The data describes the market for luxury boats. Now the government puts 10 percent tax on luxury boats. With the tax imposed, the price of a luxury boat is, O A. $0.40 million B. $4.20 million O C. $4 million D. $400 million E. $4.40 million With the 10 percent tax on luxury boats, O A. the tax reduces the quantity of luxury boats sold to zero, so there is no tax. B. the buyer pays all of the tax. O C. the seller pays all of the tax. O D. the buyer and the seller split the tax evenly. O E. it is impossible to say how the tax is split between the buyer and seller. The government raises tax revenue of $ >>> Answer to 1 decimal place. million. .....

The data describes the market for luxury boats. Now the government puts 10 percent tax on luxury boats. With the tax imposed, the price of a luxury boat is, O A. $0.40 million B. $4.20 million O C. $4 million D. $400 million E. $4.40 million With the 10 percent tax on luxury boats, O A. the tax reduces the quantity of luxury boats sold to zero, so there is no tax. B. the buyer pays all of the tax. O C. the seller pays all of the tax. O D. the buyer and the seller split the tax evenly. O E. it is impossible to say how the tax is split between the buyer and seller. The government raises tax revenue of $ >>> Answer to 1 decimal place. million. .....

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter5: Elastic And Its Application

Section: Chapter Questions

Problem 10PA

Related questions

Question

Q28

NOT GRADED THIS IS A PRACTICE REVIEW

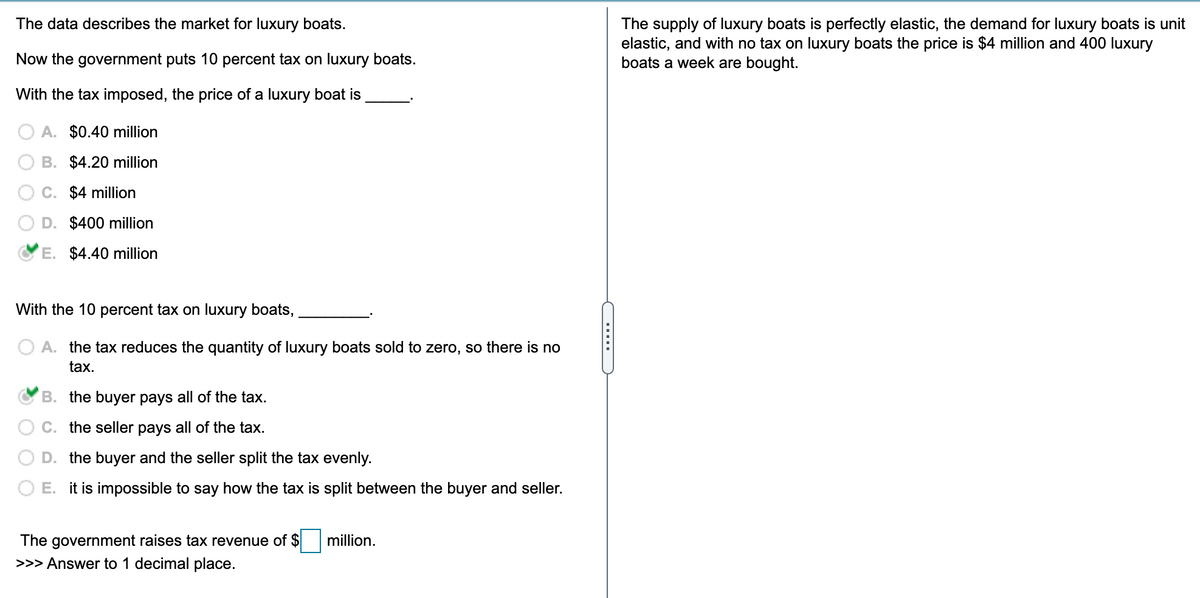

Transcribed Image Text:The data describes the market for luxury boats.

The supply of luxury boats is perfectly elastic, the demand for luxury boats is unit

elastic, and with no tax on luxury boats the price is $4 million and 400 luxury

boats a week are bought.

Now the government puts 10 percent tax on luxury boats.

With the tax imposed, the price of a luxury boat is

A. $0.40 million

B. $4.20 million

C. $4 million

D. $400 million

E.

$4.40 million

With the 10 percent tax on luxury boats,

O A. the tax reduces the quantity of luxury boats sold to zero, so there is no

tax.

B. the buyer pays all of the tax.

C. the seller pays all of the tax.

D. the buyer and the seller split the tax evenly.

E. it is impossible to say how the tax is split between the buyer and seller.

The government raises tax revenue of $

million.

>>> Answer to 1 decimal place.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning