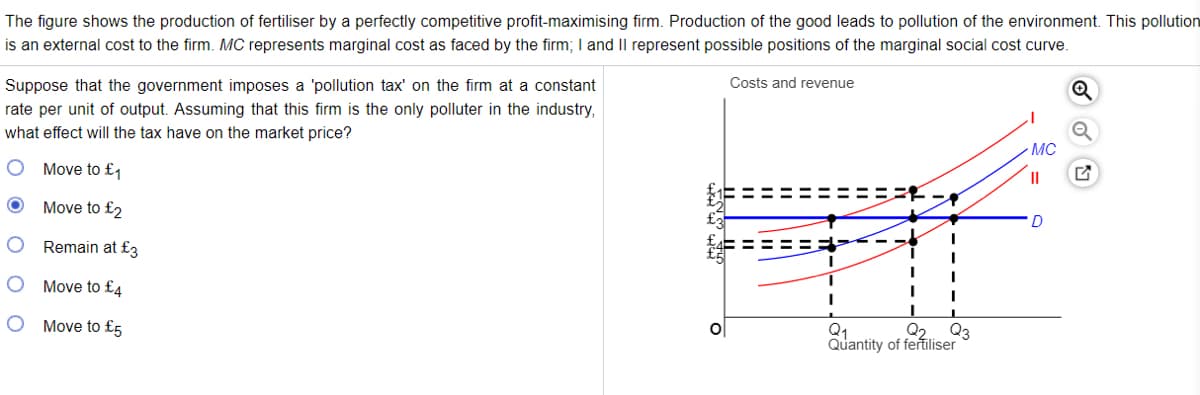

The figure shows the production of fertiliser by a perfectly competitive profit-maximising firm. Production of the good leads to pollution of the environment. This pollution is an external cost to the firm. MC represents marginal cost as faced by the firm; I and II represent possible positions of the marginal social cost curve. Costs and revenue Suppose that the government imposes a 'pollution tax' on the firm at a constant rate per unit of output. Assuming that this firm is the only polluter in the industry, what effect will the tax have on the market price? MC O Move to £1 II Move to £2 D Remain at £3 %3D O Move to £4 Move to £5 Q1 Q2 Q3 Quantity of fertiliser

The figure shows the production of fertiliser by a perfectly competitive profit-maximising firm. Production of the good leads to pollution of the environment. This pollution is an external cost to the firm. MC represents marginal cost as faced by the firm; I and II represent possible positions of the marginal social cost curve. Costs and revenue Suppose that the government imposes a 'pollution tax' on the firm at a constant rate per unit of output. Assuming that this firm is the only polluter in the industry, what effect will the tax have on the market price? MC O Move to £1 II Move to £2 D Remain at £3 %3D O Move to £4 Move to £5 Q1 Q2 Q3 Quantity of fertiliser

Micro Economics For Today

10th Edition

ISBN:9781337613064

Author:Tucker, Irvin B.

Publisher:Tucker, Irvin B.

Chapter14: Environmental Economics

Section: Chapter Questions

Problem 5SQ: The perfectly competitive profit-maximizing firm in Exhibit 6 creates water and air pollution as a...

Related questions

Question

Transcribed Image Text:The figure shows the production of fertiliser by a perfectly competitive profit-maximising firm. Production of the good leads to pollution of the environment. This pollution

is an external cost to the firm. MC represents marginal cost as faced by the firm; I and II represent possible positions of the marginal social cost curve.

Suppose that the government imposes a 'pollution tax' on the firm at a constant

Costs and revenue

rate per unit of output. Assuming that this firm is the only polluter in the industry,

what effect will the tax have on the market price?

- MC

Move to £1

II

Move to £2

Remain at £3

Move to £4

Move to £5

Q1

Quantity of fertiliser

Q2. Q3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning