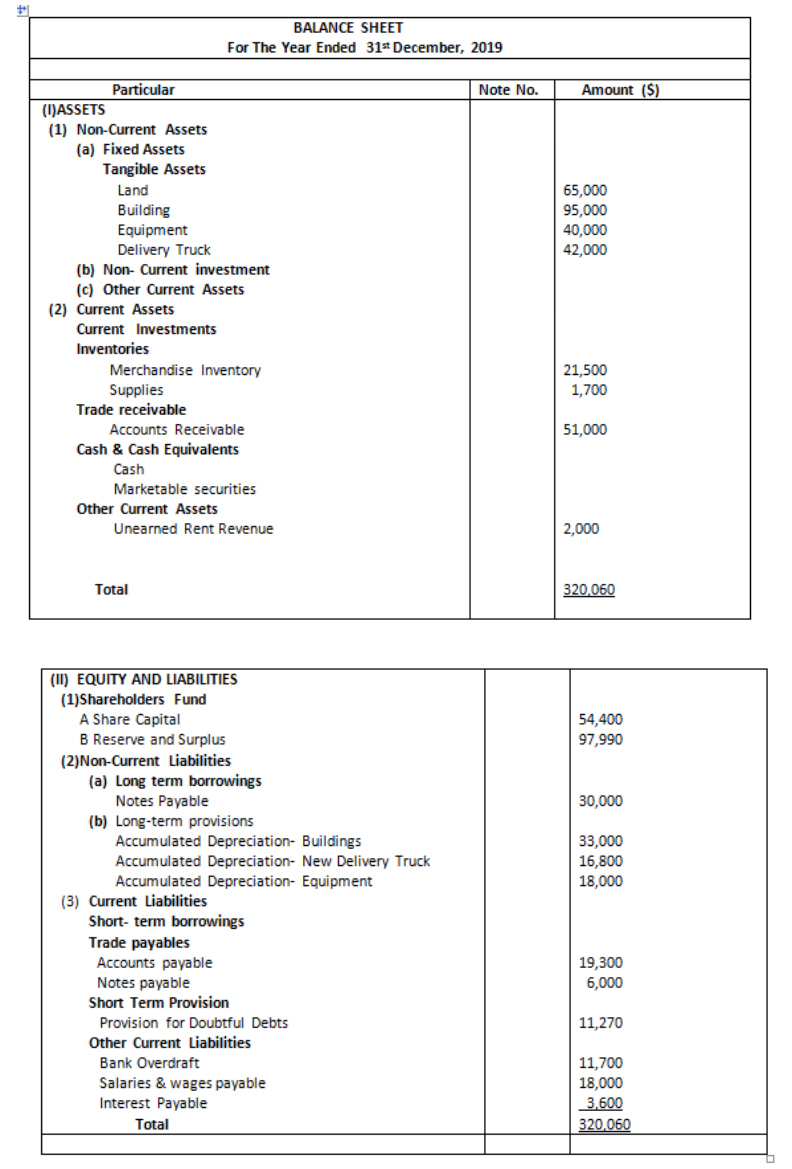

Compute the following ratiosat December 31, 2019: i.Current ratio ii.Acid-test Ratio iii.Account Receivables Turnover iv.Average collection period v.Inventory Turnover vi.Days in inventory vii.Profit margin viii.Debts to Asset ratio ix.Return on Assets x.Times Interest Earned

Compute the following ratiosat December 31, 2019: i.Current ratio ii.Acid-test Ratio iii.Account Receivables Turnover iv.Average collection period v.Inventory Turnover vi.Days in inventory vii.Profit margin viii.Debts to Asset ratio ix.Return on Assets x.Times Interest Earned

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 17P: On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and...

Related questions

Question

Compute the following ratiosat December 31, 2019:

i.Current ratio

ii.Acid-test Ratio

iii.Account Receivables Turnover

iv.Average collection period

v.Inventory Turnover

vi.Days in inventory

vii.Profit margin

viii.Debts to Asset ratio

ix.Return on Assets

x.Times Interest Earned

Transcribed Image Text:BALANCE SHEET

For The Year Ended 31* December, 2019

Particular

Note No.

Amount ($)

(I)ASSETS

(1) Non-Current Assets

(a) Fixed Assets

Tangible Assets

Land

65,000

Building

Equipment

Delivery Truck

(b) Non- Current investment

(c) Other Current Assets

95,000

40,000

42,000

(2) Current Assets

Current Investments

Inventories

21,500

1,700

Merchandise Inventory

Supplies

Trade receivable

Accounts Receivable

51,000

Cash & Cash Equivalents

Cash

Marketable securities

Other Current Assets

Unearned Rent Revenue

2,000

Total

320,060

(I) EQUITY AND LIABILITIES

(1)Shareholders Fund

A Share Capital

B Reserve and Surplus

(2)Non-Current Liabilities

(a) Long term borrowings

Notes Payable

(b) Long-term provisions

Accumulated Depreciation- Buildings

54,400

97,990

30,000

Accumulated Depreciation- New Delivery Truck

Accumulated Depreciation- Equipment

33,000

16,800

18,000

(3) Current Liabilities

Short- term borrowings

Trade payables

Accounts payable

19,300

6,000

Notes payable

Short Term Provision

Provision for Doubtful Debts

11,270

Other Current Liabilities

Bank Overdraft

11,700

18,000

3,600

320,060

Salaries & wages payable

Interest Payable

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning