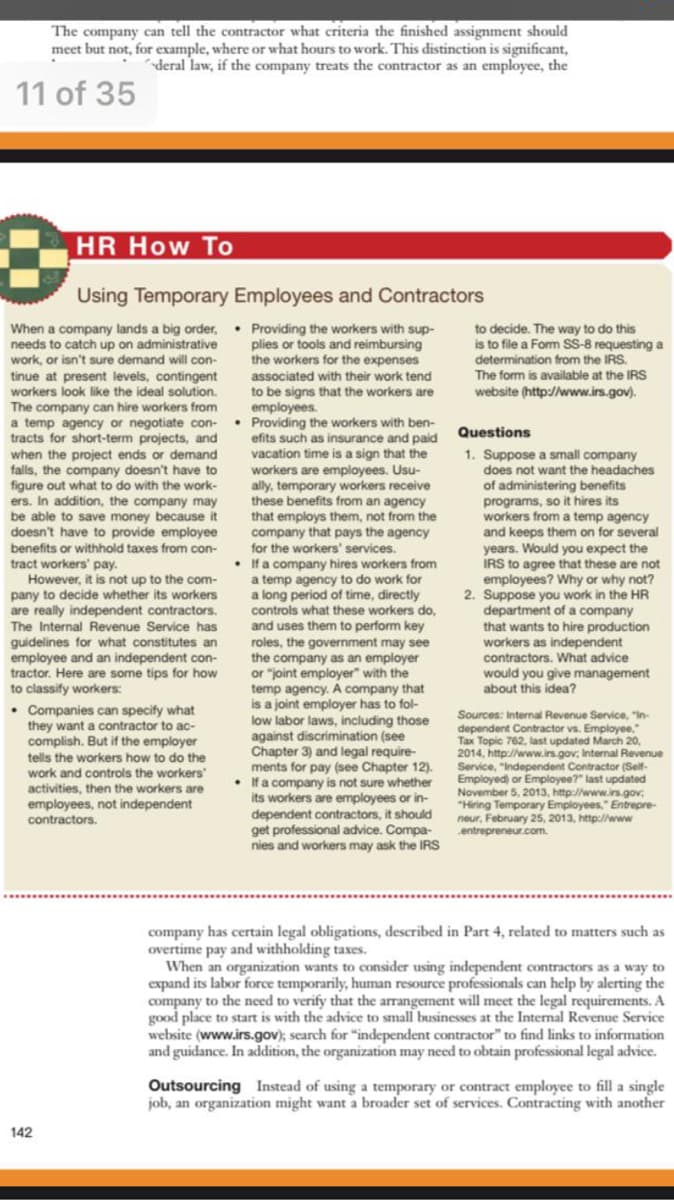

The company can tell the contractor what criteria the finished assignment should

meet but not, for example, where or what hours to work. This distinction is significant,

deral law, if the company treats the contractor as an employee, the

11 of 35

HR How To

Using Temporary Employees and Contractors

When a company lands a big order, Providing the workers with sup-

needs to catch up on administrative

work, or isn't sure demand will con-

plies or tools and reimbursing

the workers for the expenses

to decide. The way to do this

is to file a Form SS-8 requesting a

determination from the IRS.

The form is available at the IRS

website (http://www.irs.gov).

associated with their work tend

to be signs that the workers are

employees.

• Providing the workers with ben-

ents such as insurance and paid

vacation time is a sign that the

workers are employees. Usu-

ally, temporary workers receive

these

tinue at present levels, contingent

workers look like the ideal solution.

The company can hire workers from

a temp agency or negotiate con-

tracts for short-term projects, and

Questions

1. Suppose a small company

does not want the headaches

when the project ends or demand

falls, the company doesn't have to

figure

ers, In addition, the company may

t what to do with the work-

of administering benefits

programs, so it hires its

workers from a temp ager

and keeps them on for several

Would you expect the

IRS to agree that these are not

employees? Why or why not?

2. Suppose you work in t

department of a

that wants to hire production

workers as independent

contractors. What advice

would you give management

about this idea?

out

benefits from an

that employs them, not from the

company that pays the agency

agency

be able to save money because it

doesn't have to provide employee

benefits

tract workers' pay.

However, it is not up to the com-

pany to decide whether

are really independent contractors.

The Internal Revenue Service has

guidelines for what constitutes an

employee and an independent con-

tractor. Here are some tips for how

to classify workers:

or withhold taxes from con-

for the workers' services.

• Ifa company hires workers from

temp agency to do work for

long period of time,

at

its

workers

a

the HR

what these workers do,

contr

and uses them to perform key

roles, the government may see

the company as an employer

or "joint employer" with the

temp agency. A company that

is a joint employer has to fol-

low labor laws, including those

against discrimination (see

Chapter 3) and legal require-

ments for pay (see Chapter 12).

• Ifa company is not sure whether

its workers are employees or in-

dependent contractors, it should

get professional advice. Compa-

nies and workers may ask the IRS

• Companies can specify what

they want a contractor to ac-

complish. But if the employer

tells the workers how to do the

Sources: Internal Revenue Service, "In-

dependent Contractor vs. Employee,

Tax Topic 762, last updated March 20,

2014, http://www.irs.gov; Internal Revenue

Service, "Independent Contractor (Self-

Employed) or Employee?" last updated

November 5, 2013, http://www.irs.gov:

"Hiring Temporary Employees," Entrepre-

neur, February 25, 2013, http://www

entrepreneur.com.

work and controls the workers'

activities, then the workers are

employees, not independent

contractors.

company has certain legal obligations, described in Part 4, related to matters such as

overtime pay and withholding taxes.

When an organization wants to consider using independent contractors as a way to

expand its labor force temporarily, human resource professionals can help by alerting the

company to the need to verify that the arrangement will meet the legal requirements. A

good place to start is with the advice to small businesses at the Internal Revenue Service

website (www.irs.gov); search for "independent contractor" to find links to information

and guidance. In addition, the organization may need to obtain professional legal advice.

Outsourcing Instead of using a temporary or contract employee to fill a single

job, an organization might want a broader set of services. Contracting with another

142

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON