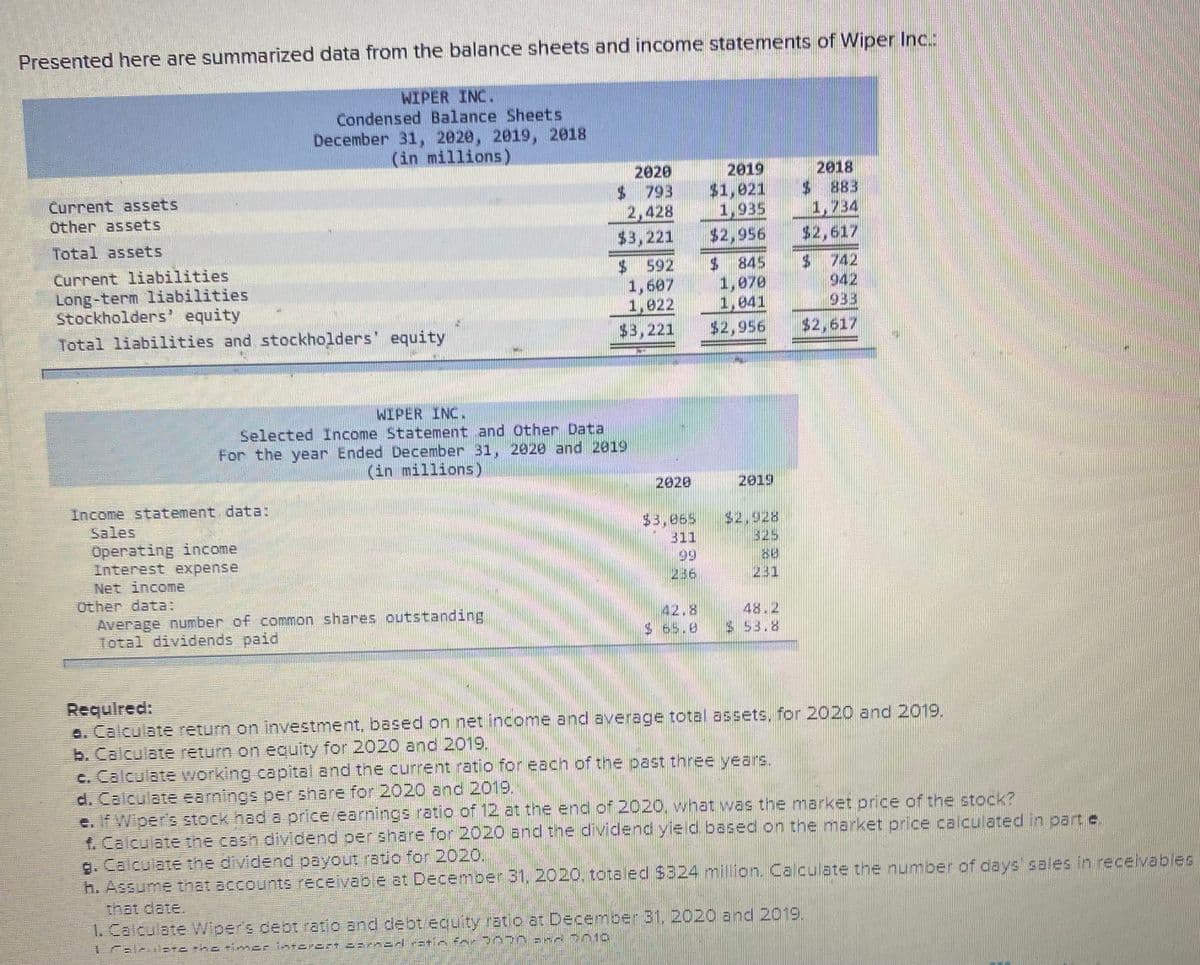

Presented here are summarized data from the balance sheets and income statements of Wiper Inc.: WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 $ 793 2,428 2018 $883 1,734 2019 $1,021 1,935 $2,956 $ 845 1,070 1,041 $2,956 Current assets Other assets Total assets $3,221 $2,617 $ 592 1,607 1,022 $ 742 942 Current liabilities Long-term liabilities Stockholders' equity 933 Total liabilities and stockholders' equity $3,221 $2,617 WIPER INC. Selected Income Statement and Other Data For the year Ended December 31, 2020 and 2019 (in millions) 2020 2019 Income statement data: Sales $3,065 311 $2,928 325 Operating income Interest expense Net income Other data: 99 236 88 TFZ Average number of common shares outstanding Total dividends paid 42.8 $65.0 48.2 $ 53.8 Requlred: a. Calculate return on investment, based on net income and average total assets, for 2020 and 2019. b. Calculate return on equity for 2020 and 2019. c. Calculate working capital and the current ratio for each of the past three years. D010

Presented here are summarized data from the balance sheets and income statements of Wiper Inc.: WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 $ 793 2,428 2018 $883 1,734 2019 $1,021 1,935 $2,956 $ 845 1,070 1,041 $2,956 Current assets Other assets Total assets $3,221 $2,617 $ 592 1,607 1,022 $ 742 942 Current liabilities Long-term liabilities Stockholders' equity 933 Total liabilities and stockholders' equity $3,221 $2,617 WIPER INC. Selected Income Statement and Other Data For the year Ended December 31, 2020 and 2019 (in millions) 2020 2019 Income statement data: Sales $3,065 311 $2,928 325 Operating income Interest expense Net income Other data: 99 236 88 TFZ Average number of common shares outstanding Total dividends paid 42.8 $65.0 48.2 $ 53.8 Requlred: a. Calculate return on investment, based on net income and average total assets, for 2020 and 2019. b. Calculate return on equity for 2020 and 2019. c. Calculate working capital and the current ratio for each of the past three years. D010

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

100%

Practice Pack

hello, I need help please

Transcribed Image Text:Presented here are summarized data from the balance sheets and income statements of Wiper Inc.:

WIPER INC.

Condensed Balance Sheets

December 31, 2020, 2019, 2018

(in millions)

2020

$ 793

2,428

2019

$1,021

1,935

$2,956

2018

$ 883

1,734

$2,617

$ 742

942

933

Current assets

Other assets

Total assets

$3,221

Current liabilities

Long-term liabilities

Stockholders' equity

$ 592

1,607

1,022

$3,221

$ 845

1,070

1,041

$2,956

Total liabilities and stockholders' equity

$2,617

WIPER INC.

Selected Income Statement and Other Data

For the year Ended December 31, 2020 and 2819

(in millions)

2020

2019

Income statement data:

Sales

Operating income

Interest expense

Net income

Other data:

Average number of common shares outstanding

Total dividends paid

$3,065

311

99

236

$2,928

325

231

48.2

s.53.8

$ 65.0

Required:

a. Calculate return on investment, based on net income and average total assets, for 2020 and 2019.

b. Calculate return on ecuity for 2020 and 2019.

c. Calculate working capital and the current ratlo for each of the past three years.

d. Calculate eamings per share for 2020 and 2019.

e. If Wiper's stock had a price/earnings ratio of 12 at the end of 2020, what was the market price of the stock?

t. Calculate the cash dividend per share for 2020 and the dividend yield based on the market price calculated in part e

9. Calculate the dividend payout ratio for 2020.

h. Assume that accounts receivabie at December 31, 2020. totaled $324 million. Calculate the number of days' sales in receivables

that date.

1. Calculate Wipers debt ratio and debt/equity ratio at December 31, 2020 and 2019.

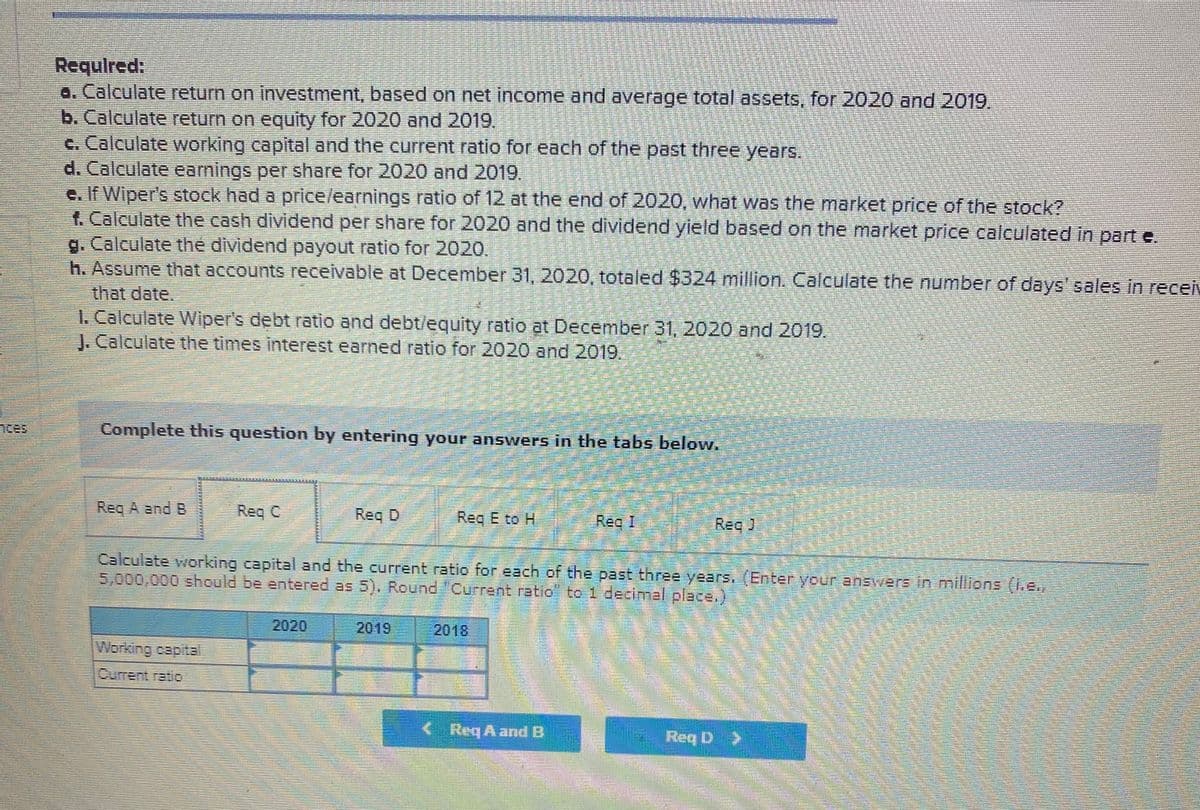

Transcribed Image Text:Requlred:

Q. Calculate return on investment, based on net income and average total assets, for 2020 and 2019.

b. Calculate returm on equity for 2020 and 2019,

c. Calculate working capital and the current ratio for each of the past three years.

d. Calculate earnings per share for 2020 and 2019.

e. If Wiper's stock had a price/earnings ratio of 12 at the end of 2020, what was the market price of the stock?

1. Calculate the cash dividend per share for 2020 and the dividend yield based on the market price calculated in part e.

g. Calculate the dividend payout ratio for 2020.

h. Assume that accounts receivable at December 31,2020, totaled $324 million. Calculate the number of days' sales in receiv

that date.

1. Calculate Wiper's debt ratio and debt/equity ratio at December 31, 2020 and 2019.

J. Calculate the times interest earned ratio for 2020 and 2019.

nces

Complete this question by entering your answers in the tabs below.

Req A and B

Req C

Req D

Req E to H

Reg I

Reg )

Calculate working capital and the current ratio for each of the past three years. (Enter your answers in millions (he.

5,000,000 should be entered as 5). Round "Current ratio" to1 decimal place.)

2020

2019

2018

Working capital

iCurrent ratio

< Req A and B

< a ba

選

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning