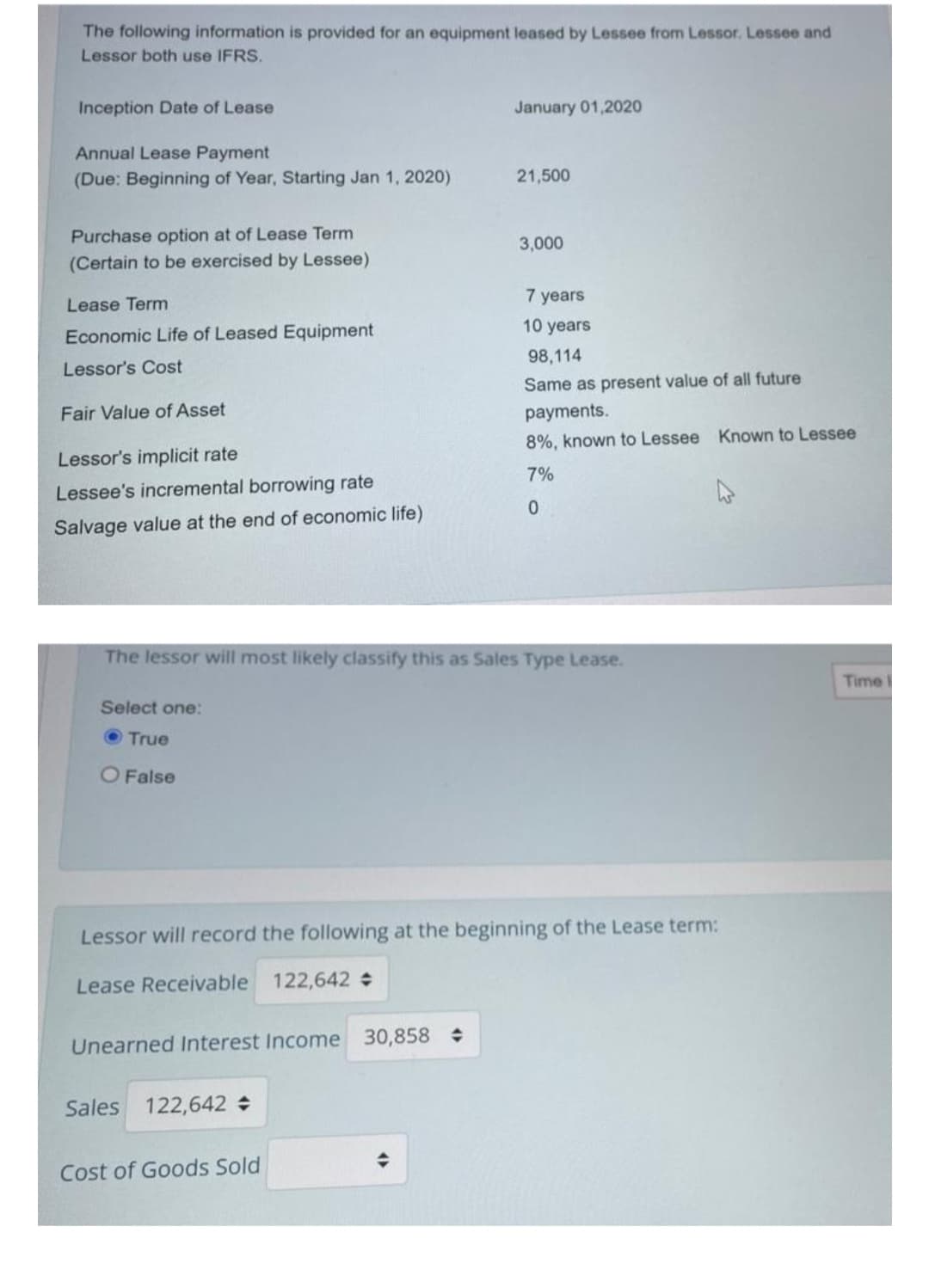

The following information is provided for an equipment leased by Lessee from Lessor. Lessee and Lessor both use IFRS. Inception Date of Lease Annual Lease Payment (Due: Beginning of Year, Starting Jan 1, 2020) Purchase option at of Lease Term (Certain to be exercised by Lessee) Lease Term Economic Life of Leased Equipment Lessor's Cost Fair Value of Asset Lessor's implicit rate Lessee's incremental borrowing rate Salvage value at the end of economic life) Select one: True O False Unearned Interest Income 30,858 January 01,2020 The lessor will most likely classify this as Sales Type Lease. Sales 122,642 = 21,500 Cost of Goods Sold 3,000 Lessor will record the following at the beginning of the Lease term: Lease Receivable 122,642 ÷ 7 years 10 years 98,114 Same as present value of all future payments. 8%, known to Lessee Known to Lessee 7% 0 F Ti

The following information is provided for an equipment leased by Lessee from Lessor. Lessee and Lessor both use IFRS. Inception Date of Lease Annual Lease Payment (Due: Beginning of Year, Starting Jan 1, 2020) Purchase option at of Lease Term (Certain to be exercised by Lessee) Lease Term Economic Life of Leased Equipment Lessor's Cost Fair Value of Asset Lessor's implicit rate Lessee's incremental borrowing rate Salvage value at the end of economic life) Select one: True O False Unearned Interest Income 30,858 January 01,2020 The lessor will most likely classify this as Sales Type Lease. Sales 122,642 = 21,500 Cost of Goods Sold 3,000 Lessor will record the following at the beginning of the Lease term: Lease Receivable 122,642 ÷ 7 years 10 years 98,114 Same as present value of all future payments. 8%, known to Lessee Known to Lessee 7% 0 F Ti

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 8RE: Use the following information to decide whether this equipment lease qualifies as an operating,...

Related questions

Question

Transcribed Image Text:The following information is provided for an equipment leased by Lessee from Lessor. Lessee and

Lessor both use IFRS.

Inception Date of Lease

Annual Lease Payment

(Due: Beginning of Year, Starting Jan 1, 2020)

Purchase option at of Lease Term

(Certain to be exercised by Lessee)

Lease Term

Economic Life of Leased Equipment

Lessor's Cost

Fair Value of Asset

Lessor's implicit rate

Lessee's incremental borrowing rate

Salvage value at the end of economic life)

Select one:

True

O False

Unearned Interest Income 30,858 ÷

January 01,2020

Sales 22,642 =

21,500

The lessor will most likely classify this as Sales Type Lease.

Cost of Goods Sold

3,000

7 years

10 years

Lessor will record the following at the beginning of the Lease term:

Lease Receivable 122,642 ÷

98,114

Same as present value of all future

payments.

8%, known to Lessee Known to Lessee

7%

0

Time

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning