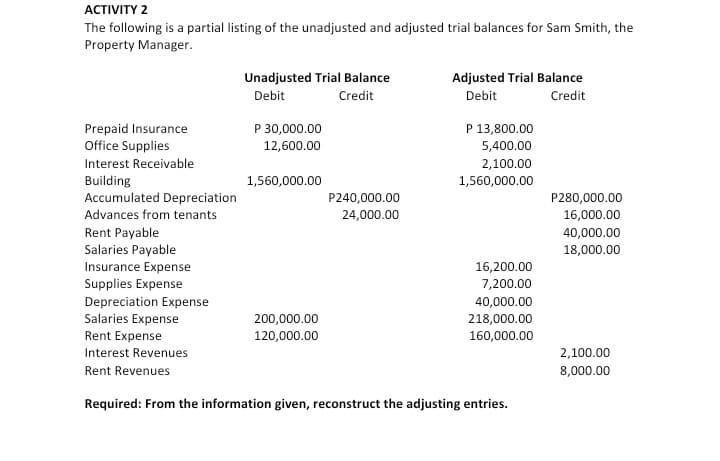

The following is a partial listing of the unadjusted and adjusted trial balances for Sam Smith, the Property Manager. Unadjusted Trial Balance Adjusted Trial Balance Credit Debit Credit Debit P 30,000.00 P 13,800.00 Prepaid Insurance Office Supplies 12,600.00 5,400.00 Interest Receivable 2,100.00 Building Accumulated Depreciation Advances from tenants 1,560,000.00 1,560,000.00 P240,000.00 P280,000.00 24,000.00 16,000.00 Rent Payable Salaries Payable Insurance Expense Supplies Expense Depreciation Expense Salaries Expense Rent Expense 40,000.00 18,000.00 16,200.00 7,200.00 40,000.00 200,000.00 120,000.00 218,000.00 160,000.00 Interest Revenues 2,100.00 Rent Revenues 8,000.00 Required: From the information given, reconstruct the adjusting entries.

The following is a partial listing of the unadjusted and adjusted trial balances for Sam Smith, the Property Manager. Unadjusted Trial Balance Adjusted Trial Balance Credit Debit Credit Debit P 30,000.00 P 13,800.00 Prepaid Insurance Office Supplies 12,600.00 5,400.00 Interest Receivable 2,100.00 Building Accumulated Depreciation Advances from tenants 1,560,000.00 1,560,000.00 P240,000.00 P280,000.00 24,000.00 16,000.00 Rent Payable Salaries Payable Insurance Expense Supplies Expense Depreciation Expense Salaries Expense Rent Expense 40,000.00 18,000.00 16,200.00 7,200.00 40,000.00 200,000.00 120,000.00 218,000.00 160,000.00 Interest Revenues 2,100.00 Rent Revenues 8,000.00 Required: From the information given, reconstruct the adjusting entries.

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.27EX: Corrected trial balance totals, 369,000 Adjusting entries from trial balances The accountant for...

Related questions

Question

Transcribed Image Text:ACTIVITY 2

The following is a partial listing of the unadjusted and adjusted trial balances for Sam Smith, the

Property Manager.

Unadjusted Trial Balance

Adjusted Trial Balance

Debit

Credit

Debit

Credit

P 30,000.00

P 13,800.00

Prepaid Insurance

Office Supplies

12,600.00

5,400.00

Interest Receivable

2,100.00

Building

Accumulated Depreciation

1,560,000.00

1,560,000.00

P240,000.00

P280,000.00

Advances from tenants

24,000.00

16,000.00

Rent Payable

Salaries Payable

Insurance Expense

Supplies Expense

40,000.00

18,000.00

16,200.00

7,200.00

Depreciation Expense

40,000.00

Salaries Expense

200,000.00

218,000.00

Rent Expense

120,000.00

160,000.00

2,100.00

8,000.00

Interest Revenues

Rent Revenues

Required: From the information given, reconstruct the adjusting entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,