Required: Analyze Delima's financial statement. Include the following ratios for 2020 and discuss your findings (2019 values are provided for comparison): 1) Current ratio 2) Inventory turnover (year 2019 - 7.2 times) 3) Debt to assets ratio (year 2019 - 82%) (year 2019 - 0.92:1)

Required: Analyze Delima's financial statement. Include the following ratios for 2020 and discuss your findings (2019 values are provided for comparison): 1) Current ratio 2) Inventory turnover (year 2019 - 7.2 times) 3) Debt to assets ratio (year 2019 - 82%) (year 2019 - 0.92:1)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.3C

Related questions

Question

100%

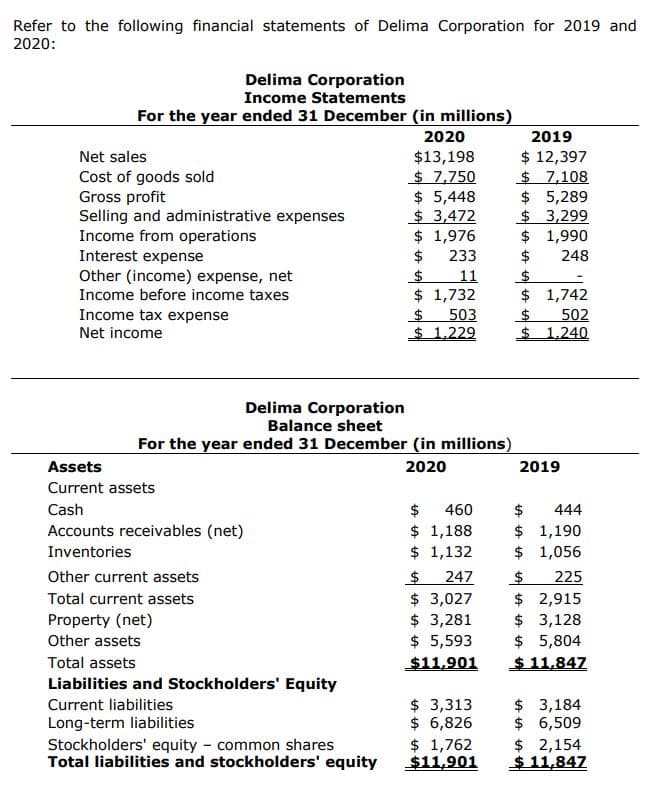

Transcribed Image Text:Refer to the following financial statements of Delima Corporation for 2019 and

2020:

Delima Corporation

Income Statements

For the year ended 31 December (in millions)

2020

2019

$13,198

$ 7,750

$ 5,448

$3,472

$ 1,976

233

$ 12,397

$ 7,108

$ 5,289

$ 3,299

$ 1,990

$

$4

$ 1,742

Net sales

Cost of goods sold

Gross profit

Selling and administrative expenses

Income from operations

Interest expense

Other (income) expense, net

$

248

11

Income before income taxes

$ 1,732

Income tax expense

503

502

Net income

$ 1,229

$ 1,240

Delima Corporation

Balance sheet

For the year ended 31 December (in millions)

Assets

2020

2019

Current assets

Cash

444

$

$ 1,188

$ 1,132

460

$ 1,190

$ 1,056

Accounts receivables (net)

Inventories

Other current assets

247

225

$ 3,027

$ 3,281

$ 5,593

$ 2,915

$ 3,128

$ 5,804

$ 11,847

Total current assets

Property (net)

Other assets

Total assets

$11,901

Liabilities and Stockholders' Equity

$ 3,313

$ 6,826

$ 1,762

$11,901

$ 3,184

$ 6,509

$ 2,154

$ 11,847

Current liabilities

Long-term liabilities

Stockholders' equity - common shares

Total liabilities and stockholders' equity

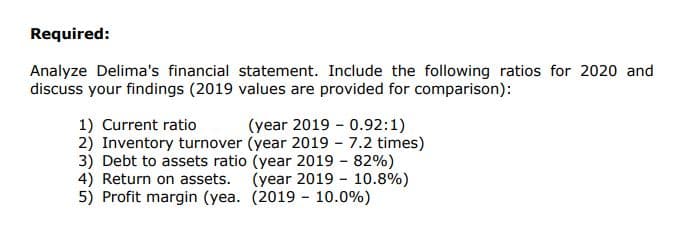

Transcribed Image Text:Required:

Analyze Delima's financial statement. Include the following ratios for 2020 and

discuss your findings (2019 values are provided for comparison):

1) Current ratio

2) Inventory turnover (year 2019 - 7.2 times)

3) Debt to assets ratio (year 2019 - 82%)

4) Return on assets. (year 2019 - 10.8%)

5) Profit margin (yea. (2019 - 10.0%)

(year 2019 - 0.92:1)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning