The following information relates to Hardin Limited's year-ended 31 December 2020: • The statement of comprehensive income shows profit for the year of R154 000. • The calculation of this profit included the following income and expenses: Impairment of building: R64 000 (before tax: R74 000) • Profit on sale of plant: R23 200 (before tax: R32 000) • Inventory write-down: R10 00 (before tax: R15 000) • The statement of changes in equity reflected preference dividends of R3 450. • 12 000 shares in issue throughout the year. Required: Calculate the basic earnings and the headline earnings and disclose the headline earnings per share for the year-ended 31 December 2020

The following information relates to Hardin Limited's year-ended 31 December 2020: • The statement of comprehensive income shows profit for the year of R154 000. • The calculation of this profit included the following income and expenses: Impairment of building: R64 000 (before tax: R74 000) • Profit on sale of plant: R23 200 (before tax: R32 000) • Inventory write-down: R10 00 (before tax: R15 000) • The statement of changes in equity reflected preference dividends of R3 450. • 12 000 shares in issue throughout the year. Required: Calculate the basic earnings and the headline earnings and disclose the headline earnings per share for the year-ended 31 December 2020

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Question

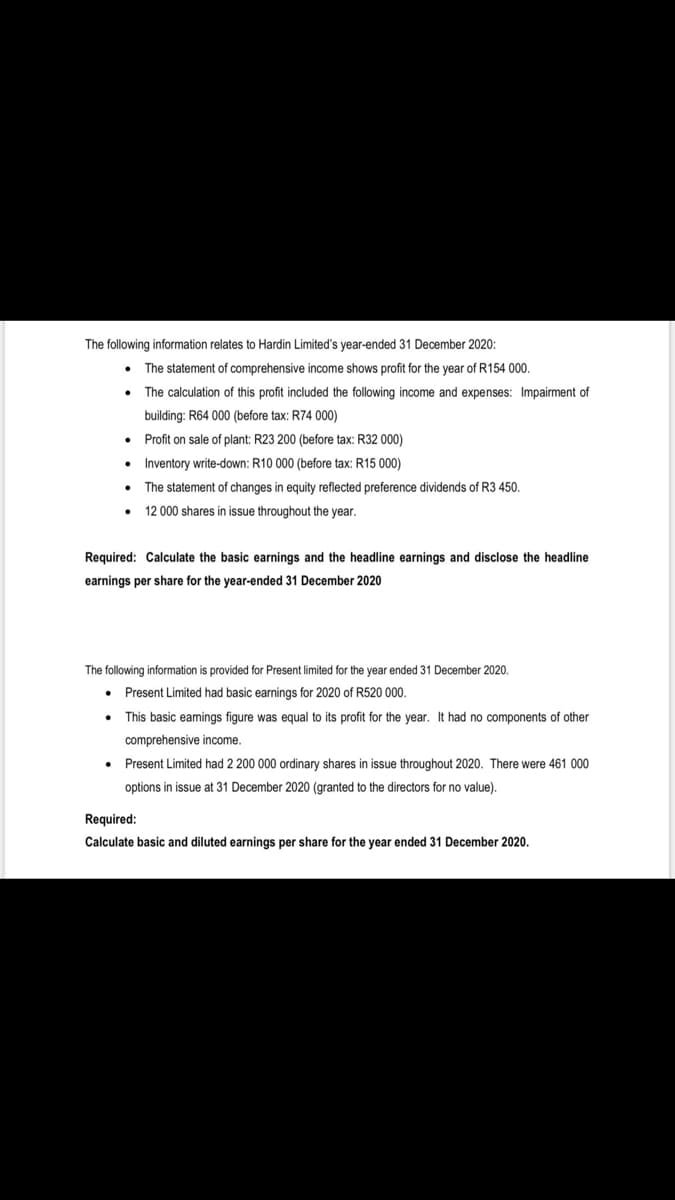

Transcribed Image Text:The following information relates to Hardin Limited's year-ended 31 December 2020:

The statement of comprehensive income shows profit for the year of R154 000.

The calculation of this profit included the following income and expenses: Impairment of

building: R64 000 (before tax: R74 000)

Profit on sale of plant: R23 200 (before tax: R32 000)

• Inventory write-down: R10 000 (before tax: R15 000)

• The statement of changes in equity reflected preference dividends of R3 450.

12 000 shares in issue throughout the year.

Required: Calculate the basic earnings and the headline earnings and disclose the headline

earnings per share for the year-ended 31 December 2020

The following information is provided for Present limited for the year ended 31 December 2020.

Present Limited had basic earnings for 2020 of R520 000.

This basic eamings figure was equal to its profit for the year. It had no components of other

comprehensive income.

Present Limited had 2 200 000 ordinary shares in issue throughout 2020. There were 461 000

options in issue at 31 December 2020 (granted to the directors for no value).

Required:

Calculate basic and diluted earnings per share for the year ended 31 December 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning