Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

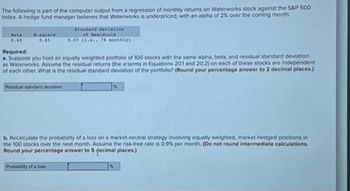

Transcribed Image Text:The following is part of the computer output from a regression of monthly returns on Waterworks stock against the S&P 500

Index. A hedge fund manager believes that Waterworks is underpriced, with an alpha of 2% over the coming month.

Beta

0.60

R-square

0.65

Standard Deviation

of Residuals

0.07 (1.e., 78 monthly)

Required:

a. Suppose you hold an equally weighted portfolio of 100 stocks with the same alpha, beta, and residual standard deviation

as Waterworks. Assume the residual returns (the e terms in Equations 201 and 20.2) on each of these stocks are independent

of each other. What is the residual standard deviation of the portfolio? (Round your percentage answer to 2 decimal places.)

Residual standard deviation

b. Recalculate the probability of a loss on a market-neutral strategy involving equally weighted, market-hedged positions in

the 100 stocks over the next month. Assume the risk-free rate is 0.9% per month. (Do not round intermediate calculations.

Round your percentage answer to 5 decimal places.)

Probability of a loss

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the following data to answer the question regarding the performance of Guardian Stock Fund and the market portfolio. The risk- free return during the sample period was 5%. Average return Standard deviation of returns Beta Residual standard deviation Guardian 14% 26% 1.2 0.60 X 4% Calculate the information ratio measure of performance for Guardian Stock Fund. (Round your answer to 2 decimal places. Do not round intermediate calculations.) Answer is complete but not entirely correct. Information ratio Market Portfolio 10% 21% 1 0%arrow_forwardConsider the following information for Stocks A,B, and C. The returns on the three stocks are positively correlated, but they are not perfectlycorrelated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard Deviation BetaA 9.55% 15% 0.9B 10.45 15 1.1C 12.70 15 1.6 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is5.5%, and the market is in equilibrium. (That is, required returns equal expected returns.)a. What is the market risk premium (rM - rRF)?b. What is the beta of Fund P?c. What is the required return of Fund P?d. Would you expect the standard deviation of Fund P to be less than 15%, equal to 15%,or greater than 15%? Explain.arrow_forwardPlease complete in Excel (and show work)arrow_forward

- Use the following data to answer the question regarding the performance of Guardian Stock Fund and the market portfolio. The risk- free return during the sample period was 5%. Average return Standard deviation of returns Beta Residual standard deviation Guardian 14% 26% 1.2 (0.80) 4% X Answer is complete but not entirely correct. Information ratio Market Portfolio Calculate the information ratio measure of performance for Guardian Stock Fund. (Round your answer to 2 decimal places. Do not round intermediate calculations.) 10% 21% 1 0%arrow_forwardCurrently the risk-free rate equals 5% and the expected return on the market portfolio equals 11%. An investment analyst provides you with the following information: Stock A Beta 1.33 Expected Return 12% Stock B Beta 0.7 Expected Return 10% (a) Calculate the reward-to-risk ratios of stock A, stock B and in market equilibrium. Are stock A and stock B overvalued, undervalued or fairly valued? Briefly explain. [within 150 words] (b) You want a portfolio with the same risk as the market. Calculate the weights of stock A and B respectively. (please show me steps and round the final answer to 2 decimal places, thanks)arrow_forwardThe following is part of the computer output from a regression of monthly returns on Waterworks stock against the S&P 500 index. A hedge fund manager believes that Waterworks is underpriced, with an alpha of 2,1% over the coming month. Beta 1.4 Standard Deviation R- of Residuals square 0.65 0.1 (i.e., 10% monthly) Now suppose that the manager misestimates the beta of Waterworks stock, believing it to be 0.5 instead of 1.4. The standard deviation of the monthly market rate of return is 9%. If he holds a $5,000,000 portfolio of Waterworks stock. The S&P 500 currently is at 2,000 and the contract multiplier is $50. a. What is the standard deviation of the (now improperly) hedged portfolio? (Round your answer to 3 decimal places.) Standard deviation % b. What is the probability of incurring a loss on improperly hedged portfolio over the next month if the monthly market return has an expected value of 1% and a standard deviation of 9%? The manager holds a $5 million portfolio of Waterworks…arrow_forward

- pm.2arrow_forwardAssume the return on a market index represents the common factor and all stocks in the economy have a beta of 1. Firm-specific returns all have a standard deviation of 31%. Suppose an analyst studies 20 stocks and finds that one-half have an alpha of 2.0%, and one-half have an alpha of –2.0%. The analyst then buys $1.1 million of an equally weighted portfolio of the positive-alpha stocks and sells short $1.1 million of an equally weighted portfolio of the negative-alpha stocks. Required: a. What is the expected profit (in dollars), and what is the standard deviation of the analyst’s profit? (Enter your answers in dollars not in millions. Do not round intermediate calculations. Round your answers to the nearest dollar amount. b-1. How does your answer for standard deviation change if the analyst examines 50 stocks instead of 20?arrow_forwardBaghibenarrow_forward

- USE THE FOLLOWING DATA FOR QUESTIONS 4-6: A portfolio is equally invested in Stock A, Stock B, Stock C, and Treasury Bills (25% each). The expected returns of each of these holdings is 4.8%, 11.2%, 18.6%, and 3.0%, respectively. The Betas for each of the stocks is as follows: A 0.4, B 1.8, and C 2.6. Q6: Based on your answers to questions 4 and 5, assuming an expected return of the market of 8.5%, should you invest in this portfolio from a risk/reward perspective? Multiple Choice O O Yes Noarrow_forwardThe following are estimates for two stocks. Firm- Specific Expected Standard Stock Return Beta Deviation A 14% 0.90 30% B 21 1.40 42 The market index has a standard deviation of 20% and the risk-free rate is 7%. Required: a. What are the standard deviations of stocks A and B? b. Suppose that we were to construct a portfolio with proportions: Stock A Stock B T-bills 0.30 0.45 0.25 Compute the expected return, beta, nonsystematic standard deviation, and standard deviation of the portfolio.arrow_forwardConsider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard Deviation Beta 16% 0.8 B 16 1.2 с 8.50 16 1.6 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 4.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) a. What is the market risk premium (re-ra)? Round your answer to one decimal place. b. What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. c. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. % d. What would you expect the standard deviation of Fund P to be? 1. Less than 16% II. Greater than 16% III. Equal to 16% -Select- 6.50% 7.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education