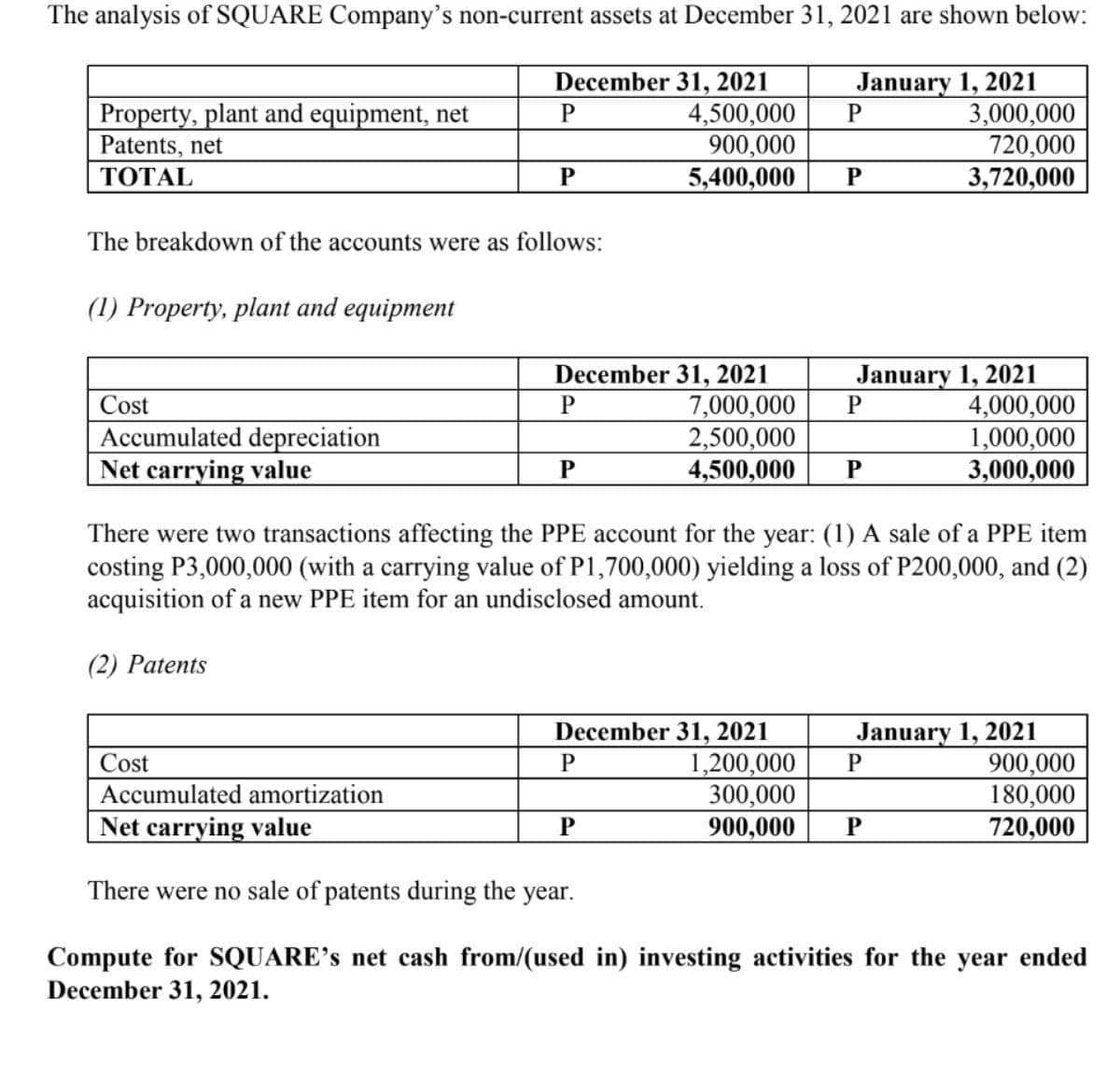

The analysis of SQUARE Company's non-current assets at December 31, 2021 are shown below: Property, plant and equipment, net Patents, net ТОTAL December 31, 2021 4,500,000 900,000 5,400,000 January 1, 2021 3,000,000 720,000 3,720,000 P P P The breakdown of the accounts were as follows: (1) Property, plant and equipment January 1, 2021 4,000,000 1,000,000 3,000,000 December 31, 2021 Cost Accumulated depreciation Net carrying value 7,000,000 2,500,000 4,500,000 P P There were two transactions affecting the PPE account for the year: (1) A sale of a PPE item costing P3,000,000 (with a carrying value of P1,700,000) yielding a loss of P200,000, and (2) acquisition of a new PPE item for an undisclosed amount. (2) Patents December 31, 2021 1,200,000 300,000 900,000 January 1, 2021 900,000 180,000 720,000 Cost Accumulated amortization Net carrying value P There were no sale of patents during the year. Compute for SQUARE's net cash from/(used in) investing activities for the year ended December 31, 2021.

The analysis of SQUARE Company's non-current assets at December 31, 2021 are shown below: Property, plant and equipment, net Patents, net ТОTAL December 31, 2021 4,500,000 900,000 5,400,000 January 1, 2021 3,000,000 720,000 3,720,000 P P P The breakdown of the accounts were as follows: (1) Property, plant and equipment January 1, 2021 4,000,000 1,000,000 3,000,000 December 31, 2021 Cost Accumulated depreciation Net carrying value 7,000,000 2,500,000 4,500,000 P P There were two transactions affecting the PPE account for the year: (1) A sale of a PPE item costing P3,000,000 (with a carrying value of P1,700,000) yielding a loss of P200,000, and (2) acquisition of a new PPE item for an undisclosed amount. (2) Patents December 31, 2021 1,200,000 300,000 900,000 January 1, 2021 900,000 180,000 720,000 Cost Accumulated amortization Net carrying value P There were no sale of patents during the year. Compute for SQUARE's net cash from/(used in) investing activities for the year ended December 31, 2021.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

Transcribed Image Text:The analysis of SQUARE Company's non-current assets at December 31, 2021 are shown below:

December 31, 2021

4,500,000

900,000

5,400,000

January 1, 2021

3,000,000

720,000

3,720,000

Property, plant and equipment, net

Patents, net

P

ТОTAL

P

P

The breakdown of the accounts were as follows:

(1) Property, plant and equipment

December 31, 2021

7,000,000

2,500,000

4,500,000

January 1, 2021

4,000,000

1,000,000

3,000,000

Cost

Accumulated depreciation

Net carrying value

P

P

There were two transactions affecting the PPE account for the year: (1) A sale of a PPE item

costing P3,000,000 (with a carrying value of P1,700,000) yielding a loss of P200,000, and (2)

acquisition of a new PPE item for an undisclosed amount.

(2) Patents

December 31, 2021

1,200,000

300,000

900,000

January 1, 2021

900,000

180,000

720,000

Cost

Accumulated amortization

Net carrying value

There were no sale of patents during the year.

Compute for SQUARE's net cash from/(used in) investing activities for the year ended

December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning