The following information was extracted from the records of Terra Ltd for the year ended 30 June 2024. TERRA LTD as at 30 lune 2024 Accounts receivable 70,000 Allowance for doubtful debts (15,000) Motor vehicles 280,000 Accumulated depreciation — motor vehicles (56,000) Prepaid insurance 34,000 Rent receivable 2,200 Bad debts expense 22,000 Interest payable 5,000 Rent revenue 7,800 Insurance Expense Ck 18,000 Deterred tax asset 2,100 Deferred tax liability 10,800 Additional information ✓ Estimated useful-life for tax purposes 10 years ✓ Estimated useful-life for accounting 15 years ✓ Rent received 5,000 ✓ Opening balance for prepaid insurance 29,500 ✓ Opening balance for the allowance for doubtful debts 7,000 ✓ Interest expenses 5,000 ✓ Tax rate 30% ✓ Profit before tax 245,300 Prepare the current tax worksheet and related journal entries. b. Prepare the deferred tax worksheet and related journal entries. Here is my question: I received the question you guys answered yesterday night, and I still have some questions about it. why the interest payable should be ignored? why the bad debt written off is $14000 as we know the opening balance for doubtful debt is 7000, and the allowance for Doubtful debt is 15000, bad debt expense is 22,000. In my opinion, bad debt written off is 7000+15000-22000 (I know its wired). How the T-ledge will be? why we don't use the Deffer tax asset (tax loss) in the current tax liability? why the depreciation is just one year amount? I think the information given it's 3 years' amount

The following information was extracted from the records of Terra Ltd for the year ended 30 June 2024.

TERRA LTD as at 30 lune 2024

Additional information ✓ Estimated useful-life for tax purposes 10 years ✓ Estimated useful-life for accounting 15 years ✓ Rent received 5,000 ✓ Opening balance for prepaid insurance 29,500 ✓ Opening balance for the allowance for doubtful debts 7,000 ✓ Interest expenses 5,000 ✓ Tax rate 30% ✓ Profit before tax 245,300

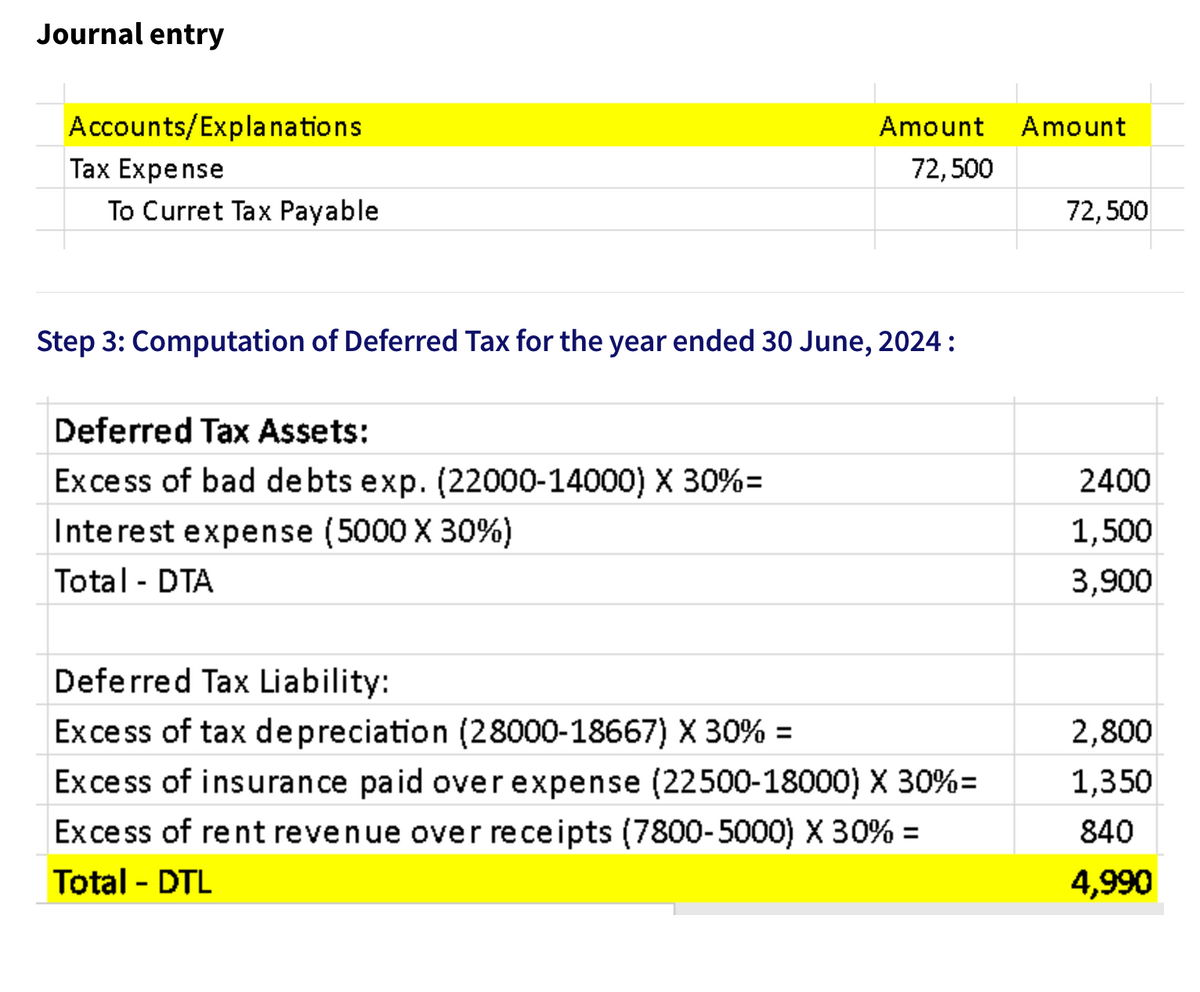

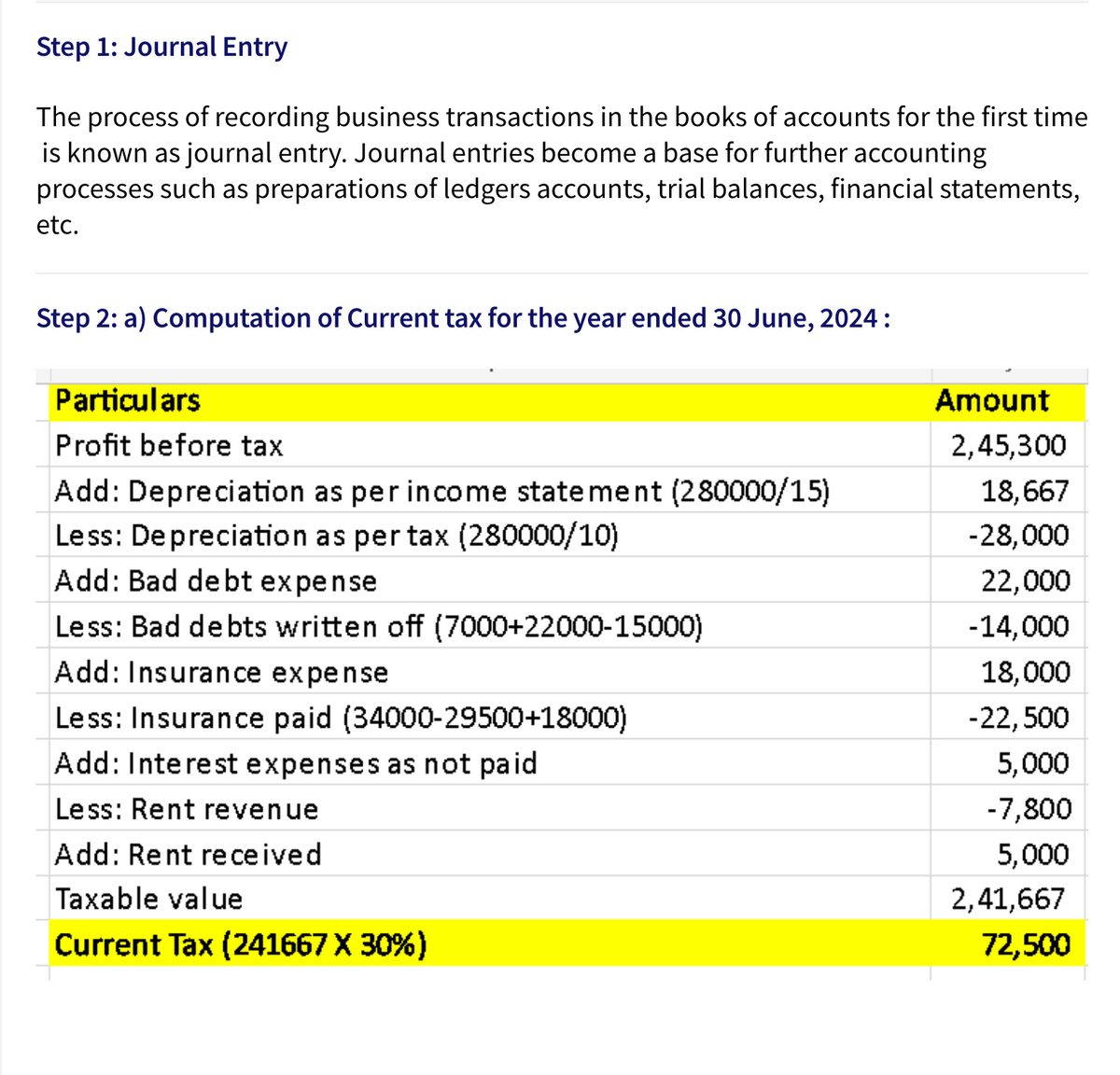

Prepare the current tax worksheet and related

Here is my question: I received the question you guys answered yesterday night, and I still have some questions about it.

why the interest payable should be ignored?

why the bad debt written off is $14000 as we know the opening balance for doubtful debt is 7000, and the allowance for Doubtful debt is 15000, bad debt expense is 22,000. In my opinion, bad debt written off is 7000+15000-22000 (I know its wired). How the T-ledge will be?

why we don't use the Deffer tax asset (tax loss) in the current tax liability?

why the depreciation is just one year amount? I think the information given it's 3 years' amount

Thanks for your help:)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images